Graphic Product Packaging Holding Firm ( GPK) supply uses capitalists a terrific mix of outstanding worth, secure development, rewards, as well as a market-topping efficiency over the previous 15 years as well as the last year. As well as GPK supply still trades for under $25 per share.

Graphic Product packaging is a lasting paper as well as fiber-based product packaging company that covered our quarterly price quotes once more in very early February as well as increased its expectation as it confirms just how vital its offerings are throughout any type of financial atmosphere.

An Eye-catching Bundle

Graphic Product Packaging has to do with as much from fancy as it obtains. Still, its profile of paper product packaging items are important gears in the economic situation, offering customers in sectors varying from food, drinks, as well as foodservice to individual treatment, home items, family pets, as well as past. GPK’s paper-based product packaging options consist of folding containers, food preparation options, containers, mugs, as well as far more.

The Atlanta, Georgia-headquartered company collaborates with lots of well-known brand names. Graphic Product packaging likewise holds leading market settings in layered recycled paperboard, layered natural kraft paperboard, as well as strong blonde sulfate paperboard.

Picture Resource: Zacks Financial Investment Research Study

The firm broadened its reach as well as range when it finished its purchase of AR Product packaging in November of 2021. The bargain assisted GPK expand its geographical reach due to the fact that AR is among Europe’s leading product packaging business.

Graphic Product packaging is currently a customer product packaging titan in both the united state as well as Europe. It deserves worrying simply exactly how vital GPK’s offerings remain in the economic situation as well as just how not likely they are to head out of design regardless of what the economic situation resembles one decade from currently. As well as GPK is intending to “expand its setting as the lowest-cost, first-rate paperboard manufacturer in The United States and Canada” with a brand-new mill as well as even more.

Picture Resource: Zacks Financial Investment Research Study

Development as well as Overview

Graphic Product packaging has actually expanded its profits at an instead strong clip for many years, with a couple of missteps in the process. Graphic Product packaging’s profits climbed up 7% in 2020 as well as 9% in 2021. It after that published 32% profits development in 2022 as well as 78% modified revenues growth. Much of the significant YoY climb resulted from its AR purchase, still, its natural sales stood out 3%.

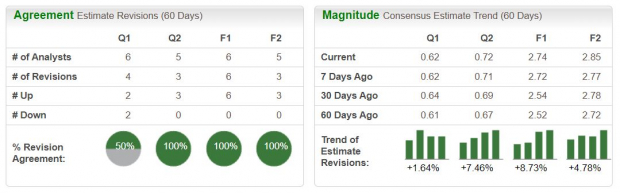

Graphic Product packaging covered our quarterly EPS price quote for the 6th quarter straight as well as it likewise upped its support also as the general S&P 500 revenues expectation discolors. This belongs to a consistent higher modifications pattern. GPK’s positive revenues modifications– with FY23 up 9% as well as FY24 up 5%– assist it record a Zacks Ranking # 1 (Solid Buy) today.

Zacks approximates require GPK’s profits to climb up an additional 5% in 2023 as well as 2% in 2024. At the same time, its modified revenues are predicted to stand out 18% in 2023 as well as 4% in FY24. Both Graphic Product packaging’s leading as well as fundamental overviews are strong taking into consideration the challenging to contend versus years of development it is confronting.

Picture Resource: Zacks Financial Investment Research Study

Various Other Principles

Wall surface Road is high up on the supply with 10 of the 13 brokerage firm suggestions Zacks contends “Solid Buys.” Graphic Product packaging likewise pays a returns that’s producing 1.7% presently to match its highly-ranked sector.

The supply lands “A” qualities for Development as well as Worth in our Design Ratings system. Graphic Product packaging is increasing its manufacturing initiatives to sustain expanding need, with its financial investment of roughly $1 billion over 3 years to be “inside moneyed with running capital.”

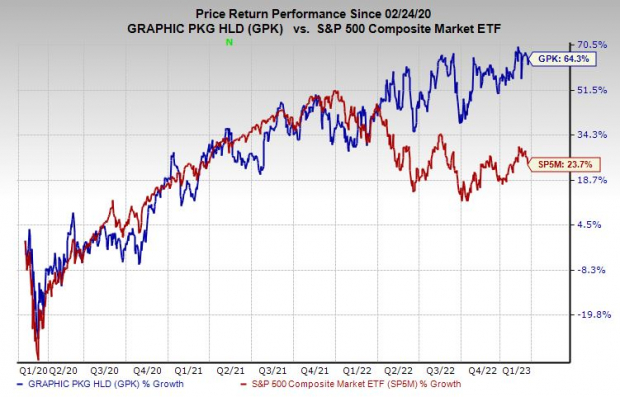

Graphic Product packaging shares have actually outclimbed the S&P 500 over the last one decade, up 215% vs. 160%. Extending back 15 years, GPK has actually climbed up 650% vs. the standard’s 205% as well as its sector’s 89%.

A lot more lately, GPK has actually risen 45% in the previous 2 years vs. its sector’s 7% as well as the marketplace’s 1% gain. The supply has actually stood out 5% YTD as well as it trades near its current documents at around $23 per share. And Also, Graphic Product packaging’s typical Zacks rate target uses 22% benefit to its present degree.

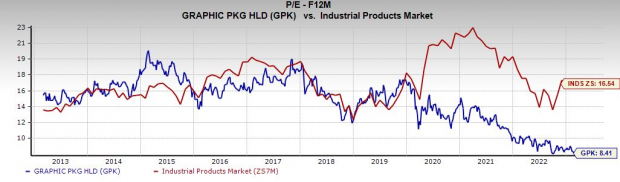

Regardless of the efficiency, GPK trades right at neutral RSI degrees as well as it simply lately get better well over its 50-day relocating standard. In addition to its inexpensive under $25 rate, GPK is trading nearly right at its very own decade-long lows (8.3 X) at 8.4 X ahead 12-month revenues. This stands for a 60% price cut to its very own highs as well as 45% versus its typical.

Graphic Product packaging likewise trades at a 50% price cut to the Zacks Industrial Products industry as well as the S&P 500.

Picture Resource: Zacks Financial Investment Research Study

Profits

Graphic Product packaging runs a boring, important service positioned for long-lasting consistent growth. Financiers should likewise take into consideration simply exactly how excellent its appraisal is considering that GPK supply has actually risen over the last 15 years. Generally, GPK seems a fantastic supply for the present market as well as financial unpredictability as well as for many years ahead.

7 Finest Supplies for the Following thirty day

Simply launched: Specialists boil down 7 elite supplies from the present listing of 220 Zacks Ranking # 1 Solid Buys. They consider these tickers “More than likely for Very Early Rate Pops.”

Given that 1988, the complete listing has actually defeated the marketplace greater than 2X over with an ordinary gain of +24.8% annually. So make certain to provide these carefully picked 7 your instant interest.

Graphic Packaging Holding Company (GPK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints shared here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.