TreeHouse Meals (THS) is a number one producer of private-label packaged meals and drinks in North America, serving main retail grocery chains, foodservice distributors, and different branded meals producers. The corporate focuses on offering a big selection of private-label choices, permitting retailers to supply cost-effective, high-quality options to nationwide manufacturers.

TreeHouse Meals has been a really poor performing inventory over the past decade, greater than halving buyers’ cash in that point. This extreme underperformance has been pushed by a number of components, however most notably, annual gross sales have fallen from a excessive of $6 billion in 2016 to only $3.3 billion right now.

Additional muddying TreeHouse Meals’ near-term future is its low Zacks Rank, which signifies that analysts have been reducing earnings estimates. Based mostly on this setup, I feel buyers ought to keep away from TreeHouse inventory till there’s a materials turnaround in its enterprise fundamentals or earnings revision pattern.

Picture Supply: Zacks Funding Analysis

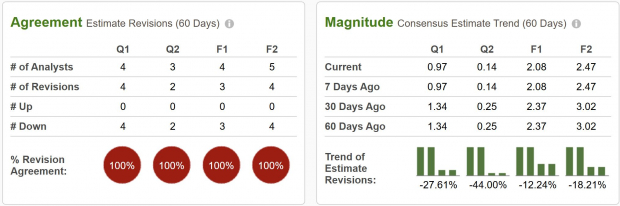

TreeHouse Meals Earnings Estimates Collapse

TreeHouse Meals is anticipated to see an additional decline in gross sales this yr, with analysts forecasting a 4.3% drop. Earnings too have been revised considerably decrease, giving it a Zacks Rank #5 (Robust Promote) score, which doesn’t bode nicely for the near-term expectations of the inventory.

Present quarter earnings estimates have been lowered by 27.6%, whereas FY24 projections have fallen by 12.2% and FY25 by 18.2%.

Picture Supply: Zacks Funding Analysis

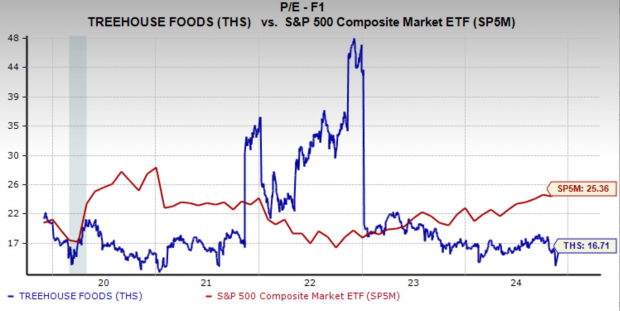

TreeHouse Meals Inventory Valuation

TreeHouse is buying and selling at a one yr ahead earnings a number of of 16.7x, which is beneath the market common and just under its five-year median of 17.8x. Whereas that is beneath its historic common and isn’t fairly a premium valuation, it nonetheless appears excessive for a enterprise that has such poor development prospects.

Picture Supply: Zacks Funding Analysis

Ought to Traders Keep away from THS Shares?

TreeHouse Meals has confronted vital headwinds over the past yr, and it doesn’t appear they’ll subside any time quickly. The meals enterprise is very tough as there may be large competitors, and the trade lives on razor skinny margins.

Till THS can present a marked enchancment in development or different enterprise fundamentals, I might advise buyers to keep away from the inventory and search alternatives elsewhere.

Free Report: 5 Clear Power Shares with Large Upside

Power is the spine of our financial system. It’s a multi-trillion greenback trade that has created a few of the world’s largest and most worthwhile firms.

Now state-of-the-art know-how is paving the way in which for clear power sources to overhaul “old school” fossil fuels. Trillions of {dollars} are already pouring into clear power initiatives, from solar energy to hydrogen gas cells.

Rising leaders from this house may very well be a few of the most fun shares in your portfolio.

Download Nuclear to Solar: 5 Stocks Powering the Future to see Zacks’ top picks free today.

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.