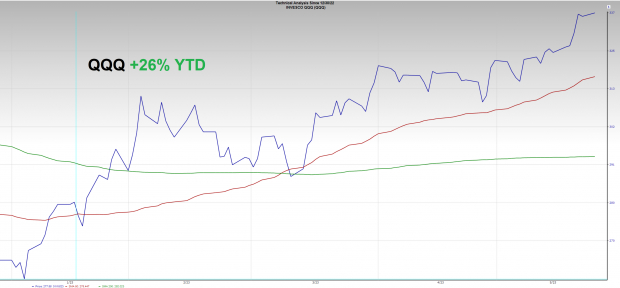

Presently, the securities market goes to a fascinating crossroads. As capitalists patiently wait on the end result of the financial debt ceiling arrangements from Washington, the United State Federal Book Fulfilling Wednesday, and also the after effects from the financial situation, there is a great deal to absorb. To make issues extra complicated, the various equity indexes are splitting from each various other in the largest margin seen in years. For instance, the tech-heavy Nasdaq 100 Index ETF ( QQQ) is greater by an excellent 26% year-to-date while the Russell 2000 Index ETF ( IWM) is greater by a meager 1% (albeit it’s needed to take care of a local financial situation).

From a capitalist point of view it can appear like an overwhelming job to attempt to make up and also variable right into an approach financial plan modifications, macro-economic variables, political arrangements, geopolitics, and also extra. I have actually discovered that the very best method to conquer this complication is to consider historic statistics, criterion, and also most of all, pay attention to what the cost and also quantity activity is informing us. With that said in mind, I will certainly damage down the bear and also bull situation for the securities market at this moment in time.

Bear Instance:

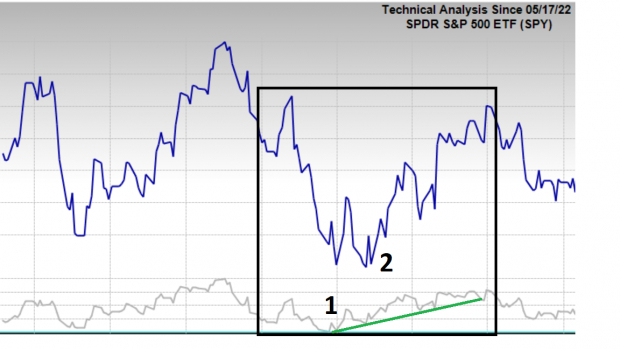

Bearish Aberration: The Loved One Stamina Index (RSI) determines the energy of a specific instrument.Presently, The RSI of the S&P 500 Index ETF ( SPY) is revealing a bearish aberration. Bearish aberrations happen when the cost of a property makes brand-new highs while energy does not– an indicator that energy might be delaying.

Picture Resource: Zacks Financial Investment Research Study

” Market the Information” Possible: Wall surface Road often tends to be a marking down tool– it rates in extremely expected occasions beforehand. Is the current thaw up in supplies an indicator that a resolution is most likely to be discovered for the existing financial debt ceiling arrangements? If so, smart capitalists might make use of the ruptured of excitement to take some revenues In October of 2022, supplies did the precise contrary and also got the information after the extremely expected “highest possible in 40 years” rising cost of living information struck information cables. Subsequently, the S&P 500 had a favorable aberration at the time.

Picture Resource: Zacks Financial Investment Research Study

Pictured: RSI aberrations can be vital inflection factors.

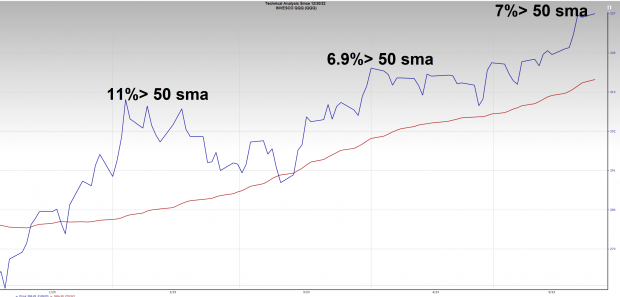

QQQ Range from the 50-day Relocating Ordinary: Relocating standards can be an important device for capitalists since it can give a recommendation factor for fads. Uptrends often tend to take 2 actions greater and also one action reduced, or 3 actions greater and also 2 go back. For capitalists, the very best strategy is to stay clear of chasing after fads and also rather aim to purchase right into assistance. Historically, when an index obtains prolonged by 7% or even more over the 50-day relocating typical it requires to remedy– either via time or cost. Late recently the QQQ index got to extensive degrees of 7% over the 50-day relocating standard.

