Evaluating Gold and Bitcoin

Whether or not it’s soccer groups, political events, or Tesla’s (TSLA) inventory prospects, it’s human nature for individuals to wish to biasedly choose their “faith” and begrudgingly follow it come hell or excessive water. One in every of Wall Avenue’s greatest debates is between Bitcoin bulls like MicroStrategy (MSTR) founder Michael Saylor and “gold bugs” like Peter Schiff. In some ways, the 2 belongings couldn’t be extra completely different. For instance, gold a medium of change for 1000’s of years, whereas Bitcoin’s first recognized transaction was within the new millennium. Gold is accepted extra by the “child boomer” technology, whereas a lot of the youthful technology has totally embraced Bitcoin.

However, Bitcoin is usually known as “digital gold” as a result of the 2 belongings share a number of similarities. Although gold is a bodily asset and Bitcoin is digital, every requires “mining.” Traders view every asset as a retailer of worth, offering a method of hedging in opposition to inflation. Lastly, each get pleasure from shortage: Bitcoin has a most provide of 21 million, whereas gold manufacturing is projected to sluggish in ~25 years.

The Authorities Spending and Inflation Drawback

The COVID-19 stimulus checks, the Clear Power for America Act, and the U.S. help for international conflicts (particularly, the Battle in Ukraine) have all contributed to unprecedented authorities spending. All through the 2000s, U.S. authorities spending has reached new heights. The U.S. nationwide debt has ballooned to greater than $35 trillion, with the curiosity on that debt anticipated to achieve the mind-boggling $1 trillion degree within the subsequent few years.

Over the previous 20 years, each political events have been at fault for the exploding debt. Worse, neither aspect of the political aisle appears to be motivated to proper the ship. Whereas Jerome Powell and the Fed had been capable of quell the inflation charge with larger rates of interest, it doesn’t change the truth that client costs are 20% larger than they had been in 2020. Although the U.S. stays an financial powerhouse, deficits have a means of snowballing, and historical past is suffering from the financial stays of spending-happy nations like Venezuela and Turkey. No matter whether or not you consider the deficit is an existential menace, inflationary hedges like gold and bitcoin have a spot in most portfolios.

Is Gold or Bitcoin a Higher Lengthy-Time period Funding?

I’m a value motion dealer centered on technical evaluation and catalyst-driven investing. Nevertheless, as somebody who owns each Bitcoin and gold in my longer-term accounts, I’ll attempt to present essentially the most unbiased evaluation as potential.

Bitcoin Beats Gold on a Complete Return Foundation

During the last decade, Bitcoin has been the top-performing asset globally, averaging a mind-blowing 693% annual return.

Picture Supply: Curvo

Over the identical interval, gold has averaged simply over 5% yearly.

Picture Supply: Zacks Funding Analysis

Whether or not you examine Bitcoin to gold or another asset, Bitcoin simply wins the whole return debate.

Higher Retailer of Worth: Gold or Bitcoin?

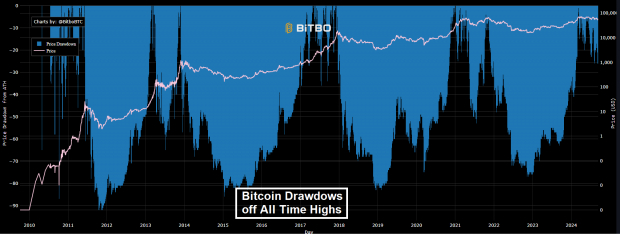

The “no free lunches” saying is prescient when unpacking the shop of worth argument between gold and Bitcoin. To attain outsized returns, traders have to be okay with extra volatility. Since 2012, Bitcoin has suffered a 70% drawdown, two 80% drawdowns, and a 90% drawdown.

