Uber Applied sciences, Inc. (UBER) posted its first full-year revenue as a public firm in 2023 by increasing its ride-hailing and supply companies whereas streamlining its operations at each flip.

Wall Road rewarded Uber by sending its inventory to new all-time highs in February, hovering 130% over the past 12 months.

Uber shares have cooled off to commerce at enticing ranges for long-term buyers given its spectacular outlook in companies it reworked from area of interest apps for folks in choose cities right into a $50 billion-a-year behemoth.

A Transformational 2023

Uber posted fourth-quarter revenue of $1.43 billion, together with a $1 billion profit from its fairness investments. The ride-hailing agency reported $652 million of earnings from operations vs. a lack of $142 million within the fourth quarter of 2022. Uber’s This fall working earnings additionally surged by $258 million quarter-over-quarter.

On prime of that, Uber’s This fall free money circulate hit $768 million vs. a destructive money circulate of -$303 million within the closing quarter of 2022. This got here after Uber posted its first-ever quarterly working revenue within the second quarter of final 12 months.

CEO Dara Khosrowshahi known as 2023 an “inflection level” proving Uber can “proceed to generate sturdy, worthwhile development at scale.”

Uber spent the final a number of years slicing jobs and streamlining its operations, all the time pivoting towards worthwhile growth amid a wild journey for its enterprise that noticed ride-hailing briefly fade throughout Covid and meals supply soar. The corporate’s energy in its core mobility and supply segments are offsetting struggles in its a lot smaller freight unit.

Picture Supply: Zacks Funding Analysis

Uber’s outcomes over the past a number of years spotlight that individuals are again to dwelling their pre-pandemic lives in full drive. Crucially, the resurgence of its ride-hailing section hasn’t come on the expense of supply, showcasing the energy of its two core enterprise fashions which might be particularly common with higher-income shoppers who’re much less impacted by lingering inflation and numerous financial cycles.

Uber grew its month-to-month lively platform shoppers by 15% YoY within the fourth quarter to 150 million, fueled by development throughout mobility (ride-hailing) and supply. Complete journeys soared 24% YoY to 2.6 billion in This fall, whereas mobility gross bookings jumped 29% YoY to $19.3 billion and supply surged 19% to $17 billion.

Uber, below Khosrowshahi, has centered closely on disciplined spending and cost-cutting measures. Uber affords far fewer reductions to shoppers and incentives to drivers nowadays. Uber is decreasing supply errors and turning into extra environment friendly whereas boosting its market share vs. rival Lyft (LYFT) and others.

Picture Supply: Zacks Funding Analysis

On prime of that, Uber is rolling out extra commercials throughout its core Uber app, Uber Eats, and past to assist monetize its rising buyer base for ride-hailing and supply. Uber additionally closely scaled again on its in-house autonomous automobile desires in favor of a strategic partnership with Waymo for self-driving ride-hailing.

Uber in December introduced a brand new partnership with autonomous trucking agency and unbiased subsidiary of Daimler Truck AG, Torc Robotics. Uber is ready to compete in opposition to or probably with the likes of Tesla (TSLA) and others within the autonomous ride-hailing, supply, and freight house down the highway.

Development Forward

Uber grew its income by 17% in 2023, even because it got here up in opposition to an unimaginable to compete in opposition to stretch of 83% gross sales development in 2022 and 56% in 2021. The ride-hailing firm is projected to submit one other 16% development in 2024 and 2025 to hit $50.49 billion subsequent 12 months—vs. $13 billion in pre-Covid 2019.

Its complete gross bookings are projected to surge 19% in 2024, primarily based on Zacks information. In the meantime, its month-to-month lively platform shoppers are anticipated to climb 13% to 169 million.

Picture Supply: Zacks Funding Analysis

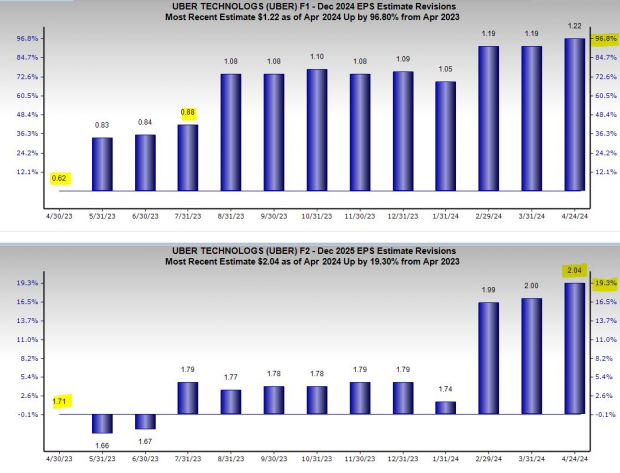

Uber swung from an adjusted lack of -$4.65 a share in 2022 to +$0.87 per share final 12 months. The corporate is anticipated to submit 40% adjusted EPS development in 2024 and one other 67% in FY25 to succeed in $2.04 per share.

Uber crushed our This fall EPS estimate by 340% ($0.66 vs. $0.15). Its consensus FY24 EPS estimate has climbed by 97% over the past 12 months, with its outlook for FY25 up 20%. The agency’s total upbeat EPS revisions assist it seize a Zacks Rank #1 (Robust Purchase) proper now.

Different Fundamentals

Uber inventory has soared round 130% over the past 12 months to interrupt above its 2021 highs to a report of round $82 a share in mid-February. Throughout the identical stretch, its rival Lyft climbed 60%, future potential robotic taxi rival Tesla moved 7% greater, and tech popped 40%.

Uber is now up 70% over the past 5 years vs. Lyft’s 70% downturn. The inventory has pulled again from its highs, buying and selling 14% beneath its data and 23% beneath its common Zacks value goal.

Uber is at present looking for assist at its 21-week transferring common, the place the S&P 500 and the Nasdaq discovered assist to begin the week. Uber fell from its most overbought RSI ranges in February to impartial.

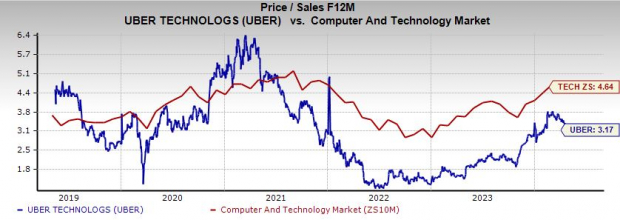

Picture Supply: Zacks Funding Analysis

Uber’s valuation is bettering. The inventory trades at a 50% low cost to its highs at 3.2X ahead gross sales and 30% beneath the Zacks tech sector. Plus, its PEG ratio, which components in its longer-term earnings development outlook, sits at 0.9 vs. tech’s 1.8.

Backside Line

Some buyers may need to wait till after Uber experiences its first quarter 2024 monetary outcomes on Could 8 earlier than they take into account shopping for the inventory.

Lengthy-term buyers are sometimes properly served to overlook the market timing sport. Plus, Wall Road loves the inventory, with 34 of the 40 brokerage suggestions Zacks has at “Robust Buys,” alongside no “Sells.”

Purchase 5 Shares BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Particular Report, Revenue from the 2024 Presidential Election (regardless of who wins).

Since 1950, presidential election years have been sturdy for the market. This report names 5 well timed shares to journey the wave of electoral pleasure.

They embrace a medical producer that gained +11,000% within the final 15 years… a rental firm completely crushing its sector… an vitality powerhouse planning to develop its already giant dividend by 25%… an aerospace and protection standout that simply landed a probably $80 billion contract… and an enormous chipmaker constructing big crops within the U.S.

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Lyft, Inc. (LYFT) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.