Supplies have actually made some wonderful gains from the October 2022 lows as well as continue to be within spewing range of the current optimal in August in 2014. Actually, the S&P 500 index is up around +20% from the October lows, motivating some to recommend that the most awful lags us.

This note is concentrated on the outsized function of the ‘Large 7 Technology Athletes’– Apple AAPL, Amazon.com AMZN, Alphabet GOOGL, Microsoft MSFT, Meta META, Nvidia NVDA & & Tesla TSLA– out there’s solid efficiency this year.

Market births justifiably indicate the marketplace’s slim management with these ‘Large 7 Technology Athletes’ as a significant debate why they do not see the rally having lasting legs. This is a reasonable factor, though we ought to keep in mind that we are beginning to see various other components of the marketplace sign up with the management group in current days.

The bears likewise indicate economic crisis threats, the rising cost of living trouble being extra ‘sticky’ than the marketplace is valuing, as well as substantial disadvantage threats to existing agreement incomes assumptions.

Economic crises are infamously tough to anticipate, as well as this ‘coming economic crisis’ has actually confirmed extra tough than a lot of.

Without a clairvoyance, it is tough to understand with assurance what exists in advance in the macroeconomy. Yet a lot of conventional financial experts are decreasing their economic crisis probabilities, though they all see above-average threats of financial difficulty. With rising cost of living progressively reducing as well as the labor market remaining rather solid, lots of out there are beginning to designate most likely probabilities to the ‘soft touchdown’ situation.

We are seeing some very early proof of this in the real-time incomes quote alterations information also. Routine visitors of our incomes discourse understand that we have actually regularly flagged a positive kip down the alterations pattern given that the beginning of 2023 Q2. Incomes price quotes have actually been maintaining in the accumulation after regularly boiling down for practically a year as well as are in fact beginning to increase for some crucial markets.

This mix of desirable macroeconomic advancements as well as positive outlook concerning the transformational power of expert system (AI) appears to be driving market positive outlook.

The ‘Large 7 Technology Athletes’ go to the leading edge of the marketplace’s AI wishes, as was clearly taken shape by Nvidia’s off-the-charts support upgrade on Might 24 th That day, Nvidia informed the marketplace that as opposed to the $7 billion-plus that the marketplace anticipated them to generate earnings for their July quarter, they see the profits number to be extra like $11 billion.

The Might 24 th support upgrade has actually placed Nvidia shares on a special trajectory. Assessment inquiries often tend to have an aspect of subjectivity concerning them, like ‘elegance remaining in the eyes of the observer.’ Yet no person in their best mind can state with a straight face that Nvidia shares are rather valued at existing degrees on a lot of traditional evaluation metrics. Yet suppose the May 24 th support upgrade confirms to be the initial amongst lots of others in the coming quarters?

Returning to the ‘Large 7 Technology Athletes’, please note that we are taking rather of a permit by calling them all to be ‘Technology’ gamers. For the document, the Zacks industry category places Tesla in the Car industry as well as Amazon.com in the Retail industry.

This elite team of 7 mega-cap firms presently represents 27.5% of the S&P 500 index’s complete market capitalization as well as is anticipated to generate 16.2% of the index’s complete incomes this year. This coincides incomes share the team generated 2020, which raised to 17.4% in 2021 as well as was up to 14.4% in 2022.

Present agreement assumptions ask for the team’s incomes share to enhance to 17.2% in 2024 as well as 18.4% in 2025.

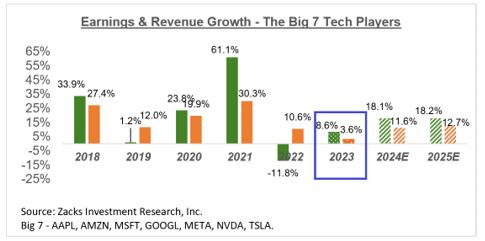

For 2023 Q2, the ‘Large 7 Technology Athletes’ are presently anticipated to attain year-over-year incomes as well as profits development prices of +13.2% as well as +6.1%, specifically. The team is anticipated to represent 15.4% of all S&P 500 incomes in 2023 Q2.

The assumption is for progressively enhancing development in the coming quarters, as the graph listed below programs.

Photo Resource: Zacks Financial Investment Study

The S&P 500 index in its entirety is anticipated to endure an -8.9% decrease in incomes on -0.6% reduced earnings in 2023 Q2.

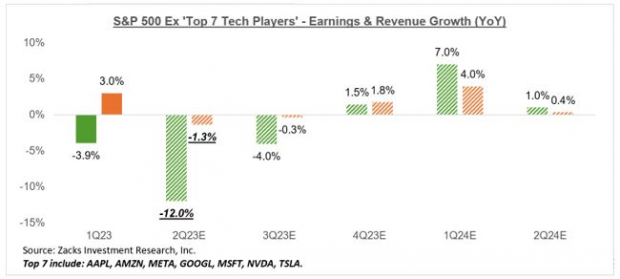

Omitting the payment from the ‘Large 7 Technology Athletes’, Q2 incomes for the continuing to be 493 S&P 500 participants would certainly be down -12% on -1.3% reduced earnings.

