Recognized to be essentially the most risky month for shares, September is when many traders rebalance their portfolios to incorporate much less dangerous belongings equivalent to equities that present publicity to important healthcare providers.

One such candidate is DaVita DVA, the main supplier of kidney care providers in the USA. With its progress prospects cemented on vital dialysis and lab-related providers, DaVita’s inventory covets a Zacks Rank #1 (Sturdy Purchase) and lands the Bull of the Day.

DaVita Has Remnants of a Development Inventory

As a medical inventory that may probably present defensive security DaVita additionally has the remnants of a progress inventory, on prime of getting the worth and important providers traders search amid heightened market volatility.

Over the past 5 years, DaVita’s EPS progress fee of 15.5% has simply trumped its business common of 4.2% and the S&P 500’s 8.1% common. The spectacular pattern seems to be set to proceed with DaVita’s backside line anticipated to develop roughly 18% in fiscal 2024 with FY25 EPS projected to extend one other 14% to $11.42 per share.

Picture Supply: Zacks Funding Analysis

Earnings Estimate Revisions

Suggesting extra short-term upside in DaVita’s inventory is that earnings estimate revisions for FY24 and FY25 have remained noticeably increased over the past 30 days. Correlating with such, it is noteworthy that DaVita’s Medical-Outpatient and Residence Healthcare Trade is at present within the prime 19% of over 250 Zacks industries.

Picture Supply: Zacks Funding Analysis

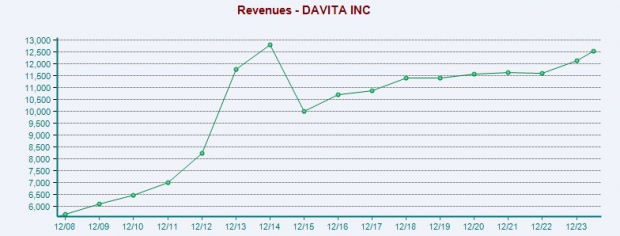

High Line Growth

DaVita’s prime line has elevated by a modest 6% within the final 5 years with gross sales at $12.14 billion in 2023 in comparison with $11.38 billion in 2019. Nonetheless, DaVita’s gross sales have been on a gentle ascension over the past 20 years and are forecasted to extend greater than 3% in FY24 and FY25 with projections edging north of $13 billion.

Picture Supply: Zacks Funding Analysis

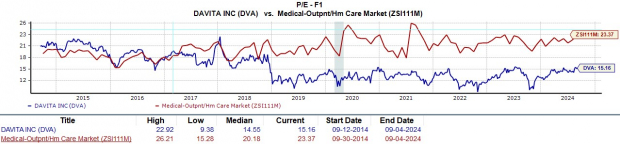

Defensive Security & Worth

Seeing as DaVita’s progress can be essential to societal well being, its valuation may be very intriguing. Buying and selling just below $150, DVA is at a really cheap 15.6X ahead earnings a number of. It is a nice low cost to its business common of 23.3X ahead earnings and the S&P 500’s 23.2X.

Picture Supply: Zacks Funding Analysis

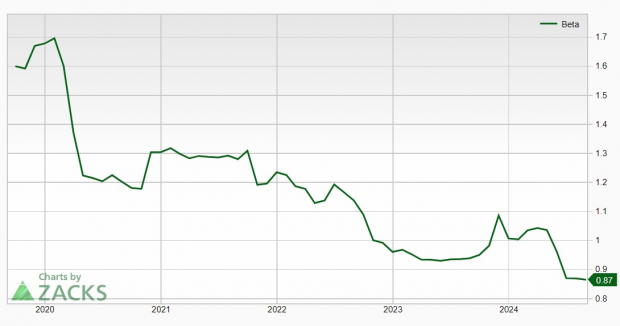

Low Beta

With Beta being a measure of threat generally used to match the volatility of shares amongst different securities, it’s vital to level out that DaVita’s calculated beta worth is at the popular stage of lower than 1.0.

Picture Supply: Zacks Funding Analysis

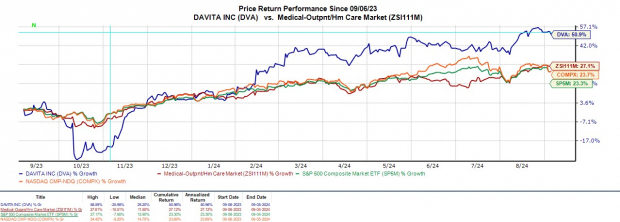

Whereas low beta shares might are likely to have a good nit 52-week vary, DaVita’s growth has catapulted its value efficiency regardless of being a much less risky funding with reference to draw back threat.

Hovering close to its 52-week excessive, DVA has soared 108% from a low of $71 a share over the past yr and is sitting on +40% good points yr up to now.

Picture Supply: Zacks Funding Analysis

Backside Line

DaVita’s interesting progress prospects and engaging valuation means that now is a perfect time to speculate contemplating its essential healtchare providers. Moreover, DVA could also be a viable defensive hedge concerning the unfavorable seasonality of the “September Impact” on the broader market.

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the full sum of solely $1. No obligation to spend one other cent.

Hundreds have taken benefit of this chance. Hundreds didn’t – they thought there should be a catch. Sure, we do have a purpose. We wish you to get acquainted with our portfolio providers like Shock Dealer, Shares Beneath $10, Expertise Innovators,and extra, that closed 228 positions with double- and triple-digit good points in 2023 alone.

DaVita Inc. (DVA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.