The Zacks Medical industry has actually had a hard time in 2023, down about 5% YTD and also underperforming about the S&P 500.

One supply staying in the world, Pfizer PFE, has actually seen its near-term expectation change unfavorable over the last numerous months, pressing the supply down right into a Zacks Ranking # 5 (Solid Market).

Photo Resource: Zacks Financial Investment Research Study

Pfizer is an international pharmaceutical and also biotechnology firm headquartered in New york city City, popular for its COVID-19 injection. Exactly how does the firm presently accumulate? Allow’s take a more detailed look.

Share Efficiency

PFE shares have actually remained in a down fad throughout 2023, shedding greater than 20% in worth and also extensively underperforming about the S&P 500.

Photo Resource: Zacks Financial Investment Research Study

And also over the last 6 months, PFE shares have actually once again hung back the basic market, shedding 6% in worth contrasted to the S&P 500’s 9% gain. The damaging cost activity suggests that vendors have actually remained in control without any significant purchasing yet to tip up.

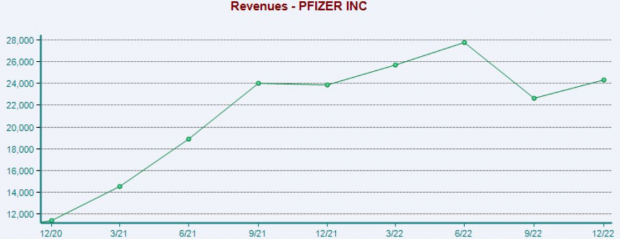

Quarterly Efficiency

Pfizer has actually constantly published better-than-expected outcomes lately, surpassing revenues and also profits quotes in 3 successive quarters. Simply in its most current launch, the pharmaceutical titan booked a 10% profits beat and also reported sales partially over assumptions.

Photo Resource: Zacks Financial Investment Research Study

Nonetheless, the marketplace had not been excited with the current double-beat, sending out shares descending post-earnings. This is shown by the environment-friendly arrowhead circled around in the graph below.

Photo Resource: Zacks Financial Investment Research Study

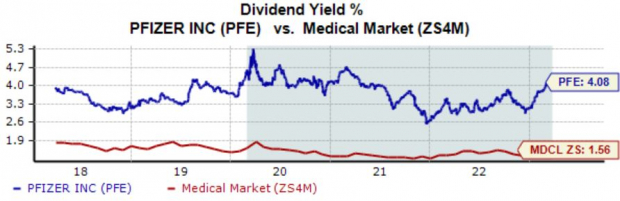

Returns

Pfizer shares do pay a strong reward, presently producing 4.1% each year. As we can see, the existing return is greater than double the standard of the Zacks Medical industry.

Over the last 5 years, PFE’s payment has actually expanded by about 4%.

Photo Resource: Zacks Financial Investment Research Study

Profits

Weak share efficiency and also unfavorable revenues price quote alterations from experts repaint a tough image for the firm’s shares in the close to term.

Pfizer PFE is a Zacks Ranking # 5 (Solid Market), showing that experts have actually taken a bearish position on the firm’s revenues expectation over the last numerous months.

For those looking for solid supplies, a wonderful concept would certainly be to concentrate on supplies lugging a Zacks Ranking # 1 (Solid Buy) or a Zacks Ranking # 2 (Buy)– these supplies sporting activity an especially more powerful revenues expectation coupled with the possible to provide eruptive gains in the close to term.

Simply Launched: Zacks Top 10 Supplies for 2023

Along with the financial investment concepts reviewed over, would certainly you such as to understand about our 10 leading choices for 2023?

From beginning in 2012 via November, the Zacks Top 10 Supplies profile has actually tripled the marketplace, obtaining a remarkable +884.5% versus the S&P 500’s +287.4%. Our Supervisor of Research study has actually currently brushed via 4,000 firms covered by the Zacks Ranking and also handpicked the very best 10 tickers to acquire and also keep in 2023. Do not miss your possibility to still be amongst the very first to participate these just-released supplies.

Pfizer Inc. (PFE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always show those of Nasdaq, Inc.