To obtain a feeling of what is presently anticipated, have a look at the graph listed below that reveals existing incomes as well as profits development assumptions for the S&P 500 index for 2023 Q2 as well as the complying with 3 quarters as well as real outcomes for the coming before 4 quarters.

Photo Resource: Zacks Financial Investment Study

The graph listed below programs this anticipated development image for the 493 S&P 500 participants. To put it simply, we have actually omitted the payment from the Large 7 Technology Athletes.

Photo Resource: Zacks Financial Investment Study

To offer you a feeling of just how much these assumptions have actually advanced over the last 3 months, the -8.9% incomes decrease in Q2 today is below the -7.2% decrease that was anticipated on March 10 th, 2023. Quotes for the last 2 quarters of the year have actually likewise boiled down extremely decently over the exact same period, with 2023 Q3 below +0.3% incomes development on March 10 th to a decrease of -0.7% today as well as Q4 below +7.9% after that to +5.4% today.

Please keep in mind that while 2023 Q2 price quotes have actually boiled down, the size of adverse alterations contrasts positively to what we saw in the similar durations of the coming before number of quarters. To put it simply, price quotes have not dropped as high as they did the last couple of quarters, not just for Q2 yet likewise for the remainder of the year.

As kept in mind previously, we have actually been explaining a remarkable stablizing in the alterations front recently, which about accompanied the beginning of Q2 in April 2023. This was a change in the total alterations pattern that had actually remained in location for practically a year prior to that.

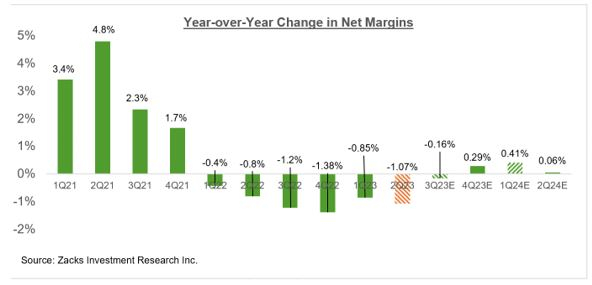

Returning to the 2023 Q2 assumptions, installed in the abovementioned incomes as well as profits development forecasts is the assumption of ongoing margin stress, a persisting style in current quarters.

The graph listed below programs the year-over-year modification in take-home pay margins for the S&P 500 index.

Photo Resource: Zacks Financial Investment Study

As you can see above, 2023 Q2 will certainly be the 6 th successive quarter of decreasing margins for the S&P 500 index.

Margins in Q2 are anticipated to be listed below the year-earlier degree for 11 of the 16 Zacks markets, with the most significant margin stress anticipated to be in the Basic Products, Building And Construction, Power, Medical, Conglomerates, Autos, Aerospace, as well as Technology markets.

On the silver lining, the Money industry is the just one anticipated to experience substantial margin gains, with the Customer Discretionary industry as a remote secondly. Industries anticipated to be basically level margins about 2022 Q2 are Retail, Utilities, as well as Industrial Products.

The graph listed below programs the incomes as well as profits development image on a yearly basis.

Photo Resource: Zacks Financial Investment Study

As kept in mind previously in the context of going over the alterations pattern relating to 2023 Q2 price quotes, we have actually been observing a remarkable stablizing in the alterations pattern given that the beginning of April 2023.

This stablizing in 2023 incomes price quotes stood for a remarkable turnaround in the constantly adverse pattern that had actually remained in location for practically a year. Present assumptions for 2023, as stood for by the above graph, are down almost -13% given that the April 2022 optimal.

Given that the beginning of 2023 Q2 in April, accumulated incomes price quotes for 2023 are basically level, with 8 of the 16 Zacks markets appreciating favorable quote alterations because period. Industries appreciating favorable quote alterations given that the beginning of Q2 consist of Building and construction, Industrial Products, Autos, Technology, as well as Retail.

The graph listed below programs existing incomes as well as profits development assumptions for the ‘Large 7 Technology Athletes.’

Photo Resource: Zacks Financial Investment Study

For a thorough check out the total incomes image, consisting of assumptions for the coming durations, please have a look at our regular Incomes Patterns report >>>>> > > > Looking Ahead to the Q2 Earnings Season

4 Oil Supplies with Substantial Benefits

International need for oil is with the roofing … as well as oil manufacturers are battling to maintain. So despite the fact that oil costs are well off their current highs, you can anticipate huge make money from the firms that provide the globe with “black gold.”

Zacks Financial investment Study has actually simply launched an immediate unique record to assist you count on this pattern.

In Oil Market ablaze, you’ll uncover 4 unanticipated oil as well as gas supplies placed for huge gains in the coming weeks as well as months. You do not wish to miss out on these suggestions.

Download your free report now to see them.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views revealed here are the sights as well as point of views of the writer as well as do not always show those of Nasdaq, Inc.