Reporting outcomes for his or her fiscal first quarter on Wednesday, Disney DIS and Qualcomm QCOM impressively exceeded earnings expectations whereas surpassing top-line estimates as properly.

Having vital market management of their respective industries, DIS and QCOM will probably be two shares to regulate within the coming weeks.

Disney’s Q1 outcomes

Strategic initiatives to chop prices have led to a continued turnaround in Disney’s working effectivity with Q1 web earnings at $3.7 billion or adjusted earnings of $1.76 per share, a 44% surge from EPS of $1.22 within the comparative quarter. Crushing Q1 EPS estimates of $1.44 by 22%, Disney has now surpassed earnings expectations for 9 consecutive quarters.

Disney’s improved profitability comes because the media conglomerate had three of the highest field workplace movies of 2024 which additionally helped enhance Q1 gross sales by 5% 12 months over 12 months to $24.69 billion and edged estimates of $24.65 billion.

Picture Supply: Zacks Funding Analysis

Qualcomm’s Q1 outcomes

Chip large Qualcomm reported Q1 web earnings of $3.18 billion with adjusted earnings spiking 24% to a quarterly peak of $3.41 per share versus EPS of $2.75 within the prior interval. Topping Q1 EPS estimates of $2.93 by 16%, Qualcomm has beat earnings expectations for seven straight quarters.

Quallcomm’s chipset enterprise delivered its first $10 billion quarter, together with file handset and automotive revenues. Total, Qualcomm’s Q1 gross sales hit a file $11.66 billion which climbed 17% from $9.93 billion a 12 months in the past and noticeably topped estimates of $10.91 billon.

Picture Supply: Zacks Funding Analysis

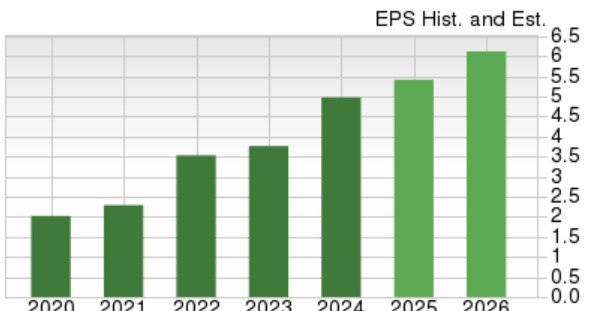

Disney & Qualcomm’s EPS Steering

Reaffirming its full-year earnings steering, Disney nonetheless expects high-single-digit EPS progress in fiscal 2025 with the Zacks Consensus at the moment at $5.43 per share or 9% progress. Based mostly on Zacks estimates, Disney’s EPS is projected to leap one other 13% in FY26 to $6.16. It’s additionally noteworthy that Disney anticipates its money from operations to be roughly $15 billion this 12 months.

Picture Supply: Zacks Funding Analysis

Offering Q2 steering, Qualcomm forecasts EPS at $2.70-$2.90 which got here in above the present Zacks Consensus of $2.68 or 10% progress (Present Qtr beneath). Moreover, Qualcomm expects Q2 revenues at $10.2 billion-$11 billion with Zacks estimates at $10.35 billion or 10% progress.

Zacks projections name for Qualcomm’s annual earnings to rise 10% this 12 months and develop one other 10% in FY26 to $12.32 per share.

Picture Supply: Zacks Funding Analysis

Backside Line

Disney and Qualcomm inventory are beginning to appear to be they might have extra upside with each sporting a Zacks Rank #2 (Purchase). To that time, their FY25 and FY26 EPS estimates had already gone up within the final 30 days. The development of optimistic earnings estimate revisions might proceed after sturdy Q1 outcomes and favorable steering.

Free At this time: Cashing in on The Future’s Brightest Vitality Supply

The demand for electrical energy is rising exponentially. On the similar time, we’re working to cut back our dependence on fossil fuels like oil and pure fuel. Nuclear vitality is a perfect alternative.

Leaders from the US and 21 different international locations lately dedicated to TRIPLING the world’s nuclear vitality capacities. This aggressive transition may imply large earnings for nuclear-related shares – and buyers who get in on the motion early sufficient.

Our pressing report, Atomic Alternative: Nuclear Vitality’s Comeback, explores the important thing gamers and applied sciences driving this chance, together with 3 standout shares poised to learn probably the most.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.