Taiwan Semiconductor TSM is making headlines on Monday, with the chip large set to take a position $100 billion for manufacturing crops in the USA. Because the world’s largest built-in circuit foundry firm, the funding would increase Taiwan Semiconductor’s presence within the U.S., after beforehand shelling out $65 billion to construct fabrication services in Arizona.

Strengthening the provision chain for chip-related supplies, Taiwan Semiconductor’s services are vital to many U.S. companies, with its largest buyer being Apple AAPL.

Apple Partnership

Taiwan Semiconductor is a vital provider to lots of the notable chip producers within the U.S., together with Nvidia NVDA and AMD AMD. Nevertheless, Apple is by far its largest buyer with processing methods for Apple MacBook computer systems, iPads, and iPhones being enhanced by TSMC know-how.

In 2023 it was reported that Apple contributed to 1 / 4 of Taiwan Semiconductor’s income ($17 billion). Maintaining in thoughts that Taiwan Semiconductor’s relations with the U.S. Authorities and American companies have continued to strengthen, it is noteworthy that the corporate’s income is predicted to spike 26% in fiscal 2025 to $113.63 billion versus $90.08 billion final 12 months. Plus, Taiwan Semiconductor’s prime line is projected to increase one other 19% in FY26 to over $135 billion.

Picture Supply: Zacks Funding Analysis

EPS Progress & Constructive Revisions

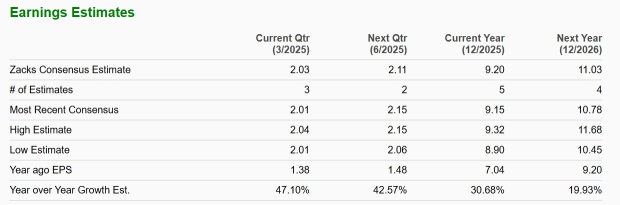

Identified for its operational effectivity, Taiwan Semiconductor’s annual earnings are anticipated to soar 30% this 12 months to $9.20 per share, in comparison with EPS of $7.04 in 2024. Even higher, FY26 EPS is projected to extend one other 20%

Picture Supply: Zacks Funding Analysis

Notably, FY25 and FY26 EPS estimates are up 4% and 1% within the final 60 days, respectively.

Picture Supply: Zacks Funding Analysis

TSM Value Efficiency & Valuation

Amid latest market volatility, Taiwan Semiconductor inventory has now dipped 9% by way of the primary three months of 2025 however continues to be up +30% over the past 12 months. Within the final three years, it is noteworthy that TSM has positive aspects of almost +70%, to impressively outperform the broader indexes and Apple’s +48%.

Picture Supply: Zacks Funding Analysis

Buying and selling round $178, TSM shares are at a 19.6X ahead earnings a number of which is close to their decade lengthy median and nicely beneath a excessive of 34.4X throughout this era. At a slight low cost to the benchmark S&P 500’s 22.4X, TSM may be a less expensive solution to get publicity to Apple’s market dominance with AAPL buying and selling over $240 and 33.2X ahead earnings.

Picture Supply: Zacks Funding Analysis

Conclusion & Closing Ideas

Correlating with an expansive development trajectory and a optimistic pattern of earnings estimate revisions, Taiwan Semiconductor inventory sports activities a Zacks Rank #2 (Purchase).

Whereas China has referred to as out Taiwan Semiconductor for “in search of to present away the island’s semiconductor business to the U.S. for political help”, buyers might agree that boosting its operations and investments in America might be profitable contemplating the corporate’s consumer base of tech giants like Apple, Nvidia, and AMD.

Simply Launched: Zacks High 10 Shares for 2025

Hurry – you possibly can nonetheless get in early on our 10 prime tickers for 2025. Handpicked by Zacks Director of Analysis Sheraz Mian, this portfolio has been stunningly and constantly profitable. From inception in 2012 by way of November, 2024, the Zacks High 10 Shares gained +2,112.6%, greater than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed by way of 4,400 firms lined by the Zacks Rank and handpicked the very best 10 to purchase and maintain in 2025. You possibly can nonetheless be among the many first to see these just-released shares with monumental potential.

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.