With market uncertainty resurfacing, traders will probably be searching for shares that may climate a possible financial downturn.

One firm that could be catching traders’ consideration after releasing its This fall outcomes on Thursday is Cheniere Vitality LNG. Whereas LNG wasn’t capable of shake off the volatility in immediately’s buying and selling session, Cheniere crushed its This fall EPS expectations, making a development of optimistic earnings estimate revisions more likely to proceed.

Cheniere’s This fall Outcomes

Engaged in liquified pure fuel manufacturing, Cheniere’s earnings have been anticipated to drop to $2.69 per share after a tougher-to-compete towards interval that noticed This fall EPS at $5.76 a yr in the past. Nevertheless, Cheniere reported This fall EPS of $4.33, crushing expectations by 61%.

This got here on gross sales of $4.43 billion, which was down from $4.82 billion within the comparative quarter however edged estimates of $4.4 billion. Working North America’s first large-scale liquified fuel export facility, Cheniere has exceeded earnings expectations in three of its final 4 quarterly experiences with a really spectacular common EPS shock of 74.42%.

Picture Supply: Zacks Funding Analysis

Constructive EPS Revisions

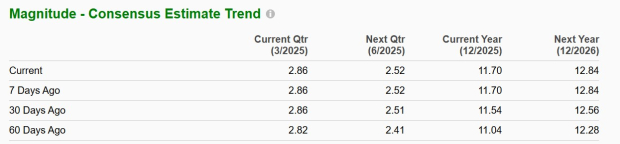

Most intriguing, is that earlier than Cheniere’s huge This fall earnings beat, fiscal 2025 EPS estimates had already elevated 6% during the last 60 days from $11.04 a share to $11.70 (Present Fiscal Yr). It’s additionally noteworthy that FY26 EPS estimates are up 4% within the final two months from $12.28 a share to $12.84.

Picture Supply: Zacks Funding Analysis

Monitoring Cheniere’s Inventory Peformance

With optimistic earnings estimate revisions being the most important indicator of extra upside in a inventory, LNG is up a modest +3% yr up to now regardless of falling over 2% in Friday’s broader selloff. Moreover, Cheniere’s inventory has spiked over +40% within the final yr and is sitting on +90% positive aspects within the final three years.

Picture Supply: Zacks Funding Analysis

Backside Line

Recognized for its huge earnings potential, Cheniere Vitality inventory will probably be one to keep watch over within the coming weeks and at present sports activities a Zacks Rank #2 (Purchase). Reassuringly, LNG is at an affordable 19.4X ahead earnings a number of and does supply a 0.88% annual dividend yield.

7 Greatest Shares for the Subsequent 30 Days

Simply launched: Specialists distill 7 elite shares from the present listing of 220 Zacks Rank #1 Robust Buys. They deem these tickers “Most Seemingly for Early Value Pops.”

Since 1988, the total listing has crushed the market greater than 2X over with a median achieve of +24.3% per yr. So make sure you give these hand picked 7 your rapid consideration.

Cheniere Energy, Inc. (LNG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.