Today’s incomes align will certainly be highlighted by 2 premier Zacks supplies generally Mills ( GIS) as well as Darden Dining Establishments ( DRI) with both readied to report their monetary third-quarter records on March 23.

Allow’s see if it’s time for capitalists to purchase either supply as these firms look positioned to take advantage of greater food intake.

General Mills (GIS)

With General Mills’ Food-Miscellaneous Sector presently in the leading 39% of over 250 Zacks Industries the legendary international producer as well as marketing expert of top quality customer food seems a recipient.

To that factor, General Mills supply sporting activities a Zacks Ranking # 2 (Buy) presently with incomes quote modifications remaining to trend greater prior to its Q3 record.

Photo Resource: Zacks Financial Investment Research Study

Q3 Sneak Peek & & Expectation

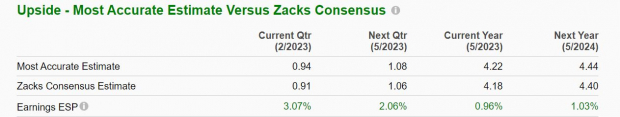

General Mills’ Q3 incomes are predicted at $0.91 per share, up 8% from Q3 2022. Also much better, the Zacks Expected Shock Forecast (ESP) suggests General Mills might defeat fundamental assumptions with one of the most Precise Quote having Q3 EPS at $0.94. On the leading line, third-quarter sales are anticipated to be $4.91 billion, likewise up 8% from the previous year quarter.

Photo Resource: Zacks Financial Investment Research Study

On The Whole, General Mills incomes are currently anticipated to leap 6% in monetary 2023 as well as climb an additional 5% in FY24 at $4.40 per share. Sales are anticipated to be up 5% this year as well as surge an additional 3% in FY24 to $20.57 billion. A lot more significantly, monetary 2024 would certainly stand for 22% development from pre-pandemic degrees with 2019 sales at $16.86 billion.

Efficiency & & Evaluation

General Mills supply is down -3% year to day as well as near the Food-Miscellaneous Markets -4% while tracking the S&P 500’s +5%. Nevertheless, over the last 2 years, GIS supply is up +32% to squash the criteria as well as its Zacks Subindustry’s -3%.

Photo Resource: Zacks Financial Investment Research Study

Trading around $81 per share, GIS supply professions at 19.3 X onward incomes which is near the market standard of 18.2 X. This is likewise listed below its years high of 23.5 X as well as closer to the mean of 17.5 X with the climbing incomes price quotes using additional assistance.

Photo Resource: Zacks Financial Investment Research Study

Darden Dining Establishments (DRI)

Darden Dining establishments is likewise placed to take advantage of a solid organization atmosphere as well as greater food intake with its Retail-Restaurants Sector in the leading 19% of all Zacks Industries.

Darden is just one of the biggest laid-back eating restaurant drivers on the planet with procedures in the united state as well as Canada that consist of Olive Yard as well as Longhorn Steakhouse. Sporting a Zacks Ranking # 2 (Buy) Darden’s incomes quote modifications have actually trended greater throughout the quarter.

Photo Resource: Zacks Financial Investment Research Study

Q3 Sneak Peek & & Expectation

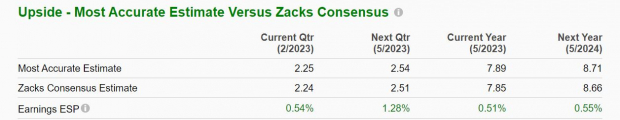

The Zacks Agreement for Darden’s Q3 incomes is $2.24 per share, which would certainly be a 16% boost from Q3 2022 EPS of $1.93. The Zacks ESP suggests Darden might a little defeat incomes assumptions with one of the most Precise Quote at $2.25 a share. Sales for the quarter are anticipated to be $2.72 billion, up 11% from the previous year quarter.

Photo Resource: Zacks Financial Investment Research Study

In addition, Darden’s incomes are currently anticipated to climb 6% this year as well as climb 10% in FY24 at $8.66 per share. Sales are predicted to leap 8% in FY23 as well as surge an additional 5% in FY24 to $10.99 billion. A lot more remarkable, monetary 2024 would certainly stand for 29% development from pre-pandemic degrees with 2019 sales at $8.51 billion.

Efficiency & & Evaluation

Darden supply is up +11% YTD to cover the S&P 500 as well as the Retail-Restaurant Markets +4%. Also much better, over the last 3 years Darden supply is up an extremely outstanding +274% to greatly outmatch the criteria as well as its Zack Subindustry’s +79%.

Photo Resource: Zacks Financial Investment Research Study

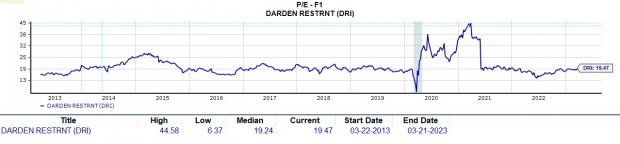

Darden supply presently trades at $153 per share as well as 19.4 X onward incomes which is perfectly underneath the market standard of 21.6 X. Darden likewise trades 56% listed below its decade-long high of 44.5 X as well as on the same level with the mean of 19.2 X.

Photo Resource: Zacks Financial Investment Research Study

Takeaway

General Mills as well as Darden’s price-to-earnings appraisals are still appealing about their past in addition to incomes quote modifications trending greater. The leading as well as profits development of both firms stays appealing as well as capitalists might intend to think about these supplies as their solid efficiencies over the last couple of years might proceed, particularly if the Q3 records are solid.

5 Supplies Ready To Dual

Each was handpicked by a Zacks professional as the # 1 preferred supply to acquire +100% or even more in 2021. Previous suggestions have actually risen +143.0%, +175.9%, +498.3% as well as +673.0%.

A lot of the supplies in this record are flying under Wall surface Road radar, which offers an excellent chance to participate the very beginning.

Today, See These 5 Potential Home Runs >>

General Mills, Inc. (GIS) : Free Stock Analysis Report

Darden Restaurants, Inc. (DRI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always show those of Nasdaq, Inc.