It’s essentially the most essential interval for shares – earnings season.

Many corporations are scheduled to report within the coming weeks, together with Reserving Holdings BKNG, on February 23rd, after the market shut.

Reserving Holdings is likely one of the largest on-line journey corporations on the planet. The corporate’s travel-related choices cowl lodge rooms, airline tickets, rental automobiles, trip packages, cruises, “issues to do” at buyer locations, and journey insurance coverage.

How does the corporate presently stack up? We are able to use outcomes from a peer, Expedia EXPE, as a small gauge. Let’s take a more in-depth look.

Expedia This fall

Expedia posted earnings per share of $1.26 in its newest launch, falling wanting the Zacks Consensus EPS Estimate by greater than 30%.

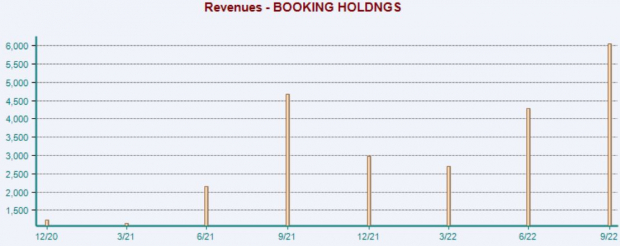

Quarterly income totaled $2.6 billion, once more falling wanting our $2.7 billion estimate by roughly 2% however rising 13% year-over-year. Under is a chart illustrating the corporate’s income on a quarterly foundation.

Picture Supply: Zacks Funding Analysis

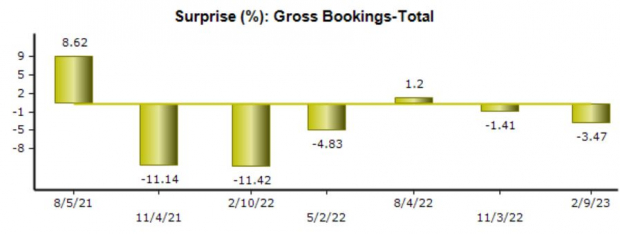

In fact, the corporate’s Gross Bookings was an necessary a part of the discharge, a metric that displays journey demand.

For the quarter, gross reserving totaled 20.5 million, falling wanting our consensus estimate by practically 3.5%. As we will see within the chart beneath, EXPE has primarily struggled to exceed expectations inside this metric.

Picture Supply: Zacks Funding Analysis

Peter Kern, CEO, on the quarter, “We had been happy that we had been in a position to ship our most worthwhile 12 months in 2022, regardless of the friction from remodeling our enterprise mannequin and know-how platform. Whereas our This fall outcomes had been negatively impacted by extreme climate, demand was in any other case sturdy and accelerating, and has been markedly stronger because the begin of the 12 months.”

Expedia shares misplaced roughly 8% within the following buying and selling session.

Reserving Holdings

Quarterly Estimates –

Analysts have taken a bullish stance for the quarter to be reported, with 5 constructive earnings estimate revisions hitting the tape during the last a number of months. The Zacks Consensus EPS Estimate of $20.97 suggests a 33% Y/Y climb in earnings.

Picture Supply: Zacks Funding Analysis

Our consensus income estimate sits at $3.9 billion, indicating an enchancment of 29% from the year-ago quarter.

Quarterly Efficiency –

BKNG has persistently exceeded EPS estimates, beating expectations in eight consecutive quarters. Prime line outcomes have additionally been constructive, with the corporate exceeding income estimates in seven of its final eight releases.

Simply in its newest launch, BKNG penciled in a 7.4% EPS beat and reported income 2.5% above expectations.

Picture Supply: Zacks Funding Analysis

Valuation

BKNG shares presently commerce at a 4.9X ahead price-to-sales ratio, beneath the 6.1X five-year median by a good margin.

Picture Supply: Zacks Funding Analysis

As well as, the corporate’s ahead earnings a number of presently sits at 19.9X, beneath the 22.6X five-year median and the Zacks Retail and Wholesale sector common.

Picture Supply: Zacks Funding Analysis

BKNG carries a Type Rating of “C” for Worth.

Placing Every little thing Collectively

As earnings season continues to chug alongside, buyers will stay busy sorting via quarterly prints.

And shortly, we’ll hear from Reserving Holdings.

A peer, Expedia EXPE, fell wanting quarterly estimates, sending shares downward.

Analysts have remained bullish for BKNG’s quarter, with estimates suggesting Y/Y climbs in each earnings and income.

As well as, the corporate has primarily exceeded quarterly estimates, delivering sturdy leads to its newest launch.

Heading into the print, Reserving Holdings BKNG is a Zacks Rank #3 (Maintain) with an Earnings ESP Rating of -3.2%.

5 Shares Set to Double

Every was handpicked by a Zacks knowledgeable because the #1 favourite inventory to realize +100% or extra in 2021. Earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

A lot of the shares on this report are flying underneath Wall Road radar, which offers an amazing alternative to get in on the bottom flooring.

Today, See These 5 Potential Home Runs >>

Expedia Group, Inc. (EXPE) : Free Stock Analysis Report

Booking Holdings Inc. (BKNG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.