Netflix NFLX is taken into account a pioneer within the streaming area, evolving from a small DVD rental supplier to a dominant streaming service supplier. The inventory has loved optimistic earnings estimate revisions throughout the board, touchdown the inventory into the highly-coveted Zacks Rank #1 (Robust Purchase).

Picture Supply: Zacks Funding Analysis

Let’s take a better take a look at how the streaming titan at the moment stacks up.

Netflix

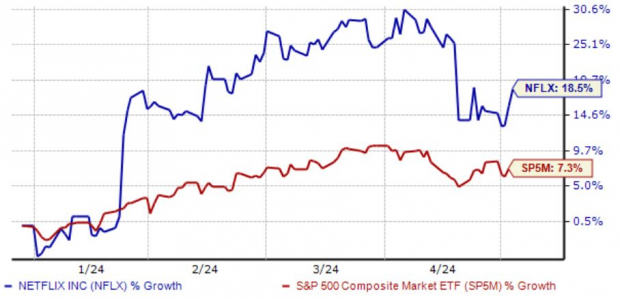

Netflix shares confronted promoting stress following its newest launch however have since recovered, up 18% general in 2024.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

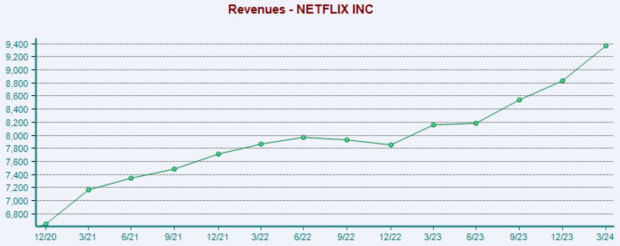

Regarding headline figures in its newest print, Netflix posted a 17% beat relative to the Zacks Consensus EPS estimate and posted gross sales modestly forward of the consensus, with each gadgets displaying appreciable development from the year-ago durations.

Under is a chart illustrating the corporate’s income on a quarterly foundation.

Picture Supply: Zacks Funding Analysis

Picture Supply: Zacks Funding Analysis

Whole subscribers had been reported at 269.6 million, reflecting a 16% soar year-over-year. Nonetheless, the true shock within the quarterly launch was that the corporate will not report quarterly membership numbers beginning subsequent 12 months in 2025 Q1, seemingly explaining the knee-jerk response post-earnings.

Nonetheless, Netflix loved a strong quarter, posting $2.1 billion in free money stream and seeing its year-to-date working margin shifting larger to twenty-eight.1% (20.6% in FY23). The corporate additionally maintained its free money stream outlook of $6 billion for FY24 and repurchased 3.6 million shares all through the interval.

The corporate’s development outlook stays shiny, with consensus expectations for its present fiscal 12 months suggesting 52% earnings development on 15% larger gross sales. The inventory sports activities a Type Rating of ‘A’ for Development.

Backside Line

Traders can implement a stellar technique to seek out anticipated winners by benefiting from the Zacks Rank – probably the most highly effective market instruments that gives a large edge.

The highest 5% of all shares obtain the extremely coveted Zacks Rank #1 (Robust Purchase). These shares ought to outperform the market greater than another rank.

Netflix NFLX can be a wonderful inventory for traders to think about, as displayed by its Zack Rank #1 (Robust Purchase).

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the full sum of solely $1. No obligation to spend one other cent.

Hundreds have taken benefit of this chance. Hundreds didn’t – they thought there should be a catch. Sure, we do have a purpose. We would like you to get acquainted with our portfolio companies like Shock Dealer, Shares Underneath $10, Expertise Innovators,and extra, that closed 228 positions with double- and triple-digit beneficial properties in 2023 alone.

Netflix, Inc. (NFLX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.