Key Takeaways

- Mid-cap shares MTSI, MASI, DRS, INGR and CRS all have the potential to turn out to be large-cap shares subsequent 12 months.

- Giant-cap shares have a market capitalization of $10 billion or extra.

- Register now to see our 7 Best Stocks for the Next 30 Days report – free as we speak!

U.S. inventory markets have witnessed renewed momentum in 2024 after a formidable 2023. The bull run continued for the previous 21 months, barring some minor fluctuations. In the meantime, market contributors predict a 70% probability for one more 25 foundation factors by the Fed in December. If this materializes, then the central financial institution will cut back the benchmark lending charge by 1% in 2024.

Except for the three main inventory indexes, the mid-cap-centric S&P 400 index has additionally rallied 21.4% 12 months up to now. Throughout the mid-cap area, a handful of shares (market capital > $9 billion< $10 billion) have the potential to turn out to be giant caps in 2025.

5 such shares are – MACOM Expertise Options Holdings Inc. MTSI, Masimo Corp. MASI, Leonardo DRS Inc. DRS, Ingredion Inc. INGR and Carpenter Expertise Corp. CRS.

Why Mid-Cap Shares

Funding in mid-cap shares is commonly acknowledged as portfolio diversification technique. These shares mix the enticing attributes of each small and large-cap shares. Prime-ranked, mid-cap shares have a excessive potential to reinforce their profitability, productiveness and market share. These can also turn out to be large-cap over time.

If the financial progress slows down as a consequence of any unexpected inner or exterior disturbance, mid-cap shares will likely be much less prone to losses than their large-cap counterparts owing to much less worldwide publicity.

Then again, if the economic system continues to thrive, these shares will acquire greater than small caps as a consequence of established administration groups, a broad distribution community, model recognition and prepared entry to the capital markets.

Purchase 5 Mid Caps Set to Flip to Giant-Cap Shares

These shares have sturdy revenues and earnings progress potential for 2025. Furthermore, these shares have seen optimistic earnings estimate revisions over the past 30 days. Every of our picks sports activities a Zacks Rank #1 (Robust Purchase). You’ll be able to see the complete list of today’s Zacks #1 Rank stocks here.

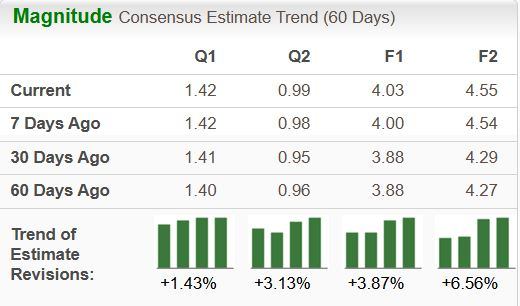

MACOM Expertise Options Holdings Inc.

MACOM Expertise Options is benefiting from stable momentum throughout telecom, knowledge middle, and industrial and protection markets. Rising 5G community deployments, rising demand for RF and microwave merchandise and power throughout protection functions are positives for MTSI.

Rising proliferation of cloud companies is bolstering each home and worldwide deployments of MTSI. Strong demand for 100G per lane, 400G and 800G short-reach optical connectivity options, is boosting MTSI’s prospects within the knowledge middle market. Robust adoption of high-performance analog elements corresponding to TIAs, CDRs and drivers that are required in 100G deployment, is one other optimistic for MTSI.

MACOM Expertise Options has an anticipated income and earnings progress charge of twenty-two.5% and 31.3%, respectively, for the present 12 months (ending September 2025). The Zacks Consensus Estimate for current-year earnings has improved 3.7% within the final 30 days.

Picture Supply: Zacks Funding Analysis

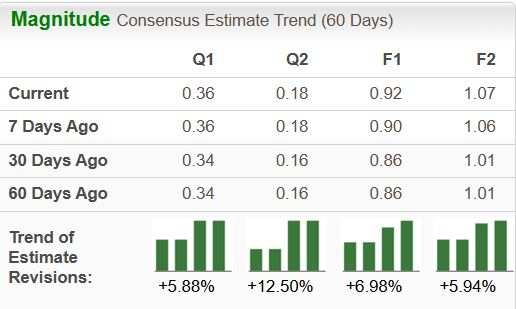

Masimo Corp.

Masimo’s merchandise have been the topic of varied research over the previous few months, which is promising. MASI’s give attention to affected person monitoring and its ongoing R&D efforts are spectacular. A stable product suite is more likely to help MASI in solidifying its enterprise globally, as evidenced by its varied tie-ups with healthcare suppliers.

A powerful liquidity place is an added plus for MASI. The Zacks mannequin anticipates the overall revenues and adjusted earnings per share to enhance between 2023 and 2026 and exhibit a CAGR of 4.8% and 5.9%, respectively.

