After flying excessive throughout the first half of the yr, pharmaceutical big Eli Lilly (NYSE: LLY) has misplaced some momentum; the corporate’s shares are down by 11% since June 1. Nonetheless, the healthcare chief nonetheless has loads of followers on Wall Avenue, together with Israel Englander, the billionaire proprietor of Millennium Administration, a hedge fund.

Millennium Administration’s stake in Eli Lilly elevated by 86% within the third quarter. Do you have to comply with Englander’s lead and enhance your stake (or provoke a place) in Eli Lilly?

What’s gone fallacious for Eli Lilly?

Since June 1, Lilly has earned approval for brand-new medicines, together with eczema remedy Ebglyss and a possible blockbuster Alzheimer’s illness medication, Kisunla. It reported a number of optimistic information readouts for its new best-selling medication tirzepatide. And the corporate’s second-quarter outcomes got here with an upward steerage adjustment.

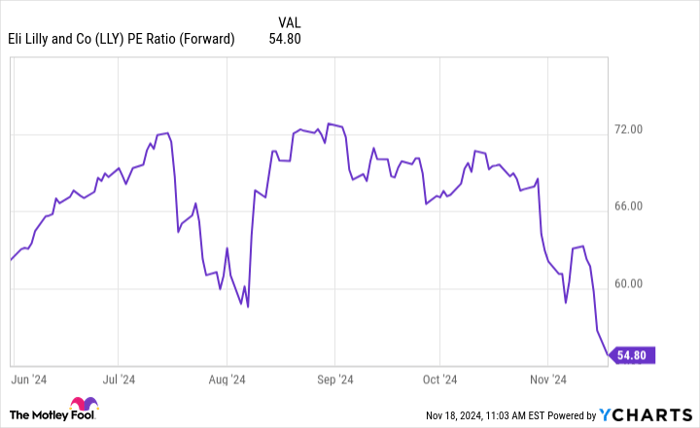

What, then, is the reason for Lilly’s poor efficiency within the second half of the yr? First, its shares look costly. Eli Lilly’s ahead price-to-earnings ratio was lately 54.8. The common for the S&P 500 is 22, and the healthcare industry‘s is just 17.4.

LLY PE Ratio (Forward) information by YCharts.

Eli Lilly has been on a tear for some time now, and its shares had been certain to face gravity sooner or later. Some traders probably determined to pocket vital earnings earlier than it did.

Second, Lilly’s third-quarter outcomes had been under expectations. Income grew by 20% yr over yr to $11.4 billion. That is not unhealthy by any means, but it surely wasn’t sufficient to impress traders, particularly contemplating the corporate’s valuation. Lilly barely lowering its steerage for the complete yr 2024 made issues worse, sending the stock off a cliff following its newest quarterly replace.

There’s loads of room to run

Eli Lilly may or may not rebound by the top of the yr. It is inconceivable to foretell how its shares will carry out within the subsequent month, or three, or six. However what if we lengthen our horizon past the subsequent 5 years? Then we now have each purpose to suppose that Lilly can ship market-beating returns. Let’s think about simply three:

First, the corporate’s tirzepatide — offered below the model title Mounjaro for diabetes and Zepbound for weight administration — continues to be solely getting began. The 2 manufacturers racked up mixed gross sales of $4.4 billion within the third quarter. Mounjaro was first authorized in Could 2022, and Zepbound in November 2023.

Wonderful information from late-stage trials has already been launched for potential new indications for tirzepatide. One in all these is lowering the danger of worsening coronary heart failure in adults who’ve coronary heart failure with preserved ejection fraction and weight problems. Tirzepatide additionally aced part 3 research in stopping diabetes in sufferers with pre-diabetes who’re chubby or overweight, and it efficiently handled sleep apnea in chubby sufferers.

Tirzepatide is a twin agonist — it mimics the operate of two hormones, GLP-1 and GIP — and its success exhibits the ability of this method. The sky is the restrict if we add different potential indications that have not handed late-stage trials but. Analysts weren’t kidding once they mentioned tirzepatide might hit peak gross sales of $25 billion.

Second, a number of of Eli Lilly’s newer medicines not named tirzepatide will finally make significant impacts inside the subsequent 5 years. Kisunla appears to be like promising, but it surely’s not the one one. Some projections say that ulcerative colitis remedy Omvoh, first authorized final yr, might generate $1.2 billion in gross sales by 2029.

Third, Lilly will make vital pipeline progress within the subsequent few years. One in all its promising candidates is retatrutide, a triple agonist. Do not forget that tirzepatide is a twin agonist. Now, Lilly goes one step additional with retatrutide, which mimics GLP-1, GIP, and glucagon; the corporate has dubbed it “triple G.” Progress on this program could possibly be a tailwind for the corporate. And it is not at all Eli Lilly’s solely thrilling candidate.

Because of its revolutionary pipeline, the drugmaker’s lineup ought to look completely different in 5 years. That is one thing else that can assist drive the inventory value larger.

Is the valuation too excessive?

Even with Eli Lilly’s robust prospects, you may hesitate to put money into it due to the excessive ahead P/E, which appears to be like prohibitive. Nonetheless, its shares do not appear as costly as soon as we put issues in context. The ahead P/E displays the market’s expectations for the corporate. If it could actually match these expectations as a rule, its valuation will not be an excessive amount of of an issue. Within the third quarter, Eli Lilly’s adjusted earnings per share (EPS) soared to $1.18, in comparison with simply $0.10 within the year-ago interval.

Subsequent yr, analysts anticipate EPS to develop by virtually 72%. This is not stunning, contemplating tirzepatide’s tempo and the truth that a number of of Lilly’s older medicines are additionally performing nicely. The corporate might maintain issues up with newer medication hitting their stride, and tirzepatide incomes label expansions. So, in my opinion, Eli Lilly is price investing in regardless of its ahead P/E. I would suggest following billionaire Englander’s lead on this one.

Don’t miss this second likelihood at a probably profitable alternative

Ever really feel such as you missed the boat in shopping for probably the most profitable shares? You then’ll need to hear this.

On uncommon events, our professional crew of analysts points a “Double Down” stock advice for corporations that they suppose are about to pop. If you happen to’re frightened you’ve already missed your likelihood to speculate, now’s the most effective time to purchase earlier than it’s too late. And the numbers communicate for themselves:

- Nvidia: if you happen to invested $1,000 once we doubled down in 2009, you’d have $368,053!*

- Apple: if you happen to invested $1,000 once we doubled down in 2008, you’d have $43,533!*

- Netflix: if you happen to invested $1,000 once we doubled down in 2004, you’d have $484,170!*

Proper now, we’re issuing “Double Down” alerts for 3 unbelievable corporations, and there might not be one other likelihood like this anytime quickly.

*Inventory Advisor returns as of November 18, 2024

Prosper Junior Bakiny has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.