Every week, Benzinga’s Inventory Whisper Index makes use of a mixture of proprietary knowledge and sample recognition to showcase 5 shares which can be slightly below the floor and deserve consideration.

Traders are continually on the hunt for undervalued, under-followed and rising shares. With numerous strategies obtainable to retail merchants, the problem usually lies in sifting by the abundance of data to uncover new alternatives and perceive why sure shares must be of curiosity.

Right here’s a take a look at the Benzinga Inventory Whisper Index for the week of Sept. 6:

Oracle Company ORCL: The know-how big is seeing robust curiosity from Benzinga readers forward of Monday’s first-quarter monetary outcomes.

The corporate is anticipated to report earnings per share of $1.33, up from $1.19 in final 12 months’s first quarter, in accordance with knowledge from Benzinga Pro. The corporate has crushed earnings per share estimates from analysts in seven straight quarters and eight of the previous 10 quarters total.

Analysts estimate the corporate will report first-quarter income of $13.24 billion, up from $12.94 billion in final 12 months’s first quarter. The corporate has missed income estimates from analysts in 4 straight quarters and 6 of the previous 10 quarters total.

Oracle highlighted AI demand within the fourth quarter with greater than 30 AI gross sales contracts valued at over $12.5 billion signed, together with a big contract with OpenAI. Oracle additionally introduced a partnership with Google Cloud on the time.

Oracle shares are up 2.3% over the past 5 days, as seen on the Benzinga Pro chart under. Oracle inventory is up 38% year-to-date in 2024.

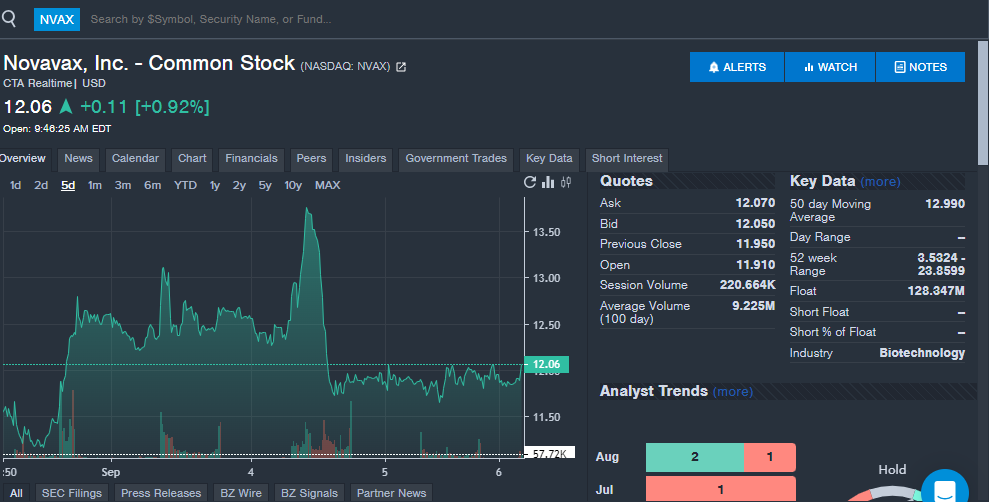

Novavax Inc NVAX: Shares of the vaccine firm had been up over 4% up to now 5 days with information that the FDA granted Emergency Use Authorization of the corporate’s up to date COVID-19 vaccine. The up to date vaccine is included within the suggestions from the U.S. Facilities for Illness Management and Prevention (CDC).

The vaccine is the one protein-based choice obtainable within the U.S. for folks aged 12 and older for the prevention of COVID-19. The corporate is also drawing curiosity from traders forward of two firm displays subsequent week. Novavax will current at H.C. Wainwright and Baird investor conferences on Monday, Sept. 9 and Tuesday, Sept. 10, respectively.

Learn Additionally: EXCLUSIVE: Prime 20 Most-Searched Tickers On Benzinga Professional In August 2024 – The place Do Tesla, Nvidia, Apple, AMD Inventory Rank?

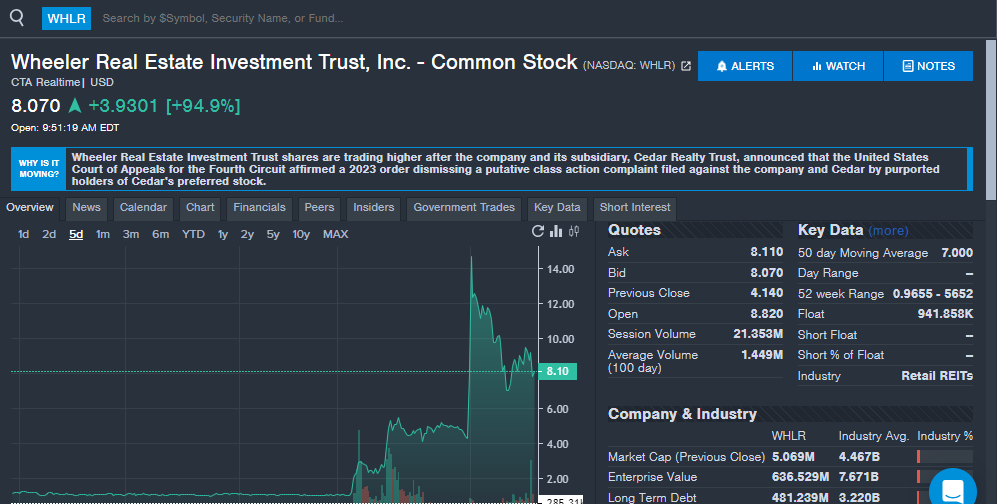

Wheeler Actual Property Funding Belief WHLR: Shares of the true property funding belief surged over 500% on the week after the corporate announced a circuit court docket affirmed the dismissal of a category motion lawsuit involving holders of Cedar Realty most well-liked inventory. Wheeler acquired Cedar in August 2022 and the lawsuit alleged a breach of contract associated to Cedar’s former board of administrators.

