February’s cooler CPI print has helped markets stabilize amid ongoing tariff issues, and one inventory traders could also be eyeing for a rebound is Netflix NFLX.

NFLX has fallen 14% from a 52-week excessive of $1,064 a share in mid-February however continues to be up +2% yr so far which has topped the S&P 500’s -6% and the Nasdaq’s -8%. Plus, during the last two years NFLX has been one of many market’s prime performers, hovering +200% to impressively outperform the broader indexes and its Zacks Broadcast Radio & Tv Market’s +97%.

Picture Supply: Zacks Funding Analysis

Netflix & Market Sentiment

Regardless of financial uncertainty, investor sentiment has remained excessive for Netflix with many analysts elevating their value targets for NFLX in correlation with the corporate’s market dominance because the main streaming supplier forward of Disney (DIS), Paramount International PARA, and Amazon’s (AMZN) Prime Video. Netflix’s unique content material and worldwide growth have been the principle contributors to its continued success together with a rising ad-supported subscription plan at a decreased value to its conventional service.

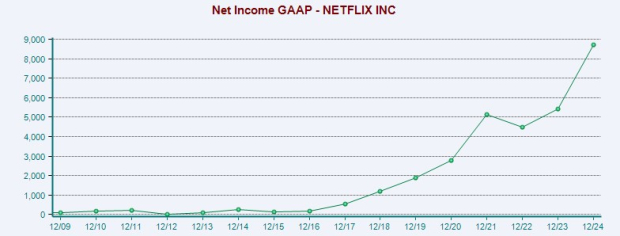

Throughout its most up-to-date This fall report in January, Netflix’s advert plan accounted for 55% of signal ups in international locations the place the service is supplied, with whole subscribers now over 300 million. Moreover, Netflix added a record-breaking 19 million subscribers throughout This fall, which was a mind-boggling 13 million extra subscribers than Wall Avenue anticipated. It’s additionally noteworthy that Netflix achieved over $10 billion in working earnings for the primary time in fiscal 2024 with GAAP internet earnings spiking 61% to $8.71 billion.

Netflix will likely be reporting Q1 outcomes on Thursday, April 17, and has exceeded the Zacks EPS Consensus in every of its final 4 quarterly studies with a mean earnings shock of seven.17%.

Picture Supply: Zacks Funding Analysis

ABR & NFLX Worth Goal

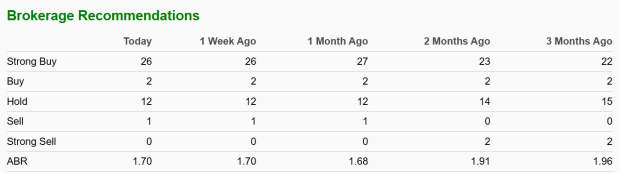

With 41 brokerage corporations protecting Netflix inventory and offering knowledge to Zacks, NFLX presently has a mean brokerage suggestion (ABR) of 1.70 on a scale of 1 to five (Robust Purchase to Robust Promote).

Picture Supply: Zacks Funding Analysis

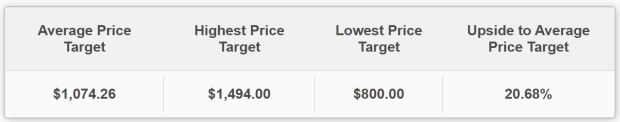

Based mostly on short-term value targets of 38 analysts, NFLX has an Common Zacks Worth Goal of $1,074.26, which suggests 20% upside from present ranges.

Picture Supply: Zacks Funding Analysis

Constructive EPS Revisions

Notably, earnings estimate revisions have remained increased for Netflix with the streaming big’s EPS anticipated to extend 24% in fiscal 2025 to $24.58 versus $19.83 a share final yr. Plus, FY26 EPS is projected to soar one other 20% to $29.66.

Extra intriguing, during the last 60 days, FY25 and FY26 EPS estimates are up 4% and 6%, respectively.

Picture Supply: Zacks Funding Analysis

Monitoring Netflix’s P/E Valuation

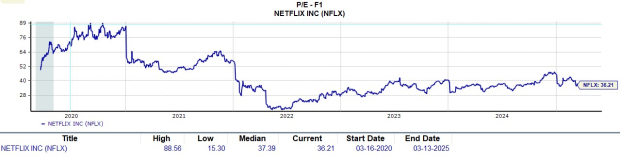

Amplifying the optimistic EPS revisions is that NFLX is buying and selling at a 36.2X ahead earnings a number of, nicely under its five-year excessive of 88.5X and a slight low cost to the median of 37.3X throughout this era.

Picture Supply: Zacks Funding Analysis

Conclusion & Remaining Ideas

Correlating with a optimistic pattern of earnings estimate revisions, Netflix inventory sports activities a Zacks Rank #1 (Robust Purchase). Though tariff issues have led to recessionary fears, Netflix’s cheaper ad-service may nonetheless propel the corporate within the occasion of a possible financial downturn. This must also assist maintain Netflix because the streaming king forward of Disney, Paramount, and Amazon.

Zacks’ Analysis Chief Names “Inventory Most Prone to Double”

Our crew of consultants has simply launched the 5 shares with the best likelihood of gaining +100% or extra within the coming months. Of these 5, Director of Analysis Sheraz Mian highlights the one inventory set to climb highest.

This prime decide is among the many most revolutionary monetary corporations. With a fast-growing buyer base (already 50+ million) and a various set of leading edge options, this inventory is poised for giant beneficial properties. After all, all our elite picks aren’t winners however this one may far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Paramount Global (PARA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.