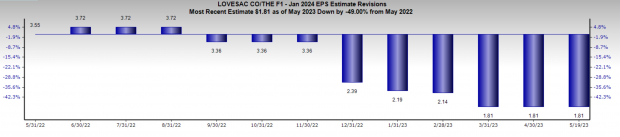

Lovesac LOVE, a furnishings business concentrating on modular styles, deals with substantial difficulties as mirrored by its Zacks Ranking # 5 (Solid Offer) as well as down trending profits alterations. In spite of a solid Q4 profits record as well as previous sales development, the supply remains to experience down stress.

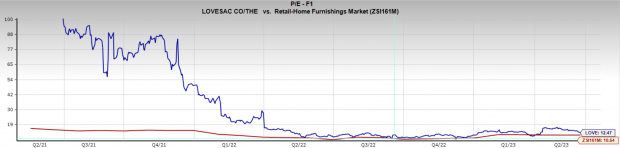

Combined with a bearish technological graph pattern as well as transforming customer costs patterns, Lovesac runs into a tough landscape, calling for a bearish position. Lovesac’s supply has actually been embeded an extended sag as well as is nearing its IPO cost from 5 years back.

Picture Resource: Zacks Financial Investment Research Study

Incomes

Incomes quotes for Lovesac have actually been continually changed reduced over the in 2014, showing dropping assumptions for the furnishings merchant. Complete year profits quotes were cut in half over that duration. Q1 profits have actually been reduced from $0.03 per share to -$ 0.39 per share, an unpleasant flip to internet unfavorable earnings.

Over the last couple of years Lovesac has actually expanded sales at a remarkable speed, consistently broadening greater than 30% yearly. Nonetheless, those prices of development are not anticipated to proceed. Experts approximate FY24 sales development of simply 8.2%, as well as FY25 development of 14.3%. Also those numbers might be testing if the economic situation reduces greater than anticipated.

Picture Resource: Zacks Financial Investment Research Study

Technical Arrangement

Lovesac supply has actually been trending down right component of 2 years, with all significant rallies satisfying a thrill of vendors. After settling for the last 6 months as well as developing out a variety, LOVE supply is damaging reduced once again. The bear flag showed in the graph listed below determined a degree of assistance at $23 bucks, which has actually been shed.

Currently listed below the $23 degree, LOVE supply might check out a lot reduced costs. Conversely, if the cost can turn around greater instantly, as well as take back the degree of assistance, it would certainly revoke the profession arrangement, although it looks instead not likely at this moment.

Picture Resource: TradingView

Dropping Retail Discretionary Costs

While customer costs on things fresh furnishings experienced a rise throughout the post-COVID boom, there is currently a pullback in optional costs. Motivated by the flooding of gravy train, customers invested much more than regular as well as most likely drew onward numerous years of customer costs.

Brand-new acquisitions like residence remodellings, autos, tvs, computer systems, as well as furnishings like that cost LOVE are not things that are bought consistently. As bigger optional acquisitions, even more similar to a huge splurge. Sellers of these items are most likely to experience a considerable downturn up until the trough of business cycle.

According to the National Retail Federation “In the initial schedule quarter of 2023, substantial united state stores revealed strategies to open up regarding 2,570 brand-new shops, down dramatically from regarding 4,400 revealed openings in in 2014’s initial quarter. They revealed strategies to shut regarding 1,760 shops, almost 3 times more than the around 635 shop closings revealed in the initial quarter of 2022.”

The truth is that as the economic situation remains to reduce, customer top priorities change, as well as unpredictabilities develop, lowering optional costs.

Contrarianism

From its IPO to currently, Lovesac has had a fish story that equity scientists as well as capitalists have actually fairly come to be connected to. LOVE has actually produced a separated item as well as delighted in amazing sales development. Nonetheless, confident sights of the supply at this moment in business cycle is a high-risk possibility.

Along with the difficulties encountering Lovesac, it deserves keeping in mind that numerous Wall surface Road experts still keep a buy ranking on the supply. While agreement viewpoints can lug weight, it is necessary to acknowledge the prospective risks of herd way of thinking in the financial investment globe.

When every person gets on one side of the profession, it can produce a chance for contrarian capitalists to maximize market inadequacies. Being a contrarian can be an efficient approach when every person gets on one side of the profession, as well as in this situation, it resembles numerous capitalists are still favorable while financial principles wear away.

Assessment

Lovesac is trading at a 1 year forward profits multiple of 12.5 x, which is over the sector ordinary 10.5 x, as well as listed below its two-year average of 14.9 x. While this is a sensible appraisal, it is still over the sector standard. As well as with the opportunity of additional compression in profits impending, it might drop better.

Picture Resource: Zacks Financial Investment Research Study

Verdict

Lovesac faces substantial difficulties in advance, noted by decreasing profits assumptions, a bearish technological graph pattern, as well as financial headwinds. Financiers need to work out care as well as carefully review the business’s efficiency, as well as future development leads moving forward.

Leading 5 ChatGPT Supplies Disclosed

Zacks Senior Citizen Supply Planner, Kevin Chef names 5 carefully picked supplies with overpriced development possibility in a dazzling field of Expert system. By 2030, the AI sector is forecasted to have a web as well as iPhone-scale financial influence of $15.7 Trillion.

Today you can buy the wave of the future, an automation that responds to follow-up concerns … confesses errors … difficulties inaccurate properties … turns down unacceptable demands. As one of the picked business places it, “Automation releases individuals from the ordinary so they can complete the amazing.”

Download Free ChatGPT Stock Report Right Now >>

The Lovesac Company (LOVE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints shared here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.