The market obtained fourth-quarter outcomes from most of the main U.S. banks on Wednesday, together with reviews from funding corporations Goldman Sachs GS and BlackRock BLK.

As two of the famend world leaders in asset administration, let’s see if it’s time to purchase inventory in both of those New York-based finance giants.

Goldman’s Large EPS Suprise

Goldman Sachs stole the present in yesterday’s busy earnings lineup which additionally included This autumn reviews from three of the 4 main large banks, Wells Fargo WFC, Citigroup C, and JPMorgan JPM.

Taking the highlight, Goldman reported an enormous EPS shock of 48% with This autumn earnings at $4.11 billion or $11.95 per share in comparison with expectations of $8.07. This got here on quarterly gross sales of $13.86 billion which was 13% above estimates of $12.26 billion.

Goldman attributed its stellar This autumn outcomes to an improved working backdrop with This autumn earnings doubling from the comparative quarter whereas gross sales elevated 22% from $11.31 billion a yr in the past.

Picture Supply: Zacks Funding Analysis

BlackRock Reaches File AUM

BlackRock didn’t blow away its This autumn expectations however was capable of flex its strong monetary figures as properly. This autumn EPS was at $11.93 in comparison with expectations of $11.27 with gross sales of $5.67 billion coming in 2% higher than anticipated.

Picture Supply: Zacks Funding Analysis

12 months over yr, BlackRock’s This autumn earnings and gross sales spiked over 20% respectively as the corporate highlighted that its belongings below administration (AUM) hit a file $11.6 trillion because of quarterly internet inflows of $281 billion.

Picture Supply: Reuters

Full-12 months Comparability

Whereas BlackRock stays the world’s largest cash supervisor, Goldman ended 2024 as the worldwide chief in introduced and accomplished mergers and acquisitions (M&A).

Total, Goldman’s complete gross sales spiked 16% in fiscal 2024 to $53.51 billion in comparison with $46.25 billion in 2023. Extra spectacular, annual earnings soared over 70% to $14.28 billion or $40.54 per share versus EPS of $22.87 in 2023. Notably, this was the second-highest mark on Goldman’s prime and backside strains with its incorporation relationship again to 1867.

As for BlackRock, complete gross sales of $20.41 billion elevated 14% with annual earnings rising over 15% to $6.37 billion or $43.61 per share. It’s additionally noteworthy that BlackRock reported file annual internet inflows of $641 billion along with its peak in AUM.

Efficiency & Valuation Comparability

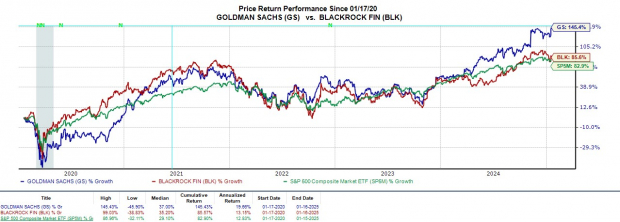

Over the past yr, Goldman’s inventory has risen +62% to impressively prime BlackRock and the benchmark S&P 500’s features of +26%. Within the final 5 years, GS is up +145% to additionally prime BLK and the broader market’s features of over +80%.

Picture Supply: Zacks Funding Analysis

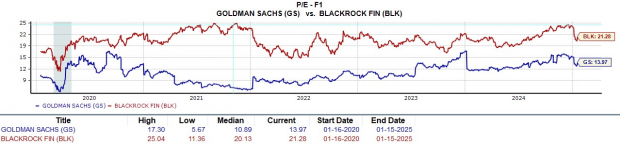

At their present ranges, GS trades at 13.9X ahead earnings and at a pleasing low cost to BLK which trades roughly on par with the benchmark at 21.2X

Picture Supply: Zacks Funding Analysis

Backside Line

Attributed to its “cheaper” P/E valuation and the truth that earnings estimate revisions are more likely to rise after an enormous This autumn EPS shock, Goldman Sachs inventory sports activities a Zacks Rank #2 (Purchase) with BlackRock touchdown a Zacks Rank #3 (Maintain).

Zacks Names #1 Semiconductor Inventory

It is just one/9,000th the dimensions of NVIDIA which skyrocketed greater than +800% since we beneficial it. NVIDIA continues to be sturdy, however our new prime chip inventory has rather more room to increase.

With sturdy earnings progress and an increasing buyer base, it is positioned to feed the rampant demand for Synthetic Intelligence, Machine Studying, and Web of Issues. World semiconductor manufacturing is projected to blow up from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

BlackRock (BLK) : Free Stock Analysis Report

Wells Fargo & Company (WFC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.