Masimo has an anticipated income and earnings progress charge of 6.1% and 12.8%, respectively, for subsequent 12 months. The Zacks Consensus Estimate for next-year earnings has improved 0.2% within the final seven days.

Picture Supply: Zacks Funding Analysis

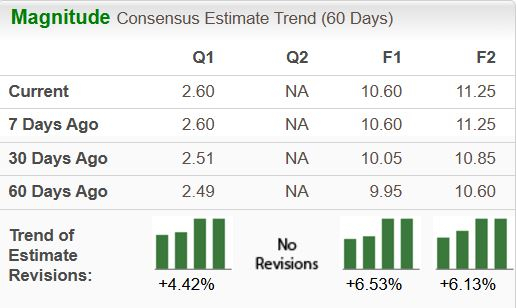

Leonardo DRS Inc.

Leonardo DRS supplies protection digital merchandise and techniques, and army help companies for the U.S. army intelligence businesses and allies. DRS operates by way of Superior Sensing and Computing section, and Built-in Mission Methods segments. DRS’ broad know-how portfolio focuses on superior sensing, community computing, drive safety and electrical energy and propulsion in addition to a spread of key protection priorities.

Leonardo DRS has an anticipated income and earnings progress charge of seven.4% and 16.9%, respectively, for subsequent 12 months. The Zacks Consensus Estimate for next-year earnings has improved 0.9% within the final seven days.

Picture Supply: Zacks Funding Analysis

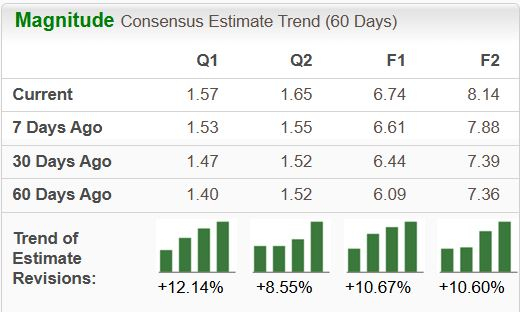

Ingredion Inc.

Ingredion is an elements options supplier specializing in nature-based sweeteners, starches and vitamin elements. INGR serves various sectors in meals, beverage, brewing, prescribed drugs and different industries.

INGR’s sweetener merchandise embody dextrose, glucose, polyols, HFCS and Maltodextrin. INGR’s vitamin options embody prebiotic fibers, resistant starch, soluble fibers and Inulin fibers. INGR’s starch-based merchandise embody each industrial and food-grade starches.

Ingredion has an anticipated income and earnings progress charge of 1.3% and 6.1%, respectively, for subsequent 12 months. The Zacks Consensus Estimate for next-year earnings has improved 3.7% within the final 30 days.

Picture Supply: Zacks Funding Analysis

Carpenter Expertise Corp.

Carpenter Expertise’s backlog was near-record ranges within the first quarter of fiscal 2025, indicating sturdy demand. CRS’ fiscal 2025 outcomes are anticipated to replicate the impacts of the continuing momentum throughout its end-use markets. CRS’ monetary place has been sturdy, offering it the flexibleness to put money into the rising applied sciences of additive manufacturing and smooth magnetics.

CRS’ cost-reduction initiatives are additionally anticipated to spice up its margins. Though CRS has been dealing with supply-chain challenges, will probably be offset by the features. Backed by stable backlog ranges, CRS’ close to and long-term outlooks for every end-use market remained optimistic. CRS’ strategic acquisitions will enhance its efficiency within the coming quarters.

Carpenter Expertise has an anticipated income and earnings progress charge of 6.9% and 42.2%, respectively, for the present 12 months (ending June 2025). The Zacks Consensus Estimate for current-year earnings has improved 2% within the final seven days.

Picture Supply: Zacks Funding Analysis

Free Right this moment: Taking advantage of The Future’s Brightest Vitality Supply

The demand for electrical energy is rising exponentially. On the similar time, we’re working to scale back our dependence on fossil fuels like oil and pure fuel. Nuclear vitality is a perfect alternative.

Leaders from the US and 21 different international locations lately dedicated to TRIPLING the world’s nuclear vitality capacities. This aggressive transition may imply super earnings for nuclear-related shares – and traders who get in on the motion early sufficient.

Our pressing report, Atomic Alternative: Nuclear Vitality’s Comeback, explores the important thing gamers and applied sciences driving this chance, together with 3 standout shares poised to profit essentially the most.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

Masimo Corporation (MASI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Ingredion Incorporated (INGR) : Free Stock Analysis Report

MACOM Technology Solutions Holdings, Inc. (MTSI) : Free Stock Analysis Report

Leonardo DRS, Inc. (DRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.