Commvault Programs CVLT, a Zacks Rank #1 (Sturdy Purchase), offers a knowledge safety platform that helps clients safe, defend, and get well their information. The corporate helps purchasers in a spread of industries together with insurance coverage and monetary companies, authorities, well being care, expertise, manufacturing, and vitality.

CVLT inventory is benefitting from underlying momentum within the expertise sector and hit an all-time excessive in value this month. Shares are displaying relative power as shopping for stress accumulates on this market chief.

The corporate is a part of the Zacks Laptop – Software program trade group, which at the moment ranks within the prime 30% out of greater than 250 Zacks Ranked Industries. As a result of it’s ranked within the prime half of all Zacks Ranked Industries, we anticipate this group to outperform the market over the following 3 to six months. This group has been steadily outperforming over the previous 12 months:

Picture Supply: Zacks Funding Analysis

Historic analysis research counsel that roughly half of a inventory’s value appreciation is because of its trade grouping. In actual fact, the highest 50% of Zacks Ranked Industries outperforms the underside 50% by an element of greater than 2 to 1.

It’s no secret that investing in shares which are a part of main trade teams can provide us a leg up relative to the market. By specializing in main shares throughout the prime 50% of Zacks Ranked Industries, we are able to dramatically enhance our stock-picking success.

Firm Description

Tinton Falls, New Jersey-based Commvault Programs affords enterprise-grade information safety as a service on a cloud platform with superior, built-in safety controls. As a part of its providing, the corporate additionally offers backup, replication and catastrophe restoration options.

As well as, Commvault Programs sells home equipment that combine its software program with {hardware} to be used in a spread of enterprise instances. The expertise firm additionally affords consulting, schooling, set up, and remote-managed companies.

Commvault Programs sells its services straight by its gross sales drive and not directly by its community of distributors, value-added resellers, programs integrators, and authentic tools producers.

Earnings Tendencies and Future Estimates

The software program firm has established a powerful earnings historical past. CVLT exceeded earnings estimates in every of the final 5 quarters. Simply final week, Commvault Programs reported fiscal fourth-quarter earnings of $0.79/share, an 8.2% beat versus the $0.73/share consensus estimate.

Revenues jumped 9.7% year-over-year to $223.3 million in the course of the quarter. The corporate has delivered a trailing four-quarter common earnings shock of 8.4%. Persistently beating earnings estimates is a recipe for fulfillment.

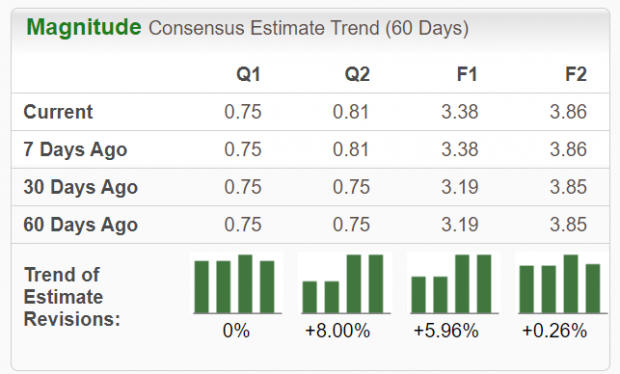

Analysts protecting CVLT are in settlement and have been elevating their earnings estimates these days. For the present fiscal 12 months, analysts bumped up earnings estimates by 5.96% prior to now 60 days. The Zacks Consensus Estimate now stands at $3.38/share, reflecting potential progress of 13.4% relative to the prior 12 months. Revenues are projected to rise 8.4% to $910 million.

Picture Supply: Zacks Funding Analysis

Let’s Get Technical

CVLT shares have been steadily outperforming the market this 12 months. That is the type of inventory we wish to embrace in our portfolio – one that’s trending nicely and receiving constructive earnings estimate revisions.

Picture Supply: StockCharts

Discover how each the 50-day (blue line) and 200-day (pink line) shifting averages are sloping up. The inventory has been making a sequence of 52-week (and all-time) highs. With each sturdy basic and technical indicators, Commvault Programs is poised to proceed its outperformance. The inventory has rewarded buyers in 2024 with a virtually 37% return.

Empirical analysis reveals a robust correlation between near-term inventory actions and traits in earnings estimate revisions. As we all know, Commvault Programs has lately witnessed constructive revisions. So long as this pattern stays intact (and CVLT continues to ship earnings beats), the inventory will possible proceed its bullish run this 12 months.

Backside Line

Commvault Programs is ranked favorably by our Zacks Type Scores, with second-best ‘B’ scores in our Progress and Momentum classes. This means that CVLT inventory is more likely to proceed to maneuver larger based mostly on a good mixture of earnings and gross sales progress in addition to sturdy value momentum.

Backed by a number one trade group and spectacular historical past of earnings beats, it’s not troublesome to see why CVLT inventory is a compelling funding. An interesting technical pattern together with strong fundamentals paint a bullish image shifting ahead.

Free Report – The Bitcoin Revenue Phenomenon

Zacks Funding Analysis has launched a Particular Report that will help you pursue huge earnings from the world’s first and largest decentralized type of cash.

No ensures for the long run, however prior to now three presidential election years, Bitcoin’s returns have been as follows: 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%.

Zacks predicts one other vital surge. Click on under for Bitcoin: A Tumultuous But Resilient Historical past.

Download Now – Today It’s FREE >>

CommVault Systems, Inc. (CVLT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.