Terex Firm TEX, a Zacks Ranking # 1 (Solid Buy), mark off all packages in regards to what we try to find in a leading supply. Appearing of a bearishness, leaders often tend to base prior to the significant indices. TEX bad in July of in 2015 as well as has actually improved the energy in 2023. Solid need is causing climbing revenues price quotes for this highly-ranked supply. The firm’s durability as well as proceeded supply rate climb speak with monitoring’s capability to adjust to the ever-changing market landscape.

TEX sporting activities the second-highest Zacks Worth Design Rating of ‘B’, suggesting a boosted likelihood that the supply drives greater on positive assessment metrics. The firm becomes part of the Zacks Production– Building as well as Mining sector team, which places in the leading 2% out of greater than 250 Zacks Ranked Industries.

Since this team is rated in the leading fifty percent of all sectors, we anticipate it to remain to outmatch the marketplace over the following 3 to 6 months. Likewise keep in mind the positive metrics for this sector team listed below:

Photo Resource: Zacks Financial Investment Research Study

Historic study studies recommend that roughly half of a supply’s rate recognition results from its sector collection. Actually, the leading 50% of Zacks Ranked Industries outshines the lower 50% by an element of greater than 2 to 1. It’s obvious that buying supplies that become part of leading sector teams can offer us an upper hand about the marketplace. By concentrating on leading supplies within the leading 50% of Zacks Ranked Industries, we can substantially boost our stock-picking success.

Firm Summary

Terex produces as well as markets airborne job systems as well as products refining equipment worldwide. Its items consist of mobile product lifts, energy devices, telehandlers, cranes, concrete mixer vehicles as well as sidewalk, as well as conveyors. Utilized in the building and construction, facilities, mining as well as reusing sectors, its items are offered under identified brand names such as Terex, Fuchs, EvoQuip, Powerscreen as well as Cedarapids.

Terex’s stockpile has actually revealed year-over-year development for 9 successive quarters as well as got to $4.1 billion at the end of the initial quarter. This places TEX in a fantastic placement for enhanced lead to the future. Strong need as well as expense financial savings will certainly assist negate the influence of diminishing supply chain interruptions.

Profits Fads as well as Future Quotes

TEX has actually developed a remarkable revenues background, exceeding revenues price quotes in each of the previous 4 quarters. Back in May, the firm reported first-quarter revenues of $1.60/ share, a 52.38% shock over the $1.05 agreement price quote. TEX has actually provided a 27.06% typical revenues shock over the last 4 quarters.

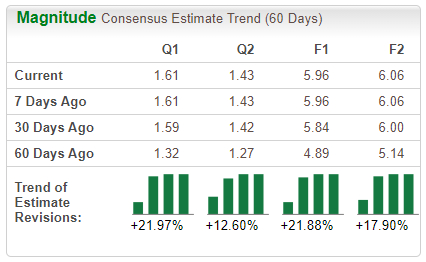

The TEX development engine is anticipated to continue to be warm this year, as experts covering the firm have actually boosted their full-year revenues price quotes by 21.88% in the previous 60 days. The Zacks Agreement EPS Quote currently stands at $5.96/ share, mirroring prospective development of 37.96% about in 2015. Sales are prepared for to climb up 11.73% to $4.94 billion.

Photo Resource: Zacks Financial Investment Research Study

Allow’s Obtain Technical

TEX shares bad well before the significant indices throughout in 2015’s bearishness. The supply has actually proceeded outshining this year as well as has actually increased in rate off the lows. Just supplies that remain in incredibly effective uptrends have the ability to make this kind of rate action. This is the sort of supply we wish to consist of in our profile– one that is trending well as well as getting favorable revenues price quote modifications.

Photo Resource: StockCharts

Notification exactly how the 200-day relocating standard (blue line) is currently sloping up. The 200-day standard has actually functioned as assistance throughout the action higher. With both solid principles as well as technicals, TEX is positioned to proceed its outperformance.

Empirical study reveals a solid connection in between near-term supply motions as well as fads in revenues price quote modifications. As we understand, Terex has actually lately observed favorable modifications. As long as this fad continues to be undamaged (as well as TEX remains to provide revenues beats), the supply will likely proceed its favorable run this year.

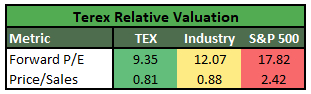

Regardless of the excellent rate run the lows, TEX continues to be reasonably underestimated:

Photo Resource: Zacks Financial Investment Research Study

Profits

Strong institutional acquiring need to remain to offer a tailwind for the supply rate. Loved one undervaluation as well as a healthy and balanced stockpile indicate even more toughness in advance. It’s not also hard to see why this firm is an engaging financial investment.

Backed by a leading sector team as well as excellent background of revenues beats, this market victor is keyed to build on its current run. Durable principles incorporated with a solid technological fad absolutely warrant including shares to the mix. Capitalists would certainly be a good idea to think about TEX as a profile prospect if they have not currently done so.

Disclosure: TEX is a present holding in the Zacks Heading Investor profile.

5 Supplies Ready To Dual

Each was handpicked by a Zacks professional as the # 1 favored supply to acquire +100% or even more in 2021. Previous suggestions have actually skyrocketed +143.0%, +175.9%, +498.3% as well as +673.0%.

The majority of the supplies in this record are flying under Wall surface Road radar, which gives a fantastic chance to participate the first stage.

Today, See These 5 Potential Home Runs >>

Terex Corporation (TEX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.