Hertz World HTZ is automobile rental firm that operates rental manufacturers all through North America, Europe, the Caribbean, Latin America, Africa, the Center East, Asia, Australia, and New Zealand. The manufacturers embrace Hertz, Greenback, and Thrifty.

Hertz World has struggled lately as annual gross sales and haven’t managed to interrupt above the pre-covid ranges. Annual gross sales in 2019 have been $9.8 billion and in 2023 have been $9.4 billion.

Earnings have fallen relatively precipitously over that point and so has the inventory worth, reflecting traders’ distaste for the enterprise.

Hertz World has a Zacks Rank #5 (Sturdy Promote) score, making it a inventory that traders ought to keep away from for now.

Picture Supply: Zacks Funding Analysis

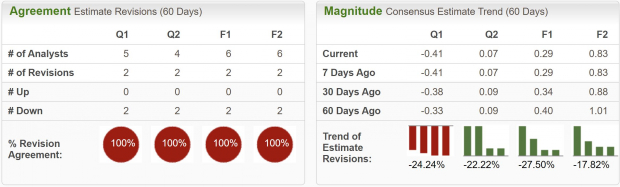

Falling Earnings Estimates

Analysts have unanimously lowered earnings estimates for Hertz World throughout future timeframes.

Present quarter earnings estimates have been lowered by 24.2% over the past two months and are anticipated to fall -205% YoY to -$0.41. FY24 earnings estimates have been revised decrease by -27.5% and are projected to say no -45.3% YoY to $0.29 per share.

Gross sales this yr and subsequent yr are forecast to develop simply 2.5% and 4.5% respectively.

Picture Supply: Zacks Funding Analysis

Premium Valuation

What makes Hertz World inventory particularly unappealing is that even with flat gross sales development and falling earnings, is that it nonetheless has a excessive valuation.

In the present day, it’s buying and selling at a one yr ahead earnings a number of of 20.4x, which is nicely above its 10-year median of 6.4x.

Picture Supply: Zacks Funding Analysis

Backside Line

Hertz World is clearly going by some rising pains. The automobile rental area may be very aggressive, with web-based choices rising most just lately, additional obfuscating Hertz’s path ahead. The corporate additionally holds an enormous quantity of debt and doesn’t seem to have a plan to treatment to weak development forecasts.

Due to these bearish developments, I consider traders ought to keep away from Hertz World inventory, and search alternatives elsewhere available in the market.

The place Will Shares Go…

If Biden Wins? If Trump Wins?

The solutions could shock you.

Since 1950, even after detrimental midterm years, the market has by no means had a decrease presidential election yr. With voters energized and engaged, the market has been virtually unrelentingly bullish regardless of which occasion wins!

Now could be the time to obtain Zacks’ free Particular Report with 5 shares that provide excessive upside for each Democrats and Republicans…

1. Medical producer has gained +11,000% within the final 15 years.

2. Rental firm is completely crushing its sector.

3. Power powerhouse plans to develop its already massive dividend by 25%.

4. Aerospace and protection standout simply landed a doubtlessly $80 billion contract.

5. Large Chipmaker is constructing big vegetation within the U.S.

Hurry, Download Special Report FREE >>

Hertz Global Holdings, Inc. (HTZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.