Hubbell Incorporated ( HUBB) is a leading producer of energy and also electric options that’s positioned to gain from 2 megatrends that are still in their onset in the united state and also internationally: electrification and also grid innovation.

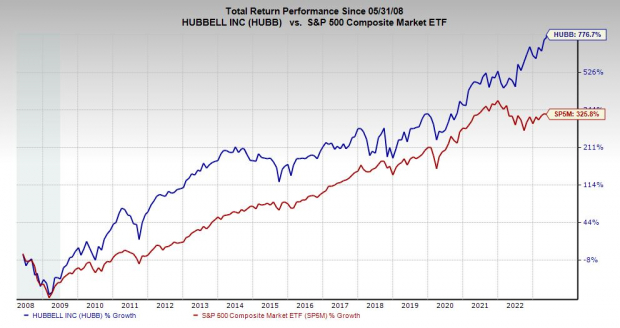

HUBB supply has greater than increased the S&P 500 over both the last two decades and also the previous 5. Hubbell shattered our quarterly revenues quote in late April and also gave considerably positive advice.

HUBB additionally damaged back over some essential technological degrees just recently on its means to fresh highs, without exhausting its assessment.

Providing Vital Development Locations

Hubbell is a leading producer of energy and also electric options with a well-known performance history that is readied to gain from the seriously pushing requirement for grid innovation and also the wave of electrification. Increasing and also sprucing up electric grids is essential as the united state and also lots of nations around the world present a lot more different power resources in the coming years.

Hubbell is a much more steady, tried and tested supply to aid gain from the flourishing development of solar, wind, nuclear, EVs, and also past. Hubbell is additionally revealed to the recurring development of broadband networks and also solution.

Hubbell has actually stayed in business for 135 years and also it flaunts a really strong background of revenues and also earnings development. HUBB divides its company right into 2 significant classifications: Energy Solutions and also Electric Solutions.

Digging a little much deeper, Hubbell’s item classifications consist of illumination and also controls, circuitry and also electric, power and also energies, and also datacom. At the same time, its remedy offerings include power financial savings, security and also safety, severe setting, cable and also cable television monitoring, and also a lot more.

Picture Resource: Zacks Financial Investment Study

Current Development and also Overview

Hubbell expanded its modified revenues by 70% in Q1 to cover the Zacks quote by 47% on the back of 11% earnings development. HUBB additionally increased its operating margin by 7% YoY to 19.4%, driven by “rate awareness, reduced resources prices and also boosted performance.”

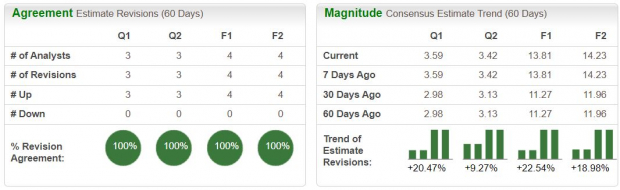

Much better still, Hubbell gave positive advice that aids it land a Zacks Ranking # 1 (Solid Buy) now. HUBB’s FY23 agreement revenues expectation has actually leapt 23% considering that its very first quartet launch, with its FY24 number currently 19% greater.

The current positivity expands HUBB’s fad of higher revenues alterations that started early in 2015. “Energy Solutions orders stayed solid, causing an additional quarter of stockpile develop as clients proactively buy grid solidifying and also resiliency campaigns, clever grid applications and also broadband releases,” chief executive officer Gerben Bakker claimed in Q1 statements on April 25.

Picture Resource: Zacks Financial Investment Study

” In Electric Solutions, commercial end markets and also critical development verticals highlighted by renewables were solid, while industrial markets were a lot more moderate, and also the property market stayed soft as anticipated.”

Existing Zacks agreement approximates ask for Hubbell to upload an additional 30% modified revenues development in 2023 and also 8% greater sales to see it draw in $5.36 billion. These forecasts adhere to 18% sales development in 2015 and also 14% development in 2021, together with double-digit EPS gains.

Hubbell is readied to increase its leading and also profits once again in 2024 also as it encounters this tough-to-compete-against stretch. And also it has actually defeated our quarterly revenues price quotes in 17 out of the last 20 durations.

Picture Resource: Zacks Financial Investment Study

Efficiency & & Appraisal

Hubbell supply has actually climbed up approximately 735% in the last two decades, with a complete return of 1,300% vs. the S&P 500’s 330% and also 575%, particular gains. HUBB additionally outperformed its Zacks Industrial Products industry on both metrics over these durations. HUBB’s outperformance stays strongly undamaged over the last 15- and also five-year amount of time also.

Hubbell shares are up 155% in the last 5 years and also 50% in the previous one year. This run consists of a virtually 30% climb considering that very early April, increased by a large post-earning launch rise.

HUBB’s current run aided the supply rebound back over both its 200-day and also 50-day relocating standards. The supply can encounter some near-term marketing stress with it trading right near fresh all-time highs

Picture Resource: Zacks Financial Investment Study

Regardless Of Hubbell’s current pop, its long-lasting outperformance, and also the reality it trades near its top in regards to rate, HUBB’s assessment barely shows up extended. HUBB is trading right around its 10-year average at 19.7 X onward revenues, which additionally notes a 16% discount rate to its very own highs. And also Hubbell is trading approximately according to the Zacks Machinery-Electrical Market.

Picture Resource: Zacks Financial Investment Study

Profits

Hubbell ought to remain to gain from the transforming power landscape, electrification, the broadband buildout, and also a lot more for years ahead. In addition to that, the business elevated its returns (by 7%) for the 15th straight year in 2022, with it generating 1.6% right now.

Hubbell flaunts an instead tough annual report that ought to aid it maintain improving its returns and also purchasing back a lot more supply, and also potentially remain to increase its company down the line with critical purchases.

( Disclosure: Ben Rains possesses HUBB in the Zacks Choice Power Innovators solution)

5 Supplies Ready To Dual

Each was handpicked by a Zacks specialist as the # 1 favored supply to obtain +100% or even more in 2021. Previous referrals have actually risen +143.0%, +175.9%, +498.3% and also +673.0%.

A lot of the supplies in this record are flying under Wall surface Road radar, which supplies a terrific possibility to participate the first stage.

Today, See These 5 Potential Home Runs >>

Hubbell Inc (HUBB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints shared here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.