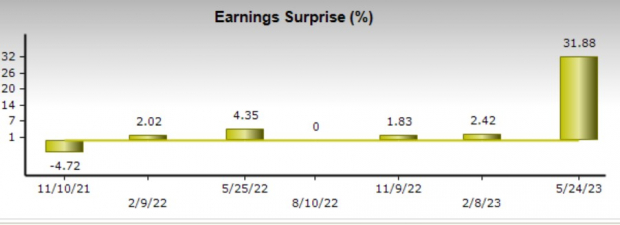

EnerSys ( ENS) supply is standing apart this incomes period after remarkably exceeding its financial fourth-quarter EPS price quotes on May 24.

As a leader in saved power options for commercial items, EnerSys had the ability to take advantage of its rates power and also boost natural development. Especially, the Manufacturing-Electronics Market remains in the leading 10% of over 250 Zacks sectors which additionally strengthens EnerSys’ Zacks Ranking # 1 (Solid Buy).

EnerSys stays well-positioned as a representative of numerous commercial batteries, battery chargers, and also various other power tools together with exterior closet options. Currently up +31% this year, there might be legs to the rally in EnerSys supply which ratings a total “A” VGM Zacks Design Ratings quality for the mix of Worth, Development, and also Energy.

Photo Resource: Zacks Financial Investment Research Study

Q4 Evaluation

EnerSys accomplished document web sales and also running incomes throughout the 4th quarter. Remarkably, incomes was available in 32% over EPS assumptions at $1.82 per share contrasted to price quotes of $1.38 a share. Fourth-quarter incomes likewise skyrocketed 51% from the prior-year quarter. On the leading line, sales went beyond price quotes by 4% at $989.90 million and also climbed 9% year over year.

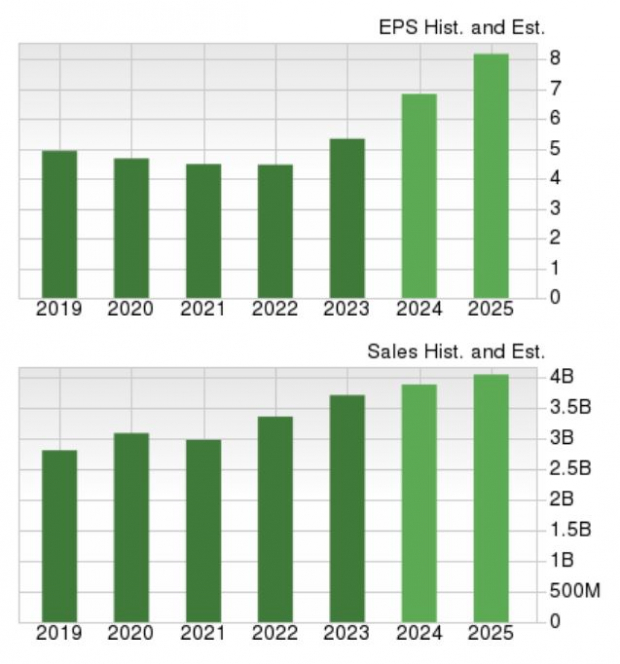

The excellent top and also profits development throughout Q4 likewise aided EnerSys accomplish document numbers in yearly sales and also incomes. Overall sales for EnerSys’ financial 2023 was available in at $3.7 billion and also enhanced 10% YoY with EPS of $5.34 leaping 19% from a year back.

Photo Resource: Zacks Financial Investment Research Study

Document Development Proceeds

Making EnerSys supply extra appealing is that its document financial 2023 is anticipated to be overshadowed moving forward. EnerSys’ incomes are anticipated to skyrocket 28% in its present financial 2024 and also climb up an additional 19% in FY25 at $8.19 per share.

Financial 2025 forecasts stand for 82% EPS development over the last 5 years with 2021 incomes at $4.49 per share. Overall sales are anticipated to be up 4% in FY24 and also surge an additional 4% in FY25 to $4.04 billion.

Photo Resource: Zacks Financial Investment Research Study

Profits

Currently seems a perfect time to purchase EnerSys supply as the firm is positioned to proceed attaining document development on its leading and also profits. While there might definitely be extra upside in shares of ENS this year, EnerSys supply is likewise coming to be an extremely audio financial investment for 2023 and also past.

Zacks Names “Solitary Best Choose to Dual”

From hundreds of supplies, 5 Zacks specialists each have actually picked their preferred to escalate +100% or even more in months to find. From those 5, Supervisor of Research study Sheraz Mian hand-picks one to have one of the most eruptive benefit of all.

It’s an obscure chemical firm that’s up 65% over in 2014, yet still economical. With unrelenting need, skyrocketing 2022 incomes price quotes, and also $1.5 billion for buying shares, retail financiers might enter any time.

This firm might equal or exceed various other current Zacks’ Supplies Ready To Dual like Boston Beer Business which skyrocketed +143.0% in little bit greater than 9 months and also NVIDIA which expanded +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Enersys (ENS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views shared here are the sights and also point of views of the writer and also do not always show those of Nasdaq, Inc.