ON Semiconductor ON is going through setbacks throughout the traditionally cyclical chip business, exacerbated by headwinds within the electrical automobile (EV) area and the economic sector.

ON Semi supplied downbeat earnings steering as soon as once more when it reported its This fall leads to early February.

ON inventory has declined 22% over the past three years, whereas the Zacks Tech Sector surged 50%. Wall Avenue has soured on the chip inventory amid shifting business situations which have led to declining earnings and income.

What’s Going Unsuitable with ON Inventory Proper Now

ON Semi is a standout within the analog chip business, providing options for the economic and automotive sectors. Over the previous few years, the corporate has targeted on boosting margins and exiting low-margin, non-core merchandise. A pivotal 2021 acquisition reworked ON Semi right into a silicon carbide provider, a key materials utilized in EVs, chargers, power infrastructure, and extra.

ON Semi posted robust progress in 2021 and 2022, fueled by hovering EV gross sales and elevated spending on sustainable power and industrial automation. Nevertheless, the corporate operates in a cyclical enterprise tied to the broader boom-and-bust spending patterns of the automotive and industrial sectors.

Picture Supply: Zacks Funding Analysis

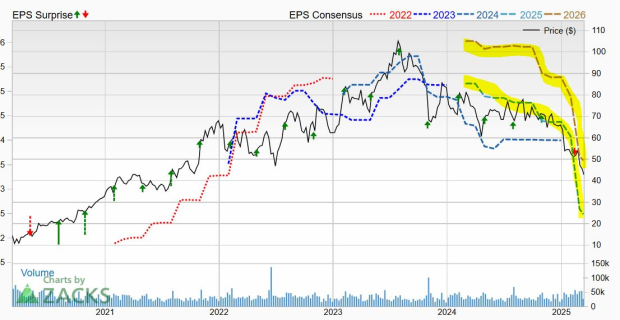

The EV market is at present experiencing a downturn after years of speedy progress, and industrial markets are additionally slowing. ON Semi’s income fell 14% in 2024, following a 1% decline in 2023. In the meantime, its earnings dropped 23% final 12 months after a 3% dip in FY23.

On February 10, ON Semi issued dismal EPS steering, inflicting its Q1 consensus estimate to plunge 45%. Over the previous few months, its earnings estimates for 2025 and 2026 have fallen 40% and 29%, respectively, contributing to its Zacks Rank #5 (Sturdy Promote).

Picture Supply: Zacks Funding Analysis

ON Semi’s long-term outlook possible stays stable, and the corporate is assured it may well climate these near-term challenges. “Our actions over the past 4 years have confirmed we’re a structurally totally different firm that’s well-equipped to navigate extended volatility,” CEO Hassane El-Khoury mentioned in ready remarks.

That mentioned, buyers may need to look elsewhere for now. Calling a backside for ON Semi might be significantly difficult, as uncertainty has intensified throughout the inventory market and the economic system, pushed partially by ongoing tariff battles.

Zacks’ Analysis Chief Names “Inventory Most Prone to Double”

Our workforce of consultants has simply launched the 5 shares with the best likelihood of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This high decide is among the many most progressive monetary companies. With a fast-growing buyer base (already 50+ million) and a various set of leading edge options, this inventory is poised for large good points. In fact, all our elite picks aren’t winners however this one might far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

ON Semiconductor Corporation (ON) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.