Listed below are three shares with purchase ranks and robust progress traits for buyers to contemplate at the moment, April 3:

CommScope Holding Firm, Inc. COMM: This community infrastructure supplier carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its present yr earnings growing 72.3% during the last 60 days.

CommScope Holding Firm, Inc. Value and Consensus

CommScope Holding Company, Inc. price-consensus-chart | CommScope Holding Firm, Inc. Quote

CommScope Holding Firm has a PEG ratio of 0.34 in contrast with 0.83 for the trade. The corporate possesses a Growth Score of A.

CommScope Holding Firm, Inc. PEG Ratio (TTM)

CommScope Holding Company, Inc. peg-ratio-ttm | CommScope Holding Firm, Inc. Quote

Choice Care Well being, Inc. OPCH: This firm supplies infusion and residential care administration options carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its present yr earnings growing 33.3% during the last 60 days.

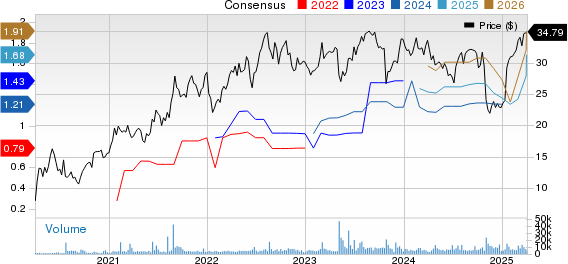

Choice Care Well being, Inc. Value and Consensus

Option Care Health, Inc. price-consensus-chart | Choice Care Well being, Inc. Quote

Choice Care Well being has a PEG ratio of 1.85 in contrast with 2.61 for the trade. The corporate possesses a Progress Rating of B.

Choice Care Well being, Inc. PEG Ratio (TTM)

Option Care Health, Inc. peg-ratio-ttm | Choice Care Well being, Inc. Quote

JD.com, Inc. JD: This provide chain-based know-how and repair supplier carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its present yr earnings growing 6.7% during the last 60 days.

JD.com, Inc. Value and Consensus

JD.com, Inc. price-consensus-chart | JD.com, Inc. Quote

JD.com has a PEG ratio of 0.27 in contrast with 0.51 for the trade. The corporate possesses a Progress Rating of B.

JD.com, Inc. PEG Ratio (TTM)

JD.com, Inc. peg-ratio-ttm | JD.com, Inc. Quote

See the full list of top-ranked stocks here.

Study extra in regards to the Growth score and how it is calculated here.

Zacks’ Analysis Chief Names “Inventory Most More likely to Double”

Our staff of specialists has simply launched the 5 shares with the best likelihood of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This high decide is among the many most revolutionary monetary companies. With a fast-growing buyer base (already 50+ million) and a various set of leading edge options, this inventory is poised for large features. After all, all our elite picks aren’t winners however this one might far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

CommScope Holding Company, Inc. (COMM) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

Option Care Health, Inc. (OPCH) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.