As one of many headline names of this week’s earnings lineup, Meta Platforms META was capable of impressively exceed its fourth-quarter expectations on Wednesday.

Correlating with stellar positive factors over the previous few years, Meta has now surpassed earnings expectations for 9 consecutive quarters and buyers could also be questioning if it’s time to purchase inventory within the social media large after its newest EPS shock.

Picture Supply: Zacks Funding Analysis

Meta’s Sturdy This fall Outcomes

Primarily derived from promoting income, Meta’s This fall gross sales of $48.38 billion topped estimates of $46.96 billion whereas stretching 20% from $40.11 billion a 12 months in the past.

Advert impressions throughout all apps elevated by 6% and 11% year-over-year for the fourth quarter and full 12 months 2024, respectively. Moreover, common value per advert elevated by 14% and 10% YoY. This got here on a 5% YoY enhance in person engagement with Meta’s DAP (Every day Energetic Individuals) rising to a median of three.35 billion.

Meta’s profitability elevated to $20.83 billion or $8.02 per share, a 50% enhance from EPS of $5.33 within the prior 12 months quarter on web earnings of $14.01 billion. Surpassing the Zacks This fall EPS Consensus of $6.68 by 20%, Meta’s shock revenue was attributed to AI-driven promoting focusing on.

Picture Supply: Zacks Funding Analysis

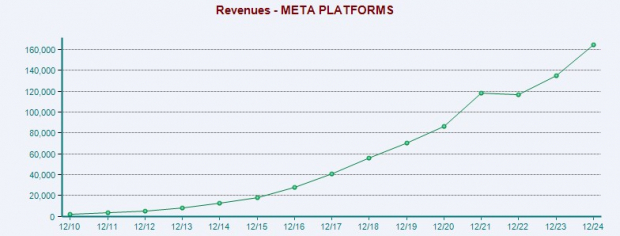

Meta’s Full Yr Outcomes

Total, Meta’s complete gross sales elevated 22% in fiscal 2024 to $164.5 billion versus $134.9 billion in 2023. Annual earnings got here in at $62.36 billion or $23.86 per share, a 60% spike from EPS of $14.87 in 2023 on web earnings of $39.09 billion.

Picture Supply: Zacks Funding Analysis

Meta’s Income Steering

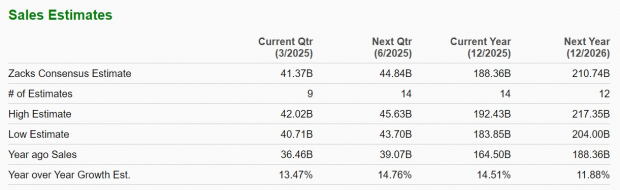

Whereas Meta didn’t present a full-year top-line information, the corporate expects Q1 2025 income to be between $39.5-$41.8 billion with the present Zacks Consensus at $41.37 billion or 13% development (Present Qtr under).

Based mostly on Zacks estimates, Meta’s complete gross sales are projected to extend one other 12% in FY26. Zacks projections name for six% EPS development in FY25 with Meta’s backside line projected to extend one other 11% subsequent 12 months to $28.37 per share.

Picture Supply: Zacks Funding Analysis

Meta’s Engaging P/E Valuation

Buying and selling round $700, Meta’s inventory is at a 26.6X ahead earnings a number of which isn’t a stretched premium to the benchmark S&P 500.

What could attraction to long-term buyers is that META has the second least expensive P/E valuation amongst its Magnificent 7-themed huge tech friends with Alphabet’s GOOGL being the bottom at 22.4X and Tesla TSLA the very best at 123.3X.

Picture Supply: Zacks Funding Analysis

Takeaway

For now, Meta Platforms inventory lands a Zacks Rank #3 (Maintain). It is exhausting to depend META out with reference to extra upside after Meta’s robust This fall outcomes however there are reemerging considerations in regards to the firm’s elevated spending.

To that time, Meta initiatives capital expenditures within the vary of $60-$65 billion in 2025 in comparison with $39.23 billion final 12 months. That stated, Meta’s success with AI advert focusing on does counsel that elevated spending on its synthetic intelligence infrastructure may show to be very profitable and price holding META within the portfolio.

Zacks’ Analysis Chief Names “Inventory Most More likely to Double”

Our workforce of specialists has simply launched the 5 shares with the best likelihood of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This prime decide is among the many most revolutionary monetary companies. With a fast-growing buyer base (already 50+ million) and a various set of leading edge options, this inventory is poised for large positive factors. After all, all our elite picks aren’t winners however this one may far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.