Capitalists have actually cooled down on the commercial particular niche of the property investment company (REIT) field. There’s no much better instance of that than the approximately 25% decrease from 2022 highs in the cost of commercial titan Prologis ( NYSE: PLD) That REIT is, undeniably, a leader in the commercial REIT field, however capitalists could still discover even more varied W.P. Carey ( NYSE: WPC) of even more passion. Right here’s why.

Rewards

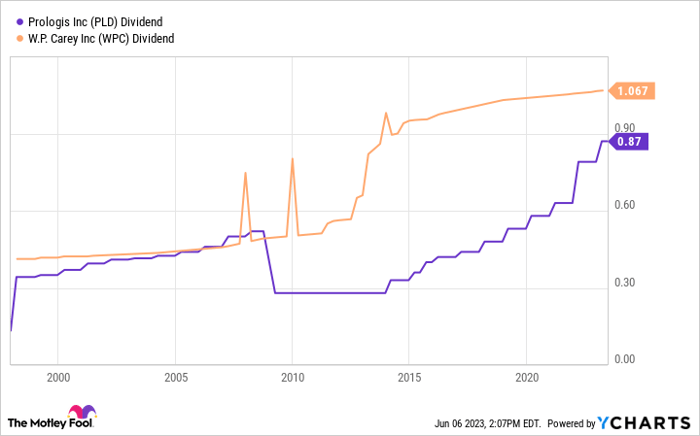

If you are taking a look at REITs, you are possibly thinking about returns. W.P. Carey’s returns return is 6.1% today, while Prologis’ return is much less than fifty percent that at 2.8%. From a return point of view, W.P. Carey conveniently defeats Prologis. Yet there’s even more to the returns tale than return alone.

Photo resource: Getty Images.

W.P. Carey has actually raised its returns each year because its going public in 1998. That’s greater than a quarter of a century of rises, consisting of throughout the Great Recession as well as the coronavirus pandemic, to name a few challenging market as well as financial durations. That touch additionally consists of the firm’s shift from a collaboration framework to a REIT, which would certainly have been a simple time to reset the returns reduced if monitoring had actually desired. It really did not, as well as has actually plainly revealed that returning worth to capitalists with normal returns rises is a crucial top priority.

PLD Dividend information by YCharts.

Comparative, Prologis wound up reducing its returns in the Great Economic downturn as well as its returns rise touch is “just” ten years long. That’s absolutely nothing to sneer at as well as the industrial-focused REIT’s returns has actually expanded at a much more quick clip than that of W.P. Carey over the previous years. However, for uniformity, W.P. Carey plainly obtains approval.

That stated, Prologis’ funds from operations (FFO) payment proportion in the very first quarter was 71%. W.P. Cary’s FFO payout ratio was 83%, which is not as solid. There’s a subtlety below, however, since Prologis runs its homes while W.P. Carey utilizes the web lease strategy.

Various methods of doing points

Prologis has an enormous profile of storage facility homes (completing 1.2 billion square feet throughout 19 nations!) that it proactively handles, consisting of offering solutions for which it makes extra earnings. It is the 800-pound gorilla of the storage facility field. Yet it really handles its homes, which causes extra prices as well as makes a reduced FFO payment proportion a sensible choice as cash money may be required for various other points (like building upgrades as well as repair services).

W.P. Carey utilizes a web lease strategy, which implies that it rents its homes to solitary occupants that are in charge of the majority of asset-level operating expense. Given that it does not need to think of those expenditures, it can manage to have a greater FFO payment proportion. Yet that’s not the only distinction.

While Prologis is laser-focused on one building particular niche, W.P. Carey has actually entered the precise contrary instructions. Its profile of approximately 1,445 homes (regarding 176 million square feet) is spread out throughout the commercial (27% of leas), storage facility (24%%), retail (17%), workplace (17%), as well as self-storage (5%) markets (a rather huge “various other” classification rounds points bent on 100%). As well as while it does not have fairly the exact same international reach as Prologis, W.P. Carey has a substantial profile of possessions in Europe (36% of leas). It is among one of the most varied REITs you can purchase, making it practically a one-stop buy capitalists looking for REIT direct exposure.

Which’s truly where the rubber hits the trail. Where Prologis is a one-trick horse with a moderate return, W.P. Carey provides you wider direct exposure, a a lot more charitable return, as well as a more powerful returns background.

One as well as done

If you are looking particularly for an out-of-favor commercial REIT, after that Prologis needs to get on your listing of names to think about. Yet if what you truly desire is simply a dividend-paying REIT, after that you have a whole lot a lot more choices. As well as among one of the most eye-catching, offered its diversity as well as returns background, is W.P. Carey. As well as like Prologis, W.P. Carey’s shares have actually remained in a drop, so the charitable 6.1% return is up towards its highest degree over the previous years. To put it simply, like Prologis, W.P. Carey feels like it gets on sale, also, however in some essential methods, it provides capitalists greater than Prologis.

10 supplies we such as far better than Prologis

When our expert group has a supply idea, it can pay to pay attention. Besides, the e-newsletter they have actually competed over a years, Supply Expert, has actually tripled the marketplace. *

They simply exposed what they think are the ten best stocks for capitalists to purchase today … as well as Prologis had not been among them! That’s right– they believe these 10 supplies are also much better acquires.

* Supply Expert returns since June 5, 2023

Reuben Gregg Brewer has settings in W. P. Carey. The has settings in as well as suggests Prologis. The suggests W. P. Carey. The has a disclosure policy.

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always mirror those of Nasdaq, Inc.