Financial Institutions remain in the information for all the incorrect factors following what seemed distinctive problems at the Silicon Valley Financial Institution. The failing of this The golden state financial institution and also the woes of First Republic Financial institution FRC have actually placed a rough limelight on the whole local financial room.

The graph listed below needs to provide you a feeling of the pressure in the local financial room. The graph reveals the year-to-date efficiency of First Republic Financial Institution and also the Zacks Banks & & Second hands market. The graph additionally reveals JPMorgan JPM as a proxy for the big money-center financial team and also the S&P 500 index.

Photo Resource: Zacks Financial Investment Study

This isn’t a replay of what the market underwent in 2008, yet it nonetheless includes in unpredictability concerning macroeconomic security each time when the united state Fed’s unmatched financial plan tightening up has actually been considering on the economic climate’s development trajectory.

We need to additionally keep in mind that the regulative modifications applied with Dodd-Frank adhering to the 2008 situation have actually efficiently ringfenced the big financial institutions. These big financial institutions and also banks regularly undergo ‘cardiovascular test’ by the united state Fed that makes sure that they have the ability to run in a range of difficult market problems.

We can claim with a high level of self-confidence that the exception that these local and also smaller sized financial institutions took pleasure in from Dodd-Frank’s arduous regulative oversight will certainly finish after the continuous situation is dealt with.

We do not understand the specifics of the brand-new policies that these regionals will certainly be needed to encounter in the future, yet they will certainly have even more funding needs. This added funding padding will certainly come with the cost of decreased success and also reduced returns from the team moving forward.

The Zacks Money industry, that includes all the financial institutions, is anticipated to attain +2.2% greater incomes in 2023 Q1 on +7% greater earnings.

The Money industry is after that separated right into 6 mezzanine market teams, consisting of Banks & & Second hands, where all the local and also regional financial institutions are positioned. The various other financial market in the Money industry is the Significant Financial institutions market that includes the money-center gamers like JPMorgan and also a few of the huge regionals.

Please keep in mind that over the coming before four-quarter duration, the Zack Major Banks market represented 44.1% of the Zacks Money industry’s complete incomes, while the Zacks Banks & & Second hands market represented just 3.2% of the total amount. This need to provide you an offer common sense of the loved one incomes power of both banking-related sectors in the Money industry.

The table listed below programs the Zacks Money industry’s 2023 Q1 incomes and also earnings development assumptions at the mezzanine market degree.

Photo Resource: Zacks Financial Investment Study

The going will certainly probably be harder for drivers in the Banks & & Second hands room following the Silicon Valley fiasco as they will certainly require to contend even more strongly for down payments. This will certainly have unfavorable ramifications for their internet rate of interest revenues.

Operators in the Significant Financial institutions room most likely gained from their regarded security in bring in down payments, yet they encountered a lot of various other headwinds that considered on success. Financial investment financial invoices were down, as were most various other costs, partially balanced out by gains on the trading side.

Car loan profiles need to be up, with gains in charge card and also C&I (industrial and also commercial) partially balanced out by weak point in vehicles, realty, and also home loans, assisting drive solid internet rate of interest revenue development.

Credit scores top quality still stays excellent, though it has actually begun softening from the traditionally reduced degree of current quarters. The size of arrangements in the Q1 incomes launches will certainly be the large swing aspect for year-over-year contrasts for the team.

Quotes for financial institution incomes have actually begun boiling down recently, with the unfavorable alterations pattern most noticable for the local gamers. For instance, have a look initially Republic FRC, which is presently anticipated to generate $1.13 per share on $1.28 billion in earnings in its March quarter launch on April 12 th This stands for a -43.5% decrease in EPS from the year-earlier degree on -8.4% reduced earnings. In regards to price quote alterations, First Republic’s present $1.13 per share price quote is below $1.38 2 weeks back and also $1.66 at the beginning of January 2023.

Unlike First Republic, approximates for JPMorgan have actually greatly continued to be secure. JPMorgan is anticipated to generate $3.43 per share in incomes on $36.03 billion in earnings, standing for year-over-year development of +30.4% and also +17.3%, specifically. The present Zacks Agreement EPS of $3.43 for 2023 Q1 is a hair listed below the $3.44 degree on March 3 rd and also $3.41 on January 6 th

The different alterations pattern for Frist Republic and also JPMorgan regardless of, it is practical to anticipate that financial institution incomes quotes will certainly be under stress moving forward.

The Incomes Broad View

To obtain a feeling of what is presently anticipated, have a look at the graph listed below that reveals present incomes and also earnings development assumptions for the S&P 500 index for 2023 Q1 and also the adhering to 3 quarters.

Photo Resource: Zacks Financial Investment Study

As you can see below, 2023 Q1 incomes are anticipated to be down -9.9% on +1.8% greater earnings. This would certainly comply with the -5.4% incomes decrease in the previous duration (2022 Q4) on +5.9% greater earnings.

Installed in these 2023 Q1 incomes and also earnings development estimates is the assumption of ongoing margin stress, which has actually been a reoccuring style in current quarters. The graph listed below programs the year-over-year adjustment in take-home pay margins for the S&P 500 index.

Photo Resource: Zacks Financial Investment Study

Experts have actually been gradually reducing their quotes for Q1, a pattern that we saw in advance of the beginning of the last few of reporting cycles also.

To provide complete context, this actions of unfavorable price quote alterations simply in advance of the beginning of the reporting cycle for that duration gets on foregone conclusion, traditionally talking. We saw this change throughout Covid when quotes started raising for a long time. However that pattern ‘stabilized’ in 2014 and also thus the unfavorable alterations to 2023 Q1 quotes, as the graph listed below programs.

