Touchdown a Zacks Rank #5 (Robust Promote) and the Bear of the Day, Goosehead Insurance coverage GSHD is a inventory that will have to be prevented primarily based on its stretched valuation and insufficient steadiness sheet.

Whereas Goosehead’s development has been fascinating since going public in 2018, GSHD appears to be like uncomfortably costly at over $100 a share. That is very true with broader trade dangers on the horizon in key markets corresponding to Los Angeles.

Picture Supply: Zacks Funding Analysis

California Wildfires & Steadiness Sheet

Though underwriting margins have been very favorable for property/casualty and multi-line insurance coverage corporations lately (greater inflationary setting), the tragic wildfires in Los Angeles have led to a excessive variety of claims and elevated monetary burden on insurers.

Notably, Goosehead additionally has operations in San Diego and Sacramento whereas different smaller insurance coverage corporations have scaled again or left the California market altogether.

Lengthy-standing insurance coverage giants like Progressive (PRG) ought to be capable of maintain and be comparatively unaffected however traders will wish to be conscious of rising corporations like Goosehead that are extra susceptible to rising prices and have insufficient steadiness sheets.

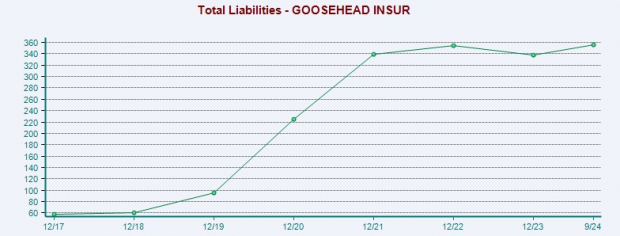

To that time, Goosehead solely has $50 million in money & equivalents regardless of its rising area of interest as an unbiased private traces insurance coverage company. Extra regarding, Goosehead is barely solvent with its whole belongings at $358 million in comparison with $356 million in whole liabilities.

Picture Supply: Zacks Funding Analysis

Goosehead’s Stretched Valuation

Taking away from its compelling development narrative is that Goosehead inventory trades at 55.4X ahead earnings and EPS estimates have dropped 10% within the final 30 days for fiscal 2025.

Picture Supply: Zacks Funding Analysis

GSHD is at an alarming premium to its Zacks Insurance coverage-Multi Line Business common of 9.9X ahead earnings with the benchmark S&P 500 at 22.5X. Moreover, Goosehead nonetheless trades at greater than 10X gross sales with the trade common at 1.5X and the benchmark at 5.6X.

Picture Supply: Zacks Funding Analysis

Backside Line

Scheduled to launch its This autumn outcomes on February 19, there seems to be extra draw back threat forward for Goosehead inventory and it wouldn’t be stunning if the corporate’s outlook for FY25 is underwhelming.

At present ranges, the chance to reward isn’t favorable as a big pullback appears to be like inevitable with GSHD up practically +200% within the final two years.

7 Greatest Shares for the Subsequent 30 Days

Simply launched: Specialists distill 7 elite shares from the present checklist of 220 Zacks Rank #1 Robust Buys. They deem these tickers “Most Seemingly for Early Worth Pops.”

Since 1988, the complete checklist has overwhelmed the market greater than 2X over with a mean acquire of +24.3% per 12 months. So make sure you give these hand picked 7 your rapid consideration.

Goosehead Insurance (GSHD) : Free Stock Analysis Report

Chubb Limited (CB) : Free Stock Analysis Report

The Allstate Corporation (ALL) : Free Stock Analysis Report

Aaron’s Holdings Company, Inc. (PRG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.