“With this matter behind us, each corporations stay well-positioned to execute on their strategic plans,” Cedar and Wheeler CEO Andrew Franklin mentioned.

The corporate owns 77 grocery-anchored procuring facilities within the Northeast, Mid-Atlantic and Southeast overlaying 14 states. With the lawsuit behind the corporate, traders may see a optimistic long-term outlook.

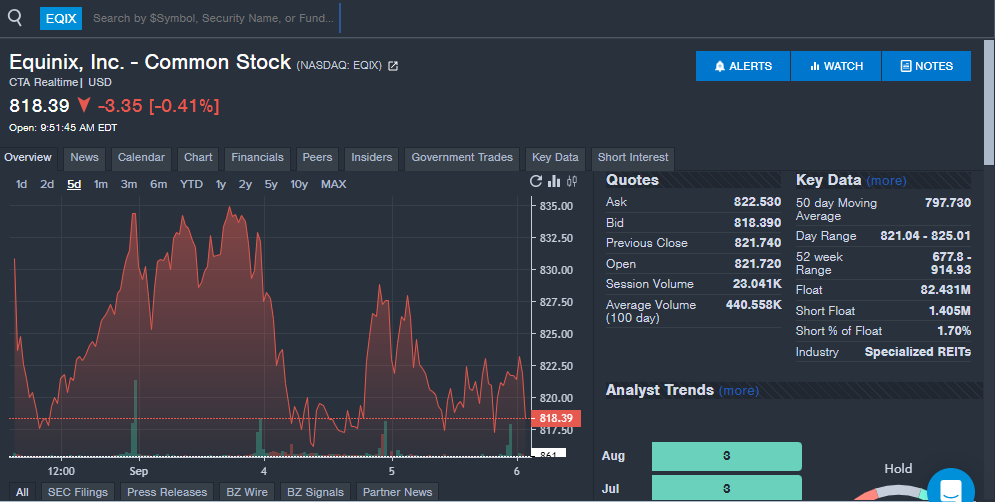

Equinix Inc EQIX: The information middle firm noticed robust curiosity from traders on the week with shares up minimally. The corporate announced it issued $750 million in inexperienced bonds throughout two accomplished choices. The inexperienced bonds are getting used to assist with sustainability initiatives for the corporate.

“Inexperienced bonds function a priceless means to safe funding and assist vital initiatives that improve the sustainability of our operations,” Equinix SVP Company Finance and Sustainability Katrina Rymill mentioned. “During the last 5 years, our inexperienced bonds have funded 172 inexperienced constructing initiatives throughout 105 websites, 33 power environment friendly initiatives and two Energy Buy Settlement initiatives.”

The brand new inexperienced bonds may assist the corporate proceed to spend money on new efforts to assist assist the corporate’s 86 consecutive quarters of top-line income progress, which the corporate mentioned is the longest streak of any S&P 500 firm.

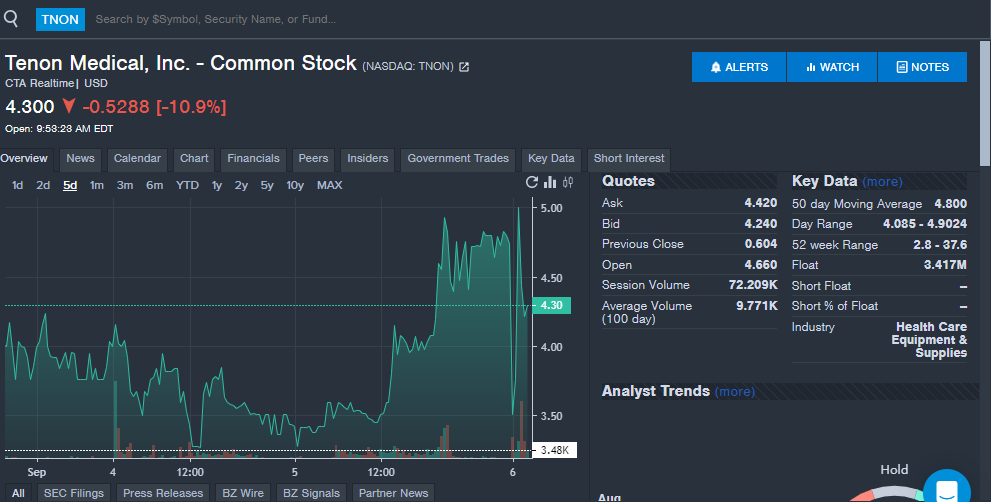

Tenon Medical Inc TNON: Investor curiosity within the medical gadget firm grew in the course of the week thanks to 2 items. The corporate introduced a 1:8 reverse inventory break up on Sept. 4 that took impact on Sept. 6. Reverse inventory splits usually draw consideration from retail traders as they scale back the float and shares excellent of an organization.

Tenon additionally introduced a peer-reviewed publication of its Catamaran SI Joint Fusion System. The peer overview confirmed proof of fusion on the 12-month mark post-procedure, the corporate mentioned.

Keep tuned for subsequent week’s report, and observe Benzinga Professional for all the newest headlines and top market-moving stories here.

Learn the newest Inventory Whisper Index reviews right here:

Learn Subsequent:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.