RH RH is a manager of layout, preference, and also design in the high-end way of life market. The business provides collections with its retail galleries, resource publications, and also online with several various sites.

Over the last 60 days, experts have actually taken an extremely bearish position on the supply, pressing it right into an undesirable Zacks Ranking # 5 (Solid Offer).

Photo Resource: Zacks Financial Investment Study

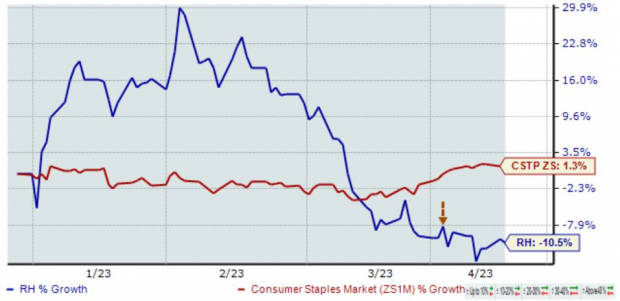

Share Efficiency & & Quarterly Outcomes

RH shares have actually battled to get grip over the in 2015, down greater than 30% and also underperforming about the Zacks Customer Staples market by a reasonable margin.

Photo Resource: Zacks Financial Investment Study

And also year-to-date, RH shares are down greater than 10%, showing vendors have actually remained in control and also once again underperforming about the Zacks Customer Staples market.

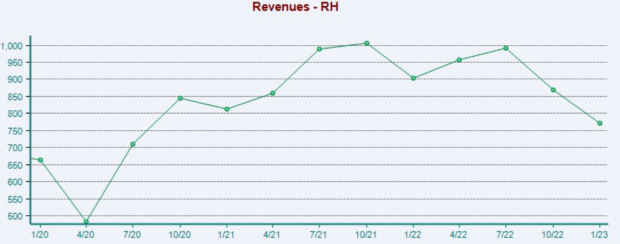

RH published rather weak lead to its most recent launch, disappointing the Zacks Agreement EPS Quote by about 14% and also coverage profits decently under assumptions.

As highlighted by the arrowhead in the graph below, the marketplace had not been thrilled with the outcomes, with shares relocating descending post-earnings.

Photo Resource: Zacks Financial Investment Study

RH’s following quarterly launch is arranged for June 1 st; the Zacks Agreement EPS Price Quote of $2.32 suggests a 70% decrease in profits year-over-year. Better, our agreement profits price quote stands at $726.2 million, 24% less than the year-ago number.

Photo Resource: Zacks Financial Investment Study

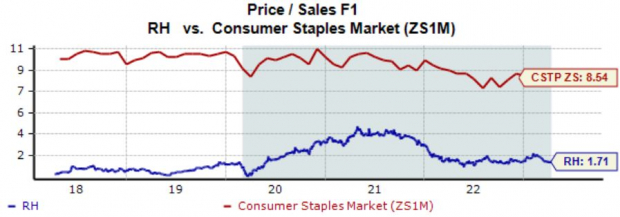

Appraisal

Presently, RH shares trade at a 19.1 X onward profits several, over the 17.2 X five-year mean and also almost according to the Zacks market standard.

Photo Resource: Zacks Financial Investment Study

Better, the business’s onward price-to-sales currently exercises to be 1.7 X, according to the five-year mean and also well listed below the Zacks market standard.

Photo Resource: Zacks Financial Investment Study

RH lugs a Design Rating of “D” for Worth.

Profits

Weak quarterly outcomes and also unfavorable profits price quote alterations from experts repaint a tough photo for the business in the close to term.

RH RH is a Zacks Ranking # 5 (Solid Offer), showing that experts have actually taken a bearish position on the business’s profits expectation over the last numerous months.

For those looking for solid supplies, an excellent suggestion would certainly be to concentrate on supplies bring a Zacks Ranking # 1 (Solid Buy) or a Zacks Ranking # 2 (Buy)– these supplies sporting activity an especially more powerful profits expectation coupled with the possible to provide eruptive gains in the close to term.

4 Oil Supplies with Substantial Benefits

Worldwide need for oil is with the roofing … and also oil manufacturers are battling to maintain. So although oil costs are well off their current highs, you can anticipate large make money from the business that provide the globe with “black gold.”

Zacks Financial investment Study has actually simply launched an immediate unique record to assist you count on this fad.

In Oil Market ablaze, you’ll uncover 4 unanticipated oil and also gas supplies placed for large gains in the coming weeks and also months. You do not wish to miss out on these referrals.

Download your free report now to see them.

RH (RH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views revealed here are the sights and also point of views of the writer and also do not always show those of Nasdaq, Inc.