Shopify Inc. SHOP inventory has doubled the Expertise sector over the past two years and blown it away since SHOP’s 2015 IPO.

Shopify inventory crushed Amazon throughout each intervals, but it trades 50% beneath its all-time highs.

Shopify’s spectacular income and earnings outlook is pushed by its growth and profit-focused streamlining efforts. Shopify boasts a stellar steadiness sheet and its choices turn out to be integral to its rising portfolio of various shoppers.

It is likely to be time for buyers to purchase Shopify inventory down 50% from its peaks whereas tons of different massive tech shares seem overheated and commerce close to all-time highs.

Why Shopify Continues to Thrive in an E-commerce World Dominated by Amazon

Shopify helps its shoppers develop on-line and in particular person in an e-commerce and retail world dominated by Amazon (AMZN) and Walmart. The corporate provides options throughout 4 core phases of enterprise: begin, promote, market, and handle.

Shopify’s portfolio contains every thing from web site creation and design to gross sales, advertising and marketing, funds, automation, stock, delivery, and way more. Shopify’s clients span entrepreneurs, small and mid-businesses, and enormous enterprises.

Picture Supply: Zacks Funding Analysis

Shopify is prospering within the Amazon-heavy e-commerce business by catering to sellers and companies, whereas Amazon ruthlessly focuses on getting customers any product as quick as potential on the lowest worth.

Shopify expanded from $1.1 billion in income in 2018 to $7.1 billion in FY23 by empowering its shoppers to effectively promote throughout digital channels, in-store, wholesale, and past.

Shopify’s Development and Outlook

Shopify makes cash from recurring subscription charges and varied add-ons. Shopify’s days of 60% income progress are over, however it’s making up for that with increased costs and a deal with income.

Shopify raised its costs in 2023 (by roughly 30% for its varied plans) for the primary time in over a decade.

Shopify posted a powerful beat-and-raise second quarter. The corporate stated it “is quickly strengthening its place as a number one enabler of worldwide commerce and entrepreneurship.”

Shopify’s Gross Merchandise Quantity grew by 22% to $67.2 billion. SHOP’s Gross Funds Quantity reached $41.1 billion, representing 61% of GMV processed vs. 58% within the year-ago interval—GPV is the quantity of GMV processed by means of Shopify Funds.

SHOP grew its quarterly income by 21%, or 25% after adjusting for the sale of its logistics companies. Subscription Options income elevated 27%, “pushed by progress within the variety of retailers and pricing will increase on our subscription plans.”

In the meantime, Service provider Options income elevated 19% to $1.5 billion. On high of that, Shopify greater than doubled its free money stream margin to 16%.

Picture Supply: Zacks Funding Analysis

Shopify is projected to develop its gross sales by 22% in 2024 and 20% in 2025 to surge from $7.1 billion final yr to $10.3 billion subsequent yr (SHOP did $1.6 billion in gross sales in pre-Covid 2019).

SHOP is anticipated to spice up its adjusted earnings by 51% in 2024 to $1.12 a share after which enhance its backside line by 19% subsequent yr. Shopify’s upbeat earnings revisions assist it land a Zacks Rank #1 (Robust Purchase).

SHOP’s most correct/latest EPS estimate for FY25 got here in 13% above its already-improved consensus.

Shopify executives earlier this yr reaffirmed their dedication to preserving issues lean, with the corporate saying that worker onboarding has been “primarily flat” for the previous 5 quarters.

Time to Purchase Shopify Inventory on the Dip?

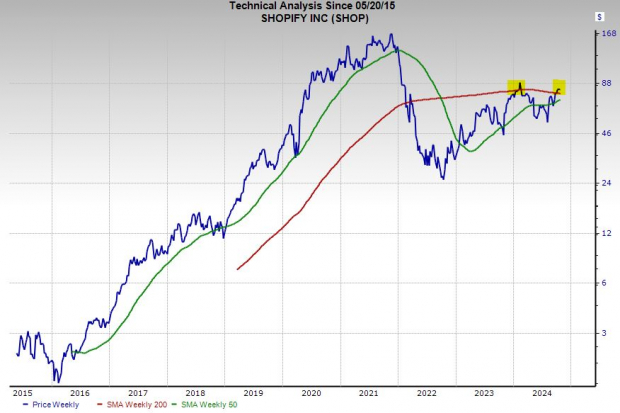

Shopify shares have climbed roughly 2,800% since its 2015 IPO, blowing away Amazon’s 800% and Tech’s 300%. Shopify inventory was a Wall Road star lengthy earlier than Covid hyper-charged the inventory.

Shopify shares then acquired hammered by increased charges and slowing progress. Shopify trades roughly 50% beneath its 2021 peaks regardless of hovering 185% within the final two years.

Shopify is making an attempt to carry its floor at its 21-day shifting common. SHOP inventory is again above its 200-week shifting common for the second time since its huge pullback.

SHOP inventory may break above its early 2024 ranges if it offers stable steering when it experiences its Q3 outcomes.

Picture Supply: Zacks Funding Analysis

Shopify’s 10-for-1 inventory break up in mid-2022 helped make it extra attainable to a bigger swath of buyers (presently buying and selling for round $82 a share).

SHOP’s sky-high valuation is holding the inventory again, however its dedication to earnings and streamlined progress helps.

SHOP’s 2.4 PEG ratio, with components in its long-term earnings progress outlook, marks an 84% low cost to its latest highs and never too giant of a premium in comparison with the Zacks Tech sector (1.6).

Why Shopify is the Bull of the Day Inventory

Shopify is rising its attain in a important space of the financial system. SHOP’s sturdy steadiness sheet ($5 billion in money and equivalents $11.3 billion in whole belongings vs. $2.2 billion in whole liabilities) will assist Shopify proceed to broaden and presumably put money into the following important frontier of commerce.

It is likely to be price including publicity to Shopify inventory 50% beneath its peaks whereas the S&P 500 trades close to all-time highs.

Infrastructure Inventory Growth to Sweep America

An enormous push to rebuild the crumbling U.S. infrastructure will quickly be underway. It’s bipartisan, pressing, and inevitable. Trillions will likely be spent. Fortunes will likely be made.

The one query is “Will you get into the correct shares early when their progress potential is biggest?”

Zacks has launched a Particular Report that can assist you do exactly that, and immediately it’s free. Uncover 5 particular firms that look to realize probably the most from development and restore to roads, bridges, and buildings, plus cargo hauling and vitality transformation on an virtually unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.