Repetition Cable ( CABLE) supply looks really eye-catching showing off a Zacks Ranking # 1 (Solid Buy) as well as a total “A” VGM Design Ratings quality for the mix of Worth, Development, as well as Energy.

The Industrial Products supply belongs to the Cable as well as Cord Products Market which is presently in the leading 1% of over 250 Zacks Industries. Repetition is a low-priced supplier of copper as well as light weight aluminum electric structure cable as well as cord for the indoor electrical wiring in residences, houses, made real estate, as well as industrial as well as commercial structures.

Repetition has actually been a key recipient of what the firm mentioned is an ongoing rigidity in resources as well as the basic failure of the market to satisfy need for the prompt distribution of completed items which has actually maintained its reservations solid.

Design Ratings

The current pullback from its 52-week highs can absolutely be a purchasing possibility as well as Repetition supply checks all packages for a buy-the-dip possibility as it associates with the Zacks Design Ratings which act as a corresponding collection of signs to utilize along with the Zacks Ranking.

” A” Energy Quality

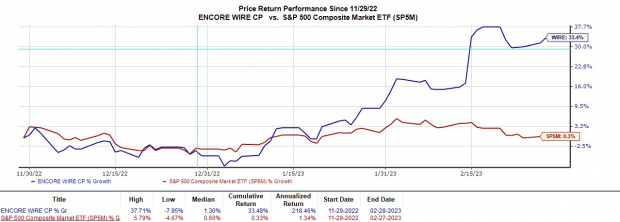

The moderate pullback over the recently might be healthy and balanced concerning even more continual advantage as cord supply has actually skyrocketed following its fourth-quarter record on February 14. Repetition remarkably exceeded Q4 fundamental assumptions by 79% on EPS of $8.28 contrasted to price quotes of $4.61.

Picture Resource: Zacks Financial Investment Research Study

Repetition supply was up +19% in February with the S&P 500 down -2% as well as the Cable & & Cord Products Market up +10%. Also much better, cord supply is up greater than 30% in the last 3 months to conveniently cover the criteria as well as its Zacks Subindustry’s +19%.

Picture Resource: Zacks Financial Investment Research Study

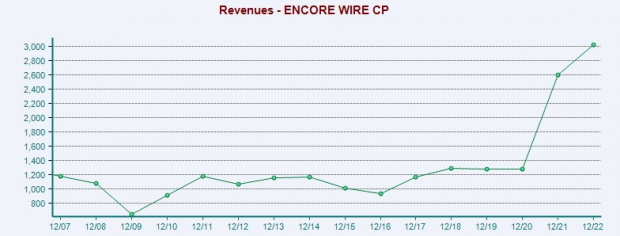

” A” Development Quality

Amongst Repetition’s outstanding development, the tale below is likewise the revenues quote modifications which credit to the supply showing off a Zacks Ranking # 1 (Solid Buy).

Repetition’s financial 2023 revenues price quotes have actually increased 28% to $19.76 per share over the last 1 month. This is a terrific indicator as FY23 revenues are anticipated to go down -46% after an extremely remarkable year that saw EPS of $36.91 in 2022.

On that particular note, Repetition’s profits development has actually been exceptional, raising 886% over the last 5 years with 2018 EPS at $3.74. On the leading line, sales of $3.01 billion in 2022 stood for 135% development over the last 5 years with 2018 sales at $1.28 billion.

Picture Resource: Zacks Financial Investment Research Study

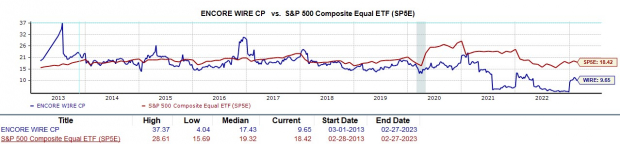

” A” Worth Quality

In relation to assessment basics, cord professions at $193 per share as well as simply 9.6 X onward revenues which gets on the same level with the sector standard as well as well listed below the S&P 500’s 18.4 X. Repetition supply likewise trades 74% listed below its decade-long high of 37.3 X as well as at a 45% discount rate to the typical of 17.4 X.

Picture Resource: Zacks Financial Investment Research Study

Annual Report & & Cash Money

Piggybacking off of Repetition’s assessment, its administration group flaunted that its remarkable annual report has no lasting financial obligation as well as its rotating credit score line is untapped. Repetition had $730.6 million in cash money at the end of 2022 contrasted to $439 million at year-end 2021.

To the pleasure of financiers, Repetition revealed it will certainly boost its share bought strategy from 1 million to 2 million shares to improve worth as well as resources return for investors. Significantly, Repetition’s reduced Price/Cash Circulation proportion is really eye-catching for financiers at 5.15 contrasted to the sector standard of 7.20 as well as the S&P 500’s 15.68.

Picture Resource: Zacks Financial Investment Research Study

Takeaway

Currently might be a good time to acquire Repetition supply as its historic efficiency additionally sustains the firm’s existing energy, assessment, as well as development. Shares of cord are currently up +489% over the last years to mainly outshine the S&P 500’s +160% with Repetition’s solid administration, reduced financial obligation, as well as cash money handy throughout financial unpredictability in the wider economic climate really encouraging.

Free Record Exposes Just How You Can Benefit from the Expanding Electric Car Market

Worldwide, electrical automobile sales proceed their exceptional development also after exceeding in 2021. High gas rates have actually sustained his need, yet so has progressing EV convenience, functions as well as modern technology. So, the eagerness for EVs will certainly be about long after gas rates stabilize. Not just are makers seeing record-high revenues, yet manufacturers of EV-related modern technology are generating the dough too. Do you recognize just how to money in? Otherwise, we have the excellent record for you– as well as it’s FREE! Today, do not miss your opportunity to download and install Zacks’ leading 5 supplies for the electrical automobile transformation at no charge as well as without commitment.

>>Send me my free report on the top 5 EV stocks

Encore Wire Corporation (WIRE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints shared here are the sights as well as viewpoints of the writer as well as do not always mirror those of Nasdaq, Inc.