The Kraft Heinz Firm KHC is just one of The United States and Canada’s biggest customer packaged food and also drink business. A few of its items consist of spices and also sauces, cheese, dairy products, dishes, meats, drink drinks, coffee, and also various other grocery store items.

Presently, the supply flaunts the highly-coveted Zacks Ranking # 1 (Solid Buy), suggesting that experts have actually come to be favorable on its near-term overview.

Picture Resource: Zacks Financial Investment Study

Additionally, the supply lives in the Zacks Customer Staples industry, which is presently placed in the leading 25% (4 out of 16) of all Zacks Sectors. With a beneficial profits overview, allow’s have a look at a couple of various other appealing elements that KHC shares are presenting.

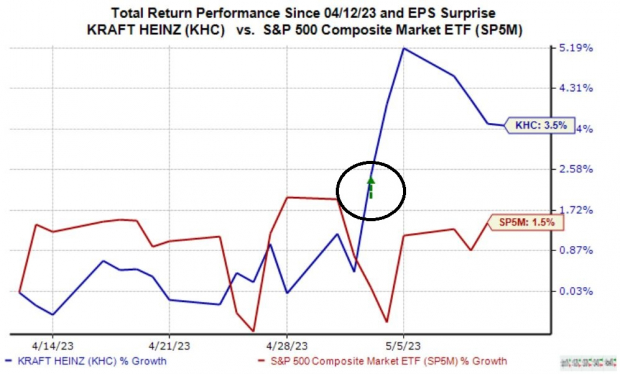

Share Efficiency & & Quarterly Outcomes

KHC shares have actually discovered purchasers over the last month, climbing up 3.5% in worth and also exceeding the S&P 500 decently. As we can see in the graph below, the marketplace responded favorably to the firm’s most recent launch, with shares obtaining a great increase post-earnings.

Picture Resource: Zacks Financial Investment Study

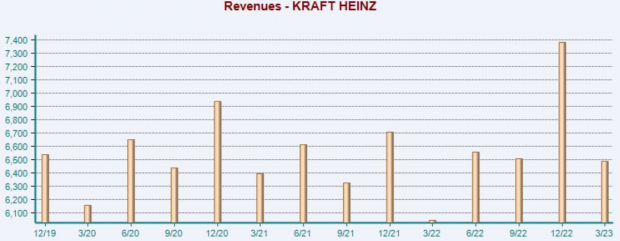

Relating to the most recent launch, the outcomes were strong. Kraft Heinz uploaded profits of $0.68 per share, 13% over the Zacks Agreement EPS Quote. Quarterly income amounted to $6.5 billion, decently over assumptions and also enhancing 7.3% from the year-ago duration.

Picture Resource: Zacks Financial Investment Study

Rates power aided drive the solid outcomes, with the print showing the 13 th successive quarter of Kraft Heinz going beyond the Zacks Agreement EPS Quote.

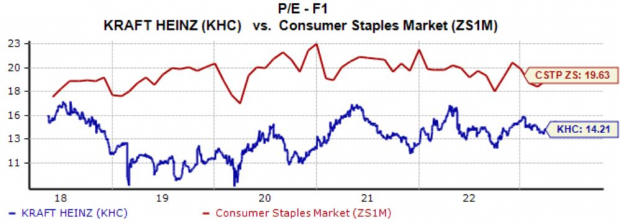

Appraisal

The firm’s shares aren’t extended pertaining to assessment, with the present 14.2 X ahead profits numerous resting simply over the five-year typical and also well listed below the Zacks Customer Staples industry standard.

Picture Resource: Zacks Financial Investment Study

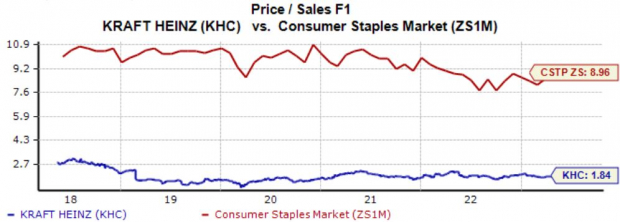

Additionally, KHC shares profession at a 1.8 X ahead price-to-sales proportion, almost according to the five-year typical and also once more well listed below the Zacks industry standard.

Picture Resource: Zacks Financial Investment Study

KHC lugs a Design Rating of “C” for Worth.

Returns

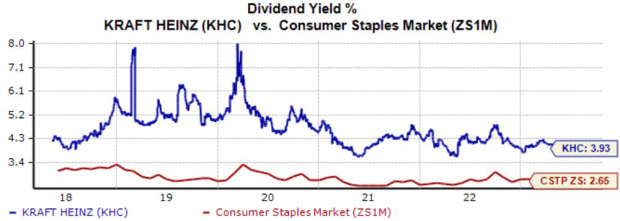

For those looking for earnings, KHC shares give specifically what you’re searching for. The firm’s yearly returns presently generates 3.9%, well over the Zacks industry standard of 2.7%.

Picture Resource: Zacks Financial Investment Study

Still, it deserves keeping in mind that the firm hasn’t raised its payment in a long time, probably guiding away those that look for constant returns development.

Profits

Financiers can execute an outstanding technique to locate predicted victors by benefiting from the Zacks Ranking– among one of the most effective market devices that gives a substantial side.

The leading 5% of all supplies get the very desirable Zacks Ranking # 1 (Solid Buy). These supplies ought to outshine the marketplace greater than any kind of various other ranking.

The Kraft Heinz Firm KHC would certainly be an exceptional supply for capitalists to go on their watchlists, as shown by its Zack Ranking # 1 (Solid Buy).

Free Record: Must-See Hydrogen Supplies

Hydrogen gas cells are currently utilized to give effective, ultra-clean power to buses, ships and also also medical facilities. This innovation gets on the edge of a substantial advancement, one that can make hydrogen a significant resource of America’s power. It can also entirely change the EV market.

Zacks has actually launched an unique record exposing the 4 supplies professionals think will certainly supply the most significant gains.

Download Cashing In on Cleaner Energy today, absolutely free.

Kraft Heinz Company (KHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints revealed here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.