With such flawless year-to-date efficiencies, capitalists might remain to consider if it’s still time to get Meta Systems ( META) or Nvidia ( NVDA) supply.

To that factor, Nvidia supply has actually currently increased +177% year to day and also Meta shares have actually risen 132%, significantly exceeding the S&P 500’s +14% and also the Nasdaq’s +27%.

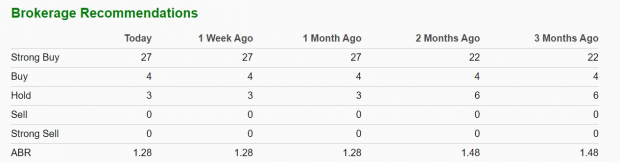

Especially, broker suggestions show experts still think these technology titans will certainly exceed the more comprehensive market with climbing incomes quotes helpful too.

Photo Resource: Zacks Financial Investment Study

Broker Referrals

Not remarkably, Meta and also Nvidia have actually passed lots of expert cost targets yet the variety of brokers suggesting their supplies continues to be high.

Out of the 38 broker suggestions covered by Zacks, 30 brokers still highly advise Meta’s supply. Computed based upon the real suggestions, Meta still has an engaging 1.38 Typical Broker Suggestion (ABR) on a range of 1 to 5 (Solid Buy to Solid Offer).

Photo Resource: Zacks Financial Investment Study

In a similar way, a high variety of brokers remain to highly advise Nvidia’s supply. Twenty-seven brokers have a solid buy suggestion with Nvidia’s ABR at an extremely eye-catching 1.28.

Photo Resource: Zacks Financial Investment Study

Revenues Price Quotes Still Deal Assistance

Possibly much more allusive to the concept that it’s still time to get Meta and also Nvidia supply is their incomes quote modifications.

Although Meta’s monetary 2023 incomes quotes are somewhat down in the last thirty days they have actually continued to be 14% greater over the last quarter at $11.94 per share contrasted to $10.43 a share 90 days earlier. And also, FY24 incomes quotes are still ticking greater and also have actually currently increased 15% over the last 3 months.

Meta’s incomes are currently anticipated to jump 21% this year and also rise one more 24% in FY24 at $14.81 per share.

Photo Resource: Zacks Financial Investment Study

Considering Nvidia, incomes quotes have actually remained to climb for the business’s present 2024 and also FY25. Over the last 3 months, FY24 and also FY25 incomes quotes have actually currently risen over 70% specifically.

Nvidia’s incomes are presently forecasted to rise 129% in FY24 at $7.66 per share contrasted to EPS of $3.34 in FY23. Much more outstanding, FY25 incomes are anticipated to climb up one more 33% at $10.19 per share.

Photo Resource: Zacks Financial Investment Study

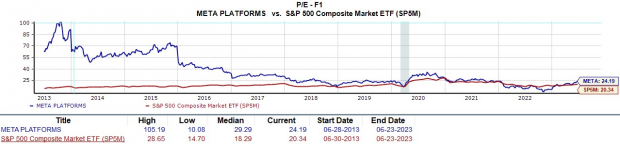

P/E Evaluations Continue To Be Affordable

Remaining to keep track of Meta and also Nvidia’s assessments, their P/E proportions are still affordable specifically about their past.

Trading at $278 a share, Meta’s supply presently trades at 24.1 X ahead incomes which is really eye-catching thinking about the Zacks Internet-Software’s Sector standard goes to 40X. Being a leader in its room and also trading at a price cut to the market standard it’s likewise fascinating that Meta’s supply still trades near the S&P 500’s 20.3 X

Moreover, Meta supply professions 77% listed below its decade-long high of 105.1 X and also at a 17% discount rate to the mean of 29.2 X.

Photo Resource: Zacks Financial Investment Study

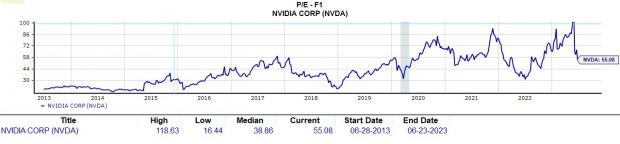

When It Comes To Nvidia and also various other business that have tremendous development possible bordering AI capacities they are truly regulating a costs now.

With that said being stated, at $406 a share and also 55X ahead incomes it’s rather comforting that Nvidia’s supply still trades well listed below its very own decade-long high of 118.6 X and also closer to the mean of 38.8 X.

Photo Resource: Zacks Financial Investment Study

Profits

It’s not unexpected that Meta and also Nvidia supply remain to garnish desirable broker suggestions thinking about incomes quotes have actually continued to be a lot greater throughout the last quarter. This makes both of these technology titans’ P/E assessments look even more affordable and also in the meantime, they want a Zacks Ranking # 1 (Solid Buy).

Framework Supply Boom to Move America

A substantial press to reconstruct the collapsing united state facilities will certainly quickly be underway. It’s bipartisan, immediate, and also unavoidable. Trillions will certainly be invested. Lot of money will certainly be made.

The only concern is “Will you enter the appropriate supplies early when their development capacity is best?”

Zacks has actually launched an Unique Record to assist you do simply that, and also today it’s totally free. Discover 5 unique business that seek to acquire one of the most from building and also repair service to roadways, bridges, and also structures, plus freight transporting and also power makeover on a virtually inconceivable range.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views shared here are the sights and also point of views of the writer and also do not always mirror those of Nasdaq, Inc.