The Mosaic Firm MOS is anticipated to see incomes decrease this year after the Ukraine Battle surged plant food rates in 2014. However this Zacks Ranking # 5 (Solid Offer) is still favorable on plant food need in 2023.

The Mosaic Firm, headquartered in Tampa florida, FL, is just one of the globe’s leading manufacturers as well as online marketers of focused phosphate as well as potash plant nutrients. It provides phosphates as well as potash plant foods as well as feed active ingredients for the worldwide farming market.

An Additional Revenues Miss in Q1

On Might 3, Mosaic reported its initial quarter 2023 incomes as well as it reported incomes of $1.14 which was a miss out on of 10.9%, or $0.14. The Zacks Agreement was seeking $1.28.

It was the 5th incomes miss out on straight.

Photo Resource: Zacks Financial Investment Study

Income dropped 8% to $3.6 billion mirroring the influence of reduced rates which were rather countered by greater quantities.

In its 3 huge classifications, quantities were greater in 2023 than in 2022. In Potash, sales quantity million tonnes was 1.9 contrasted to 1.8 in 2014. In Phosphate, sales quantity million tonnes was 1.8 contrasted to 1.7 in 2014 as well as in Mosaic Fertilizantes sales quantity million tonnes was 2.1 contrasted to 1.8.

However it was the contrary in list prices.

Potash sponge Market price was up to $421 from $582 in 2014. Phosphate DAP Offering Cost was up to $660 from $785. Mosaic Fertilizantes completed item asking price was $646, below $817.

Gross margins was up to 18.6% from 36.7% in 2014.

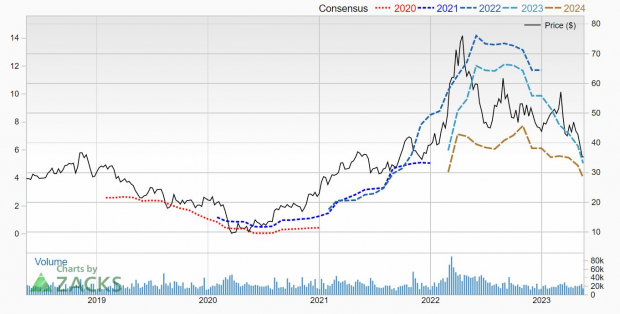

Revenues Price Quotes Lowered

The experts have actually been boldy reducing their incomes price quotes for 2023 as well as 2024 the last 3 months as plant food rates have actually softened.

For 2023, 4 have actually reduced the last thirty day as well as 1 in simply the recently. The 2023 Zacks Agreement Quote has actually dived to $5.05 from $8.45 in simply the last 3 months.

That’s an incomes decrease of 54% from 2022, when it made $11.01.

The cuts expand right into 2024 also. 5 price quotes were reduced in the last month for 2024 pressing the Zacks Agreement to $4.02 from $5.48 simply 3 months previously.

That’s an additional 20.4% decrease.

Photo Resource: Zacks Financial Investment Study

Mosaic Optimistic Regarding Need

To respond to all that expert bearishness, which is the factor the supply is a Zacks Ranking # 5 (Solid Offer), is the business’s market expectation.

It anticipates the grain as well as oilseed markets to stay limited via 2023 as well as past. Mosaic stated in The United States and Canada, view has actually boosted “dramatically” contrasted to the 2nd fifty percent of 2022.

Mosaic likewise stated springtime nutrient application prices were trending towards typical degrees. And also for both potash as well as phosphates, supply restrictions stay.

Shares Down Big

However up until incomes reverse as well as obtain increased, rather than cut, capitalists have actually made a decision to get away the supply. Year-to-date, shares are down 18.4%, yet over the in 2014 shares have actually dropped 45.5%.

It’s economical, despite the incomes cuts. It’s patronizing an onward P/E of simply 7.

Mosaic is likewise creating lots of cost-free capital. Mosaic is waiting its 2023 Funding Allowance Technique, which is to return mainly every one of the 2023 cost-free capital back to investors.

In the initial quarter, that implied $608 million was returned via share repurchases as well as returns. It’s reward is presently producing 2.3%.

Plant foods are an asset. It’s a tough market in which to spend. For capitalists curious about the plant foods, as well as Mosaic, you might intend to wait up until the Zacks Ranking relocates greater. Maintain Mosaic on your watch listing.

Spin on Buffett’s Technique Discovers Covert Treasures with Triple-Digit Possible

Regardless of what your investing design is, you’re mosting likely to intend to see this. It’s a straightforward spin on the stock-picking approach Warren Buffett has actually made use of to place numerous billions of bucks on guides at Berkshire Hathaway.

Zacks Worth Planner Tracey created this approach to discover forgotten supplies most likely to provide gains a lot larger (as well as quicker) than the ordinary worth financier anticipates. Current champions have actually climbed up as long as +348% in much less than 2 years.

The Mosaic Company (MOS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints shared here are the sights as well as viewpoints of the writer as well as do not always mirror those of Nasdaq, Inc.