Photo Resource: Zacks Financial Investment Study

Please keep in mind that while 2023 Q1 quotes have actually boiled down, the size of unfavorable alterations contrasts positively to what we saw in the similar durations in the coming before number of quarters. To put it simply, quotes have not dropped as long as they carried out in the last couple of quarters.

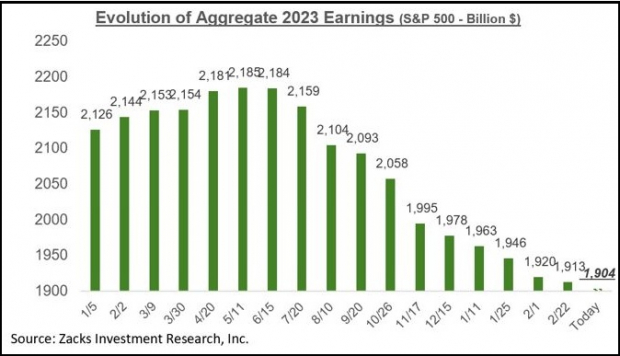

Quotes for full-year 2023 have actually additionally been boiling down also, as we have actually been mentioning regularly in these web pages. The graph listed below demonstrate how the accumulated 2023 S&P 500 incomes.

Photo Resource: Zacks Financial Investment Study

As we have actually been mentioning the whole time, 2023 incomes quotes came to a head in April 2022 and also have actually been boiling down since. Considering that the mid-April top, accumulated incomes have actually decreased by -12.6% for the index overall and also -14.4% for the index on an ex-Energy basis, with the decreases much larger in a number of significant industries.

You have actually most likely checked out the about -20% cuts to S&P 500 incomes quotes, usually, in feedback to economic crises.

Numerous on the market analyze this to suggest that quotes still have plenty to drop in the days in advance. However as the abovementioned size of unfavorable alterations over of -14% on an ex-Energy basis program, we have actually currently taken a trip a reasonable range because instructions. Notably, some vital industries in the course of the Fed’s tightening up cycle, like Building and construction, Retail, Discretionary, and also also Innovation, have actually currently obtained their 2023 quotes slashed off by a 5th given that mid-April.

We are not stating that quotes do not require to drop any type of additionally. If absolutely nothing else, quotes for the Money industry will certainly require to find down following the continuous financial market problems. However instead that the mass of the cuts are most likely behind us, especially if the coming financial recession is a whole lot much less troublesome than several appear to think or be afraid.

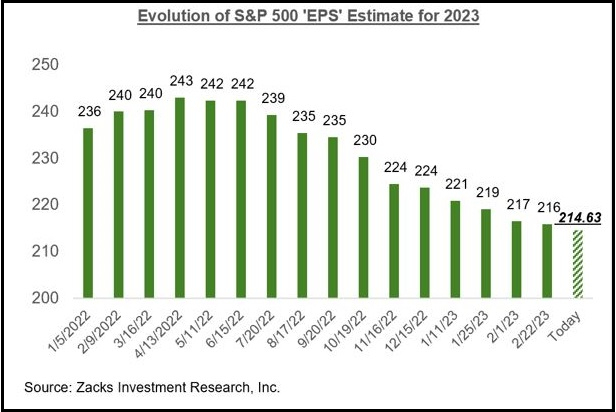

Please keep in mind that the $1.904 trillion accumulated incomes price quote for the index in 2023 estimates to an index ‘EPS’ of $214.63, below $221.08 in 2022. The graph listed below demonstrate how this 2023 index ‘EPS’ price quote has actually advanced gradually.

Photo Resource: Zacks Financial Investment Study

The graph listed below programs the incomes and also earnings development image on a yearly basis.

Photo Resource: Zacks Financial Investment Study

Today’s Coverage Docket

The Q1 incomes period will actually obtain underway when JPMorgan JPM and also the various other large financial institutions bring out their quarterly cause mid-April. However the reporting cycle has really obtained underway currently, as we saw with arise from a number of bellwether drivers like FedEx, Nike, and also 15 various other S&P 500 participants in current days.

The arise from FedEx, Nike, and also the various other index participants that reported in current days were for their financial quarters finishing in February. JPMorgan and also the financial institutions will certainly report outcomes for their financial durations finishing March. We and also various other information suppliers count these February-quarter outcomes as component of the 2023 Q1 tally.

We have an additional 3 S&P 500 participants on deck to report such February-quarter outcomes today, consisting of Conagra, Constellation Brands, and also Lamb Weston.

For the 17 S&P 500 participants that have actually reported outcomes currently, complete incomes are down -26.9% from the exact same duration in 2014 on +4.6% greater earnings, with 82.4% whipping EPS quotes and also 76.5% whipping earnings quotes. The contrast graphes listed below placed the Q1 EPS and also earnings beats portions in a historic context.

Photo Resource: Zacks Financial Investment Study

For an in-depth take a look at the total incomes image, consisting of assumptions for the coming durations, please look into our regular Incomes Fads report >>>>> > > > Analyzing the Evolving Q1 Earnings Landscape

Free Record Discloses Exactly How You Can Benefit from the Expanding Electric Car Sector

Internationally, electrical auto sales proceed their impressive development also after exceeding in 2021. High gas rates have actually sustained his need, yet so has progressing EV convenience, attributes and also modern technology. So, the eagerness for EVs will certainly be about long after gas rates stabilize. Not just are makers seeing record-high revenues, yet manufacturers of EV-related modern technology are bring in the dough also. Do you understand exactly how to money in? Otherwise, we have the best record for you– and also it’s FREE! Today, do not miss your opportunity to download and install Zacks’ leading 5 supplies for the electrical lorry change at no charge and also without any commitment.

>>Send me my free report on the top 5 EV stocks

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

First Republic Bank (FRC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views shared here are the sights and also point of views of the writer and also do not always show those of Nasdaq, Inc.