Making vital progress in addressing stock issues, Goal’s TGT inventory seems to be at a optimistic inflection level forward of its Q3 outcomes on Wednesday, November 20.

Sporting a Zacks Rank #1 (Sturdy Purchase) and touchdown the Bull of the Day, let’s check out why investing in Goal appears to be like favorable once more.

Targets Q3 Expectations

Based mostly on Zacks estimates, Goal’s Q3 gross sales are projected to extend 2% to $25.97 billion. On the underside line, Q3 EPS is predicted to rise 8% to $2.28 versus $2.10 per share within the comparative quarter.

Goal most just lately surpassed Q2 earnings expectations by almost 19% in August with EPS at $2.57 in comparison with estimates of $2.16 a share. Notably, Goal has surpassed the Zacks EPS Consensus in three of its final 4 quarterly reviews posting a median earnings shock of 20.26%.

Picture Supply: Zacks Funding Analysis

Addressing Shrink Issues

Goal has been on the forefront of addressing shrink issues as theft and broken items have affected many retailers lately. To that time, Walmart WMT, TJX Corporations TJX, and Greenback Basic DG are among the different notable names which have handled the dismal results of shrink.

As reported by Yahoo Finance, Goal has been a frontrunner in growing safety measures by putting in locking instances for gadgets vulnerable to theft whereas investing in further safety members and third-party coaching companies.

Goal additionally plans to associate with the US Division of Homeland Safety to develop cyber protection expertise in a bid to curb organized retail crime. These efforts have largely attributed to Goal’s elevated likelihood contemplating shrink diminished its revenue by an astonishing $1.2 billion within the final two years.

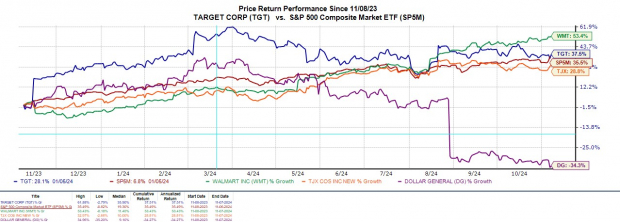

Monitoring Targets Rebound & Valuation

Boosting investor sentiment by addressing its shrink points, Goal’s inventory is up a modest +6% yr to this point however has now soared +37% over the past yr. Edging the benchmark S&P 500’s one-year efficiency, Goal has trailed Walmart’s +53% however has topped TJX’s +28% and Greenback Basic’s plummet of -34% .

Picture Supply: Zacks Funding Analysis

Most intriguing, is that TGT trades at 15.4X ahead earnings which is a pleasing low cost to the S&P 500’s 25.1X and Walmart’s 34.2X.

Magnifying this perceived low cost is that Goal’s annual earnings are forecasted to extend 7% in its present fiscal 2025 and are projected to climb one other 11% in FY26 to $10.56 per share.

It’s additionally noteworthy that TGT trades at simply 0.6X gross sales with its prime line anticipated to be nearly flat in FY25 however slated to extend 3% in FY26 to $110.27 billion.

Picture Supply: Zacks Funding Analysis

Backside Line

Correlating with Goal’s sturdy purchase ranking is that earnings estimate revisions have remained greater for FY25 and FY26. The Common Zacks Value goal of $177.28 a share suggests 20% upside in TGT with Goal checking an total “A” VGM Zacks Fashion Scores grade for the mix of Worth, Development, and Momentum.

Free: 5 Shares to Purchase As Infrastructure Spending Soars

Trillions of {dollars} in Federal funds have been earmarked to restore and improve America’s infrastructure. Along with roads and bridges, this flood of money will pour into AI knowledge facilities, renewable vitality sources and extra.

In, you’ll uncover 5 shocking shares positioned to revenue essentially the most from the spending spree that’s simply getting began on this house.

Download How to Profit from the Trillion-Dollar Infrastructure Boom absolutely free today.

Target Corporation (TGT) : Free Stock Analysis Report

The TJX Companies, Inc. (TJX) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.