Picture Resource: Zacks Financial Investment Research Study

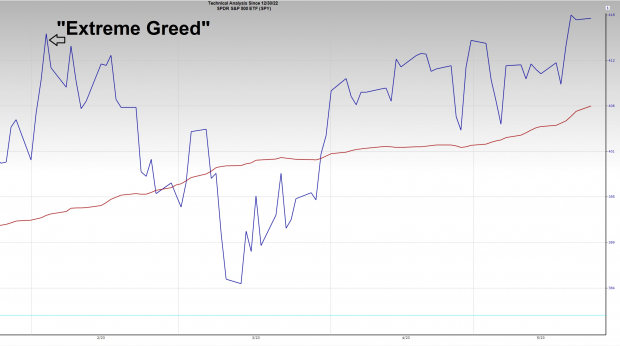

View: The CNN Anxiety and also Greed Index determines belief via 7 worry and also greed signs. The index is presently blinking the “greediest” degrees given that February– right before the marketplace sustained a multi-week improvement.

Picture Resource: Zacks Financial Investment Research Study

Bull Instance:

Trends Tend to Continue: As Larry Hite as soon as stated, ” the fad is your good friend up until completion when it flexes”. Currently, QQQ and also SPY remain in timeless uptrends. Cost is over a climbing 200-day relocating standard, the relocating standards are piled (faster relocating standards over slower ones), and also they are making greater highs and also reduced lows. Seldom does it pay to combat the primary fad for greater than a temporary profession.

Picture Resource: Zacks Financial Investment Research Study

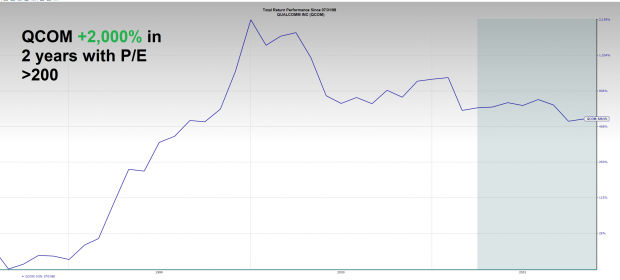

Technology to Drive Future Incomes and also Cut Expenses: Lots of worth capitalists are whining concerning huge technology assessments in business such as Microsoft (MSFT) (professions at 34x) and also Nvidia ( NVDA) (94x). Though the assessments are definitely soaring, making use of P/E as a timing tool is a fool’s duty– particularly in advancing market. First of all, the net bubble and also numerous advancing market for many years give capitalists with evidence that p/e proportion can include nosebleed degrees and also remain there for months or years prior to a supply tops.

Picture Resource: Zacks Financial Investment Research Study

Second Of All, the AI transformation might improve incomes to a factor where ingenious business like NVDA can “turn into them”. Despite this year’s inhuman relocate supplies like Alphabet ( GOOGL), MSFT, and also NVDA, context is necessary. After the 2022 technology improvement, all 3 supplies continue to be well listed below their highs, while development is anticipated to catapult greater. For instance, NVDA (which reports incomes Wednesday) is anticipated to reveal document incomes in very early 2024. At the same time, the share cost is well listed below the all-time high cost of $346 attained in late 2021.

Picture Resource: Zacks Financial Investment Research Study

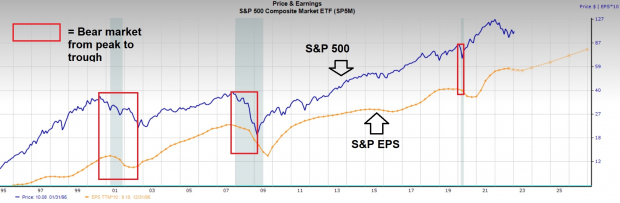

Background Informs United States that Cost Bottoms Well Prior To Incomes: The previous 3 significant bearish market (2020 Covid Collision, 2008 Global Financial Dilemma, & & 2000 Net Bubble) saw cost base prior to incomes. Will it occur once more?

Picture Resource: Zacks Financial Investment Research Study

Stablizing Beyond Technology: An essential debate in numerous bearish theses is that mega-cap technology supplies such as Apple ( AAPL) and also Advanced Micro Gadget ( AMD) are propping up the whole equity market.

Possible for More Comprehensive Engagement: Monday, IWM fired greater by 1.22%, outmatching the various other significant indices. Oppressed ARK Technology ETF ( ARKK) jumped greater by almost 5%. Distressed car retailed Carvana ( CVNA) has greater than increased off lows. All the above indicate proof that weak locations of the marketplace might be ultimately supporting.

Placing everything With Each Other

The bull and also bear disagreements outlined over recommend that the uptrend might require to stop and also remedy via time or cost in the temporary. While there is little proof to go short, brand-new longs ought to be stayed clear of up until we obtain a pullback. Longer term, the proof indicates an advancing market recuperation.

The New Gold Thrill: Exactly How Lithium Batteries Will Make Millionaires

As the electrical lorry transformation broadens, capitalists have a possibility to target big gains. Numerous lithium batteries are being made & & need is anticipated to enhance 889%.

Download the brand-new FREE report revealing 5 EV battery stocks set to soar.

Apple Inc. (AAPL) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Invesco QQQ (QQQ): ETF Research Reports

SPDR S&P 500 ETF (SPY): ETF Research Reports

iShares Russell 2000 ETF (IWM): ETF Research Reports

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

ARK Innovation ETF (ARKK): ETF Research Reports

Carvana Co. (CVNA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints shared here are the sights and also viewpoints of the writer and also do not always show those of Nasdaq, Inc.