The semiconductor {industry} is anticipated to generate $611 billion in income this yr as per World Semiconductor Commerce Statistics (WSTS), which might be a bounce of 16% from final yr’s ranges, and the nice half is that the expansion is about to proceed in 2025 as properly with an estimated enhance of 12.5% in income subsequent yr.

Artificial intelligence (AI) has turned out to be one of many key causes behind the wholesome development of the semiconductor {industry}. The proliferation of this know-how has pushed a rise in demand for a number of varieties of chips starting from application-specific built-in circuits (ASICs) to processors to reminiscence.

Corporations equivalent to Nvidia (NASDAQ: NVDA) and Micron Know-how (NASDAQ: MU) have turned out to be massive beneficiaries of the expansion in AI-fueled semiconductor demand. Nvidia’s dominant place in AI graphics processing items (GPUs) has led to eye-popping development in its income and earnings in current quarters, with shares of the corporate up 193% this yr.

Micron, alternatively, has additionally stepped on the gasoline of late, although its inventory value bounce of 27% pales compared to Nvidia’s. On this article, we’ll take a better take a look at the prospects and the valuation of each corporations to search out out which considered one of these two is the higher AI inventory to purchase proper now.

The case for Nvidia

The demand for information middle GPUs has merely taken off previously couple of years because the race to coach and deploy AI fashions has intensified. Nvidia has turned out to be the go-to provider of knowledge middle GPUs, controlling an estimated 98% of this market in 2023. The corporate bought an estimated 3.76 million information middle GPUs final yr, a rise of 42% from the previous yr.

The excellent news for Nvidia traders is that the demand for AI GPUs stays sturdy. World Market Insights estimates that the information middle GPU market might clock an annual development price of 28% by means of 2032. Given Nvidia’s dominant place on this market, it’s simple to see why the corporate’s GPU shipments are anticipated to go greater in 2025.

As an example, market analysis agency TrendForce forecasts a 55% enhance in shipments of Nvidia’s high-end GPUs subsequent yr, pushed by the arrival of the corporate’s new Blackwell chips. There’s a chance that Nvidia could possibly generate data center revenue of $200 billion subsequent yr, which might be practically double the present fiscal yr’s income run price of $98 billion (Nvidia reported $49 billion in information middle income within the first six months of the present fiscal yr).

If that is certainly the case, Nvidia might simply crush Wall Avenue’s income expectations within the subsequent fiscal yr. The corporate is anticipated to complete its ongoing fiscal yr 2025 with just below $126 billion in income, which might be greater than double the $60.9 billion it delivered within the earlier fiscal yr.

NVDA Revenue Estimates for Current Fiscal Year information by YCharts

Because the chart above tells us, analysts expect Nvidia’s income to extend one other 42% within the subsequent fiscal yr, adopted by a 17% enhance in fiscal 2027. Nonetheless, there’s a sturdy probability that Nvidia could possibly exceed these estimates because of the expansion it’s clocking in nascent however fast-growing niches such as data center networking, sovereign AI, and enterprise AI software.

These numerous catalysts counsel that Nvidia is on monitor to stay a prime AI inventory going ahead since it’s seeking to broaden its attain into markets past simply information middle GPUs.

The case for Micron Know-how

The demand for reminiscence chips which can be utilized by the likes of Nvidia of their AI GPUs has shot up massive time, main to an enormous turnaround within the fortunes of Micron Know-how. The reminiscence specialist completed fiscal 2024 (which ended on Aug. 29) with a 61% spike in income to $25.1 billion and posted a revenue of $1.30 per share as in comparison with a lack of $4.45 per share in the identical quarter final yr.

Micron administration identified in its current earnings launch that “sturdy AI demand drove a powerful ramp of our information middle DRAM merchandise and our industry-leading excessive bandwidth reminiscence.” The great half is that the reminiscence {industry} is anticipated to maintain its terrific momentum in 2025 as properly. In accordance with TrendForce, the dynamic random entry reminiscence (DRAM) market might witness a 51% enhance in income subsequent yr to $136.5 billion, pushed by the rising consumption of high-bandwidth reminiscence (HBM) that is deployed in AI chips.