Picture Supply: BiTBO

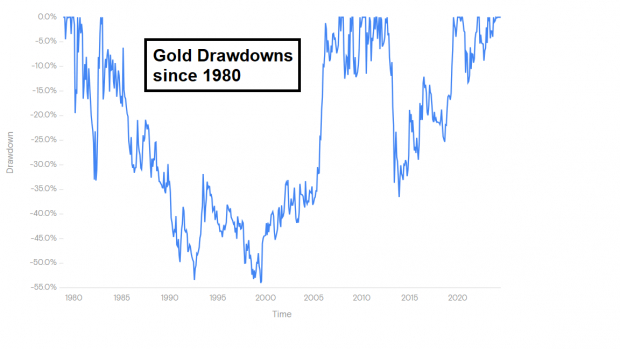

Conversely, gold’s worst drawdown over the previous 40 years was 54%.

Picture Supply: Zacks Funding Analysis

“Retailer of worth” refers to an asset or forex that retains its worth over time. Although Bitcoin has gained extra worth since its inception, the reply to which is a greater retailer of worth depends on the timeframe. For instance, in case your grandparents had been searching for a secure asset that may maintain its worth over a 3–5-year interval, gold can be way more doubtless to not have a deep drawdown. Moreover, gold can be way more stress-free to carry as a result of it tends to be far much less risky than Bitcoin.

Bitcoin/Gold Survivability

As a result of gold has been used as a medium of change for 1000’s of years, it enjoys an unfair benefit from the survivability perspective. Gold has been round for 1000’s of years, and it’ll doubtless proceed to be.

That mentioned, Bitcoin has weathered some troublesome storms in its quick historical past. First, Bitcoin survived the demise of the “Silk Highway” on-line market, the Mt. Gox change hack (which was answerable for 70% of transactions on the time), the 2008 World Monetary Disaster, and the FTX change’s fraud and subsequent collapse. Regardless of these tense moments, the Bitcoin community has by no means been infiltrated because of its distinctive community attributes like its distributed ledger and its “proof of labor” mining protocol.” However, gold has an intensive monitor document as a retailer of worth that’s inconceivable to match in a short while.

Gold and Bitcoin Usability

Every asset’s professionals are cons for the opposite asset on this case. As an example, gold bugs desire it as a result of it’s tangible and is used for jewellery and electronics. Bitcoin bulls desire it as a result of it’s digital and will be extra simply used for transfers and worldwide remittances.

Bitcoin and Gold Demand

There may be heavy demand for each asset lessons. The SPDR Gold ETF (GLD) was the biggest ETF launch till the iShares Bitcoin ETF (IBIT) got here to steal the throne. From a retail perspective, large demand for Bitcoin has led to wholesome income for crypto exchanges like Coinbase (COIN). In the meantime, retail juggernaut Costco (COST) reportedly sells ~$200 million price of gold bars month-to-month. Central financial institution shopping for set a gold shopping for document within the first half of 2024 as BRIC nations like China search to maneuver off the U.S. greenback. On the identical time, El Salvador holds a whole bunch of thousands and thousands price of Bitcoin.

Must you Purchase Gold or Bitcoin?

When you made it this far, that is the reply you could have been ready for. The reality is that the choice to take a position between gold and bitcoin comes down to every particular person. When you search to protect your capital and restrict volatility in your portfolio, gold is y the suitable alternative for you. Conversely, in case you are prepared to sit down by means of extra volatility in change for capital appreciation, try to be extra closely weighted towards Bitcoin. Keep in mind, simply because there are robust emotions on all sides of the controversy doesn’t imply you’ll be able to’t personal each in your portfolio. Consider your targets and danger urge for food and discover the suitable funding combine to your state of affairs.

Infrastructure Inventory Increase to Sweep America

An enormous push to rebuild the crumbling U.S. infrastructure will quickly be underway. It’s bipartisan, pressing, and inevitable. Trillions can be spent. Fortunes can be made.

The one query is “Will you get into the suitable shares early when their development potential is best?”

Zacks has launched a Particular Report that will help you do exactly that, and at this time it’s free. Uncover 5 particular firms that look to realize essentially the most from building and restore to roads, bridges, and buildings, plus cargo hauling and power transformation on an virtually unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

SPDR Gold Shares (GLD): ETF Research Reports

MicroStrategy Incorporated (MSTR) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.