PDD Holdings PDD also referred to as Pinduoduo, is a Chinese language e-commerce platform that makes a speciality of group shopping for offers. Based in 2015 by Colin Huang, PDD shortly gained recognition by providing discounted merchandise by means of crew purchases.

It makes use of a social commerce mannequin, encouraging customers to share offers with family and friends to unlock extra reductions. PDD’s platform is especially common in smaller Chinese language cities and rural areas, the place it has captured a major market share. The corporate’s enterprise mannequin focuses on leveraging social networks and revolutionary advertising methods to drive gross sales and engagement.

PDD Holdings at present has a number of bullish catalysts which make it an interesting inventory. Along with a high Zacks Rank, the corporate can be buying and selling at a historic low cost alongside great earnings development and is experiencing important value momentum instigated by some compelling technical chart patterns.

Moreover, though the Chinese language inventory market has languished for a major interval, it has begun to point out important relative energy and momentum. The Chinese language Tech ETF KWEB has outperformed the US inventory indexes during the last three months.

Based mostly on the restoration within the Chinese language shares market, and the overall attractiveness of PDD Holdings I imagine it makes for a compelling funding consideration.

Picture Supply: TradingView

Earnings Developments

Income at PDD Holdings has exploded in the previous few years, rising annual gross sales from $2 billion in 2018 to $35 billion within the final 12 months. This big tempo of development is anticipated to proceed with gross sales anticipated to climb 50% this 12 months and 35% subsequent 12 months.

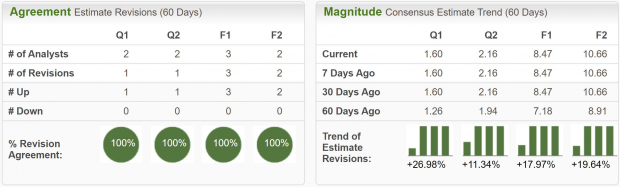

Pinduoduo has additionally seen some hefty upgrades to its earnings estimates, giving it a Zacks Rank #1 (Robust Purchase) ranking. Present quarter earnings had been revised increased by 27% during the last two months and FY24 have elevated by 18% over the identical interval.

Picture Supply: Zacks Funding Analysis

Technical Setup

After breaking out from a descending wedge on the finish of April, PDD inventory began to point out actual promise. Then per week later it broke out once more from a bull flag and is now transferring increased in direction of its latest excessive. Though there isn’t a speedy technical setup, I anticipate PDD Holdings inventory to make new highs quickly based mostly on the broader momentum in Chinese language tech shares.

Picture Supply: TradingView

Low cost Valuation

Like many different Chinese language shares, which have been hammered decrease during the last two years, Pinduoduo at present has a deeply discounted valuation. Its one-year ahead earnings a number of of 17.8x is effectively under the market common, and its two-year median of 25.6x.

However what makes this valuation seem particularly low-cost is PDD’s PEG Ratio which considers EPS development. Over the subsequent 3-5 years EPS are forecast to develop 49.3% yearly, giving it a PEG ratio of simply 0.34.

Picture Supply: Zacks Funding Analysis

Backside Line

I might be remiss to exclude the same old disclaimer of investing in Chinese language equities, as they do carry extra threat, however PDD Holdings provide such a compelling threat/reward alternative I couldn’t assist however current it.

For buyers looking for shares with low cost valuations, robust value momentum, and a contrarian twist, PDD Holdings stands out as the subsequent inventory so as to add to your portfolio.

The place Will Shares Go…

If Biden Wins? If Trump Wins?

The solutions could shock you.

Since 1950, even after damaging midterm years, the market has by no means had a decrease presidential election 12 months. With voters energized and engaged, the market has been virtually unrelentingly bullish regardless of which celebration wins!

Now could be the time to obtain Zacks’ free Particular Report with 5 shares that provide excessive upside for each Democrats and Republicans…

1. Medical producer has gained +11,000% within the final 15 years.

2. Rental firm is totally crushing its sector.

3. Power powerhouse plans to develop its already massive dividend by 25%.

4. Aerospace and protection standout simply landed a doubtlessly $80 billion contract.

5. Big Chipmaker is constructing big crops within the U.S.

Hurry, Download Special Report FREE >>

KraneShares CSI China Internet ETF (KWEB): ETF Research Reports

PDD Holdings Inc. (PDD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.