Warren Buffett’s holding firm Berkshire Hathaway BRK.B reports incomes on Friday, February 23.

Warren Buffett’s expansive corporation possesses companies throughout the range of markets. While every person recognizes him as a great supply picker as well as profile supervisor, he is additionally the guard of some 70 firms under the Berkshire Hathaway umbrella.

Likewise reporting incomes on Friday is one more popular, however substantially smaller sized holding firm, Icahn Enterprises IEP Chief Executive Officer Carl Icahn is one more spending tale as well as radical several years right into his Wall surface Road profession.

Photo Resource: Zacks Financial Investment Study

Company Introduction

Berkshire can be damaged down right into 3 key sectors. The biggest factor to the leading line is Berkshire’s insurance policy team, that includes GEICO, Berkshire Hathaway Reinsurance Business, as well as BH Key Team. While insurance policy has actually been a remarkable company for Buffett, the float insurer are called for to hold has actually additionally been an essential lorry for his many financial investments.

The following biggest section at BRKB is the Production, Solution as well as Selling procedures, that makes up 36% of income. This section is incredibly varied as well as consists of significant production companies such as specialized chemical manufacturer Lubrizol Firm, in addition to structure procedures Clayton Residences as well as Shaw Industries, which is the biggest supplier of carpetings in the nation. Berkshire’s profile additionally consists of customer items Fruit of the Loom, NetJets, Milk Queen, See’s Candies as well as a range of various other retail as well as solutions companies.

The 3rd section is the Controlled Energy companies, which generates 11% of overall income. This section is comprised of Burlington Northern Santa Fe (BNSF), which is among the biggest products railways in The United States and Canada, as well as Berkshire Hathaway Power, which was initially called Mid-American Power prior to being obtained in the late 90s.

This is done in enhancement to Buffett as well as Berkshire’s profile of public equities, that includes large risks in Apple AAPL, Occidental Oil OXY, Chevron CVX, Coca-Cola KO as well as several others.

Revenues Assumptions

Berkshire Hathaway presently sporting activities a Zacks Ranking # 3 (Hold), showing that its incomes alterations have actually continued to be reasonably level. BRKB has a solid document of defeating incomes consisting of a 14% beat last quarter as well as a 22% standard over the tracking 4.

Existing quarter approximates task sales will certainly expand 4% YoY to $75 billion. Complete year sales are anticipated to be $299 billion, a rise of 8% YoY. Revenues are anticipated to expand also, with present quarter EPS anticipated at $3.31 per share, a 1.2% rise YoY. Complete year incomes price quotes are extremely solid, anticipating EPS to climb up 23% to $14.85 per share.

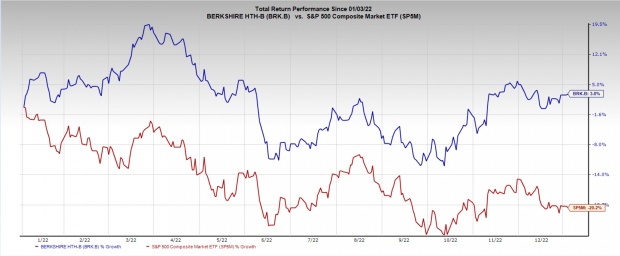

2022 was a remarkable year for Berkshire as its profile of actual possessions, as well as durable goods gained from the rise in rising cost of living. Additionally, the unpredictability that greater rates of interest gave the securities market made BRKB a safe house for financiers attempting to stay clear of the volatility of development supplies. Berkshire outshined the wide market by 23% in 2015.

Photo Resource: Zacks Financial Investment Study

Evaluation

Berkshire supply is presently trading at 18x 1 year forward incomes, listed below its 10-year typical of 20x, as well as stone’s throw off its reduced of 15x. Likewise worth keeping in mind because BRKB has an incomes several completely in accordance with the S&P 500 ordinary, which is a testimony to just how generally varied Buffett’s holding firm is.

Berkshire supplies no returns as well as never ever has. While for some that might be an exit ramp, it deserves considering that would certainly be far better to be spend all the totally free capital?

Photo Resource: Zacks Financial Investment Study

Sequence

Buffett is currently in his 90s, as well as a great deal of the success experienced by BRKB supply is straight credited to him, as well as his companion Charlie Munger. What is mosting likely to occur when they do ultimately retire or die? A sequence strategy has actually certainly been made, however, for currently it is still a trick to the general public. Can financiers anticipate Berkshire to do in addition to it has without its captain as well as initial friend?

Icahn Enterprises

It is sort of amusing just how both Berkshire as well as Icahn business report on the very same day. 2 of one of the most enigmatic faces in investing, Carl Icahn as well as Warren Buffett could not be various in several means. Icahn, a significant gamer on Wall surface Road, while Buffett remains largely in Omaha. Icahn lively as well as been afraid, while Buffett is a lot more soft-spoken, as well as admired.

IEP with its subsidiaries, runs in financial investment, power, automobile, food product packaging, realty, residence style, as well as pharma companies in the united state as well as worldwide. IEP presently has a 1 year onward P/E of 73x, as well as a returns return of 14%.

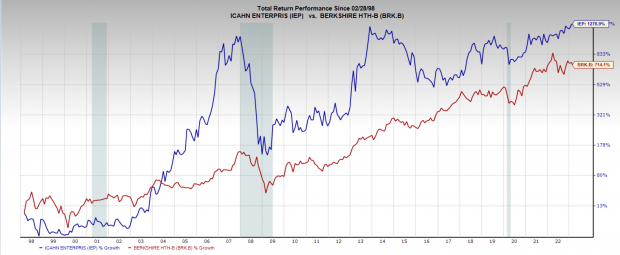

Returns in between both empires are remarkably comparable, although IEP has actually slipped by with far better returns than BRKB over the last 25 years, albeit with substantially even more volatility.

Photo Resource: Zacks Financial Investment Study

Verdict

It is constantly a large occasion when Buffett records incomes for BRKB. Berkshire, as a result of its wide diversity, can be a helpful bellwether for the economic situation, as well as the shade offered by Buffett is constantly incredibly beneficial. It will certainly interest contrast the remarks from 2 spending tales that remain at the peak of their spending jobs late in life.

Is THIS the Ultimate New Clean Power Resource? (4 Ways to Earnings)

The globe is progressively concentrated on removing nonrenewable fuel sources as well as increase use eco-friendly, tidy power resources. Hydrogen gas cells, powered by the most bountiful material in deep space, might supply a limitless quantity of ultra-clean power for several markets.

Our immediate unique record exposes 4 hydrogen supplies topped for large gains – plus our various other leading tidy power supplies.

Apple Inc. (AAPL) : Free Stock Analysis Report

Chevron Corporation (CVX) : Free Stock Analysis Report

CocaCola Company (The) (KO) : Free Stock Analysis Report

Occidental Petroleum Corporation (OXY) : Free Stock Analysis Report

Berkshire Hathaway Inc. (BRK.B) : Free Stock Analysis Report

Icahn Enterprises L.P. (IEP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always mirror those of Nasdaq, Inc.