Fabrinet FN helps large tech firms, together with Nvidia, by making small, precision elements used throughout AI knowledge facilities, telecom, and past.

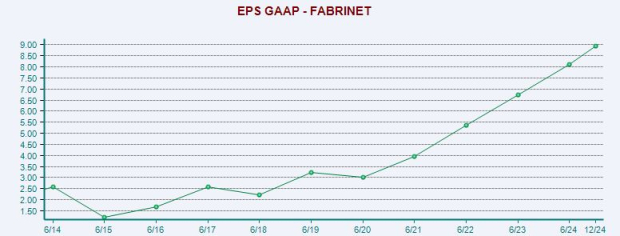

FN has averaged 13% income development over the previous six years, and its earnings have surged. AI knowledge middle chip powerhouse Nvidia is considered one of Fabrinet’s largest purchasers, and FN landed a probably main partnership with Amazon in mid-March.

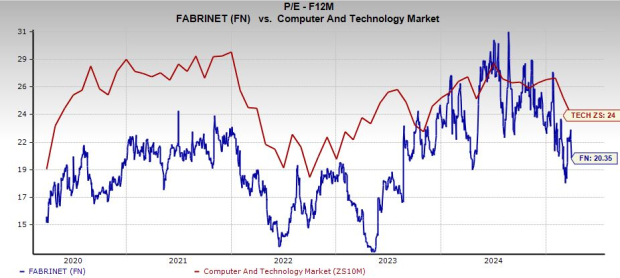

The inventory has roughly tripled the Tech sector’s efficiency since its 2010 IPO, and FN has crushed the broader know-how area in the course of the previous three years, hovering 82% in comparison with Tech’s 29%. This behind-the-scenes tech inventory trades at a strong low cost to its sector regardless of its near-term and long-term outperformance.

Fabrinet is looking for help at a long-term shifting common, and it trades 30% under its all-time highs.

Why This Underneath-the-Radar Tech Inventory Is a Robust Purchase

Fabrinet is a frontrunner in superior optical packaging and precision optical, electro-mechanical, and digital manufacturing companies for authentic tools producers of advanced merchandise.

Merely put, Fabrinet’s choices assist different tech firms make the small, advanced elements they want for his or her merchandise.

Fabrinet is a behind-the-scenes agency with choices which might be changing into extra vital by the day as AI hyperscalers and others race to construct extra knowledge facilities. As an example, a few of its tech is utilized in knowledge facilities to assist ship data at lightning speeds, enabling AI applications to run easily.

Picture Supply: Zacks Funding Analysis

Nvidia NVDA is considered one of Fabrinet’s largest purchasers. The graphics chip powerhouse reportedly accounted for roughly 35% of Fabrinet’s FY24 gross sales. Networking tools large Cisco Methods and optical parts standout Lumentum are two of its different most necessary purchasers.

Fabrinet and Amazon AMZN entered into an settlement on March 12 for Amazon to purchase warrants to buy as much as 381,922 shares of Fabrinet at $208.4826 per share. The deal incentivizes Fabrinet to deepen its function inside Amazon’s provide chain to assist help the expansion of its AI infrastructure.

FN has averaged 13% income development over the previous six years. It’s projected to develop its FY25 (interval ending in June 2025) income by one other 18% and 12% in FY26, reaching $3.78 billion—up from $2.88 billion in FY24.

Picture Supply: Zacks Funding Analysis

The corporate’s consensus earnings estimates have jumped since its Q2 FY24 launch, serving to FN earn a Zacks Rank #1 (Robust Purchase).

Fabrinet is predicted to develop its adjusted earnings by 16% in FY25 and 11% in FY26, following 16% enlargement final 12 months. FN has additionally constantly topped our EPS estimates.

Now Is a Nice Time to Purchase Fabrinet on the Dip

Fabrinet shares have soared 930% up to now 10 years, greater than tripling the Zacks Tech sector and matching Amazon’s efficiency. The inventory has ripped 1,700% greater since its 2010 preliminary public providing, in comparison with Tech’s 590% run.

Picture Supply: Zacks Funding Analysis

This chief in superior optical packaging and past has climbed 82% over the last three years, leaving Tech firmly in its rearview mirror as soon as once more.

But, traders should purchase FN inventory 30% under its highs. Fabrinet is searching for help close to its long-term 21-month shifting common, with its RSI at a few of its most oversold ranges since 2018.

Picture Supply: Zacks Funding Analysis

On the valuation facet, Fabrinet trades at a 15% low cost to the Tech sector and 35% under its personal highs at 20.4X ahead 12-month earnings. FN is buying and selling at its five-year median by way of ahead earnings, although it has climbed 270%.

Why This Picks-and-Shovels AI Inventory Is a Should-Purchase

Fabrinet performs a vital behind-the-scenes function within the knowledge middle growth and the synthetic intelligence revolution, which is more likely to be measured in many years. The AI selloff, which was lengthy overdue, offers traders an opportunity to purchase FN at a much more cheap value and valuation.

The corporate’s proximity and direct reference to Nvidia and Amazon might be useful going ahead as they gas the AI arms race. Plus, Fabrinet is a well-run firm with a stellar stability sheet, holding extra cash and equivalents ($935 million) than complete liabilities ($699 million).

Zacks Names #1 Semiconductor Inventory

It is just one/9,000th the scale of NVIDIA which skyrocketed greater than +800% since we advisable it. NVIDIA remains to be sturdy, however our new high chip inventory has rather more room to growth.

With sturdy earnings development and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. World semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Fabrinet (FN) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.