Provided that DRAM accounted for 70% of Micron’s complete income within the earlier fiscal yr, the wholesome prospects of this market bode properly for the chipmaker. Even higher, the NAND flash storage market (which produces the remainder of Micron’s income) is anticipated to extend by 29% in 2025 and generate $87 billion in income.

These sunny end-market prospects point out why Micron’s steering for the present quarter is extraordinarily stable. The corporate is anticipating $8.7 billion in income within the first quarter of fiscal 2025, together with non-GAAP (adjusted) earnings of $1.74 per share. The highest-line estimate factors towards an 84% enhance from the identical interval final yr, suggesting that Micron is on monitor to ship even stronger development within the present fiscal yr.

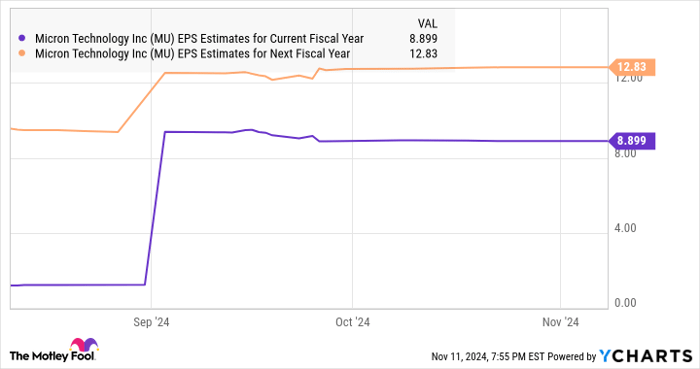

Consensus estimates compiled by Yahoo! Finance are forecasting Micron’s income to extend 52% on this fiscal yr to $38.2 billion, adopted by a 20% enhance in fiscal 2026 to $45.7 billion. The underside-line development is anticipated to stay sturdy as properly when in comparison with final fiscal yr’s studying of $1.30 per share.

MU EPS Estimates for Current Fiscal Year information by YCharts

So, similar to Nvidia, Micron seems to be like a stable AI stock. However for those who had to select from considered one of these two names, which one do you have to be shopping for?

The decision

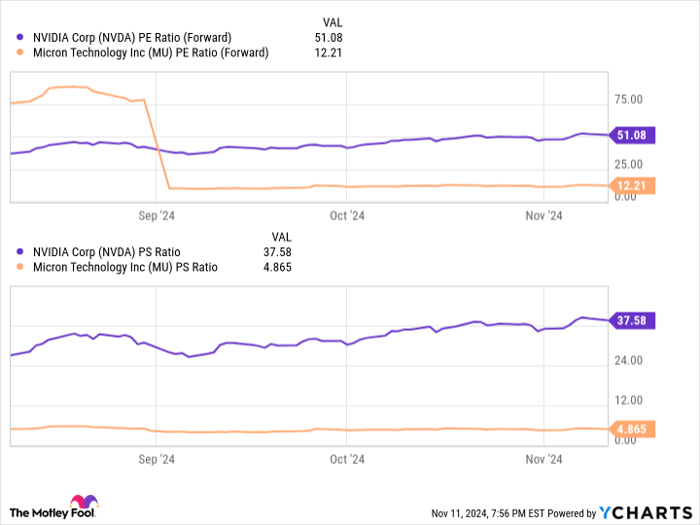

The above dialogue tells us that each Micron and Nvidia are on monitor to ship spectacular ranges of development because of AI-driven demand for his or her chips. Nonetheless, for those who’re wanting to select from these two semiconductor corporations to capitalize on the AI growth, a better take a look at their valuations will make the selection simpler.

Because the chart under tells us, Micron is considerably cheaper than Nvidia.

NVDA PE Ratio (Forward) information by YCharts

After all, Nvidia appears deserving of a premium valuation because of its spectacular share of the AI chip market, however the tempo at which Micron is rising can’t be ignored, both. So, traders searching for a mixture of worth and development can think about shopping for shares of Micron Know-how proper now due to its valuation and sturdy earnings development prospects that would assist this tech inventory maintain its newly discovered momentum and bounce greater.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 best stocks for traders to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $899,361!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of November 11, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.