Still trading well off their 52-week highs, Shopify ( STORE) and also ZoomInfo Technologies ( ZI) are 2 development supplies amongst the wider modern technology field that might be fascinating to capitalists in hopes of an ongoing rebound.

In spite of a tremulous 2022, the Nasdaq is up 11% year to day, and also Salesforce’s ( CRM) solid fourth-quarter record and also support last Wednesday absolutely supercharged technology supplies relating to belief and also energy.

While Salesforce has actually been a cream-of-the-crop instance of development amongst modern technology firms, it does position the inquiry of if Shopify and also ZoomInfo can additionally expand expansively. Additionally, capitalists are constantly trying to find technology supplies with a wealth of upside, so allow’s see if Shopify and also ZoomInfo fit the costs.

Photo Resource: Zacks Financial Investment Research Study

Shopify Organization Design

Shopify went public in 2015, with the Canada-based firm giving its multi-tenant, cloud-based, multi-channel business system for little and also medium-sized organizations (SMBs). Shopify’s software application is utilized by vendors to run their organizations throughout numerous sales networks, consisting of internet and also mobile shops, physical retail areas, social media sites shops, and also industries.

With Shopify’s system, organizations can take care of items and also stock, procedure orders and also settlements, ship orders, construct client connections, utilize analytics, and also record from one incorporated back workplace.

Photo Resource: Zacks Financial Investment Research Study

ZoomInfo Organization Design

Rotating to ZoomInfo, which introduced its IPO a lot more lately in 2020 as a driver of a cloud-based modern technology system that supplies details and also understanding on companies and also specialists mostly in the united state and also worldwide.

ZoomInfo’s system is utilized for market knowledge by sales and also advertising groups. With making use of expert system and also artificial intelligence strategies, ZoomInfo refines information that can be utilized as workable understandings to enhance revenues for lots of organizations.

ZoomInfo offers a range of markets consisting of company solutions, telecoms, monetary solutions, retail, transport, medical care, and also the wider friendliness sector to name a few.

Photo Resource: Zacks Financial Investment Research Study

Oversold Region?

Having a look at Shopify and also ZoomInfo’s efficiency and also appraisal will certainly assist obtain a far better scale of whether their supplies are oversold complying with a challenging 2022 for technology supplies.

Hereof, ZI supply stands out right now down -51% over the in 2015 to mainly underperform store’s -28%, the Nasdaq’s -12%, and also the S&P 500’s -8%. Over the last 2 years and also quickly after ZoomInfo went public, ZI supply is currently down -43% Vs. store’s -62% with both tracking the wider indexes.

Photo Resource: Zacks Financial Investment Research Study

Trading at $43 a share, Shopify supply is 43% off its 52-week highs seen last March. On the other hand, ZoomInfo shares profession at $25 and also are 71% from highs additionally seen last March. With both firms having solid company versions yet in the starting phases of chance considering their cost to sales is an excellent way to evaluate the costs spent for their supplies.

Photo Resource: Zacks Financial Investment Research Study

Both Shopify and also ZoomInfo have a P/S proportion of 7.5 X which is over the maximum degree of much less than 2X yet has actually well come down from their highs over the last 2 years as received the above graph.

Still, with Shopify’s sector standard at 3.9 X P/S and also ZoomInfo’s Market standard at 1.3 X capitalists are paying a high costs for their supplies and also there can be much better acquiring possibilities in advance hereof.

Shopify Expectation

Shopify incomes are currently anticipated to dip -50% in financial 2023 to $0.02 per share contrasted to $0.04 a share in 2022. Nonetheless, FY24 EPS is anticipated to rebound and also skyrocket greater than 2,000% at $0.54. Revenues price quotes are somewhat down for FY23 yet have actually risen 50% for FY24 throughout the quarter.

On the leading line, sales are forecasted to leap 19% this year and also climb one more 22% in FY24 to $8.11 billion. Extra excellent, financial 2024 would certainly be a 416% rise from pre-pandemic degrees with 2019 sales at $1.57 billion.

Photo Resource: Zacks Financial Investment Research Study

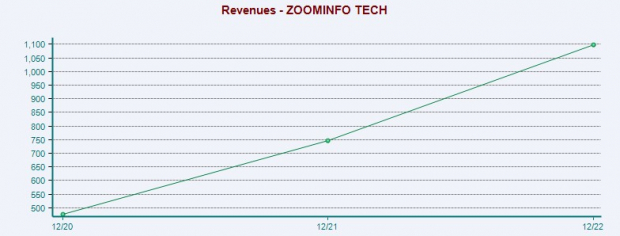

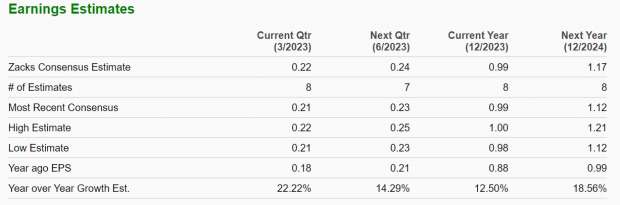

ZoomInfo Expectation

Resorting To ZoomInfo, incomes are anticipated to climb 12% this year and also dive one more 18% in FY24 at $1.17 per share. Revenues price quotes are somewhat up for FY23 yet have actually trended down for FY24 over the last 90 days.

Sales are anticipated to be up 16% in FY23 and also climb one more 18% in FY24 to $1.52 billion. And also, financial 2024 would certainly be a 418% rise from pre-pandemic degrees with 2019 sales at $293 million.

Photo Resource: Zacks Financial Investment Research Study

Takeaway

Shopify and also ZoomInfo Supply presently land a Zacks Ranking # 3 (Hold). The leading and also profits development of both firms is eye-catching yet their appraisal is not as fascinating regardless of trading well off of their 52-week highs.

Nonetheless, capitalists might be awarded for hanging on to shares of store and also ZI at their present degrees. Shopify and also ZoomInfo show up to have solid company versions and also this can catapult their development in the years ahead. The positive outlook that bordered both supplies in recent times might additionally return as rising cost of living and also wider financial worries diminish which has actually been demanding for the majority of technology firms

5 Supplies Ready To Dual

Each was handpicked by a Zacks specialist as the # 1 preferred supply to get +100% or even more in 2021. Previous suggestions have actually skyrocketed +143.0%, +175.9%, +498.3% and also +673.0%.

A lot of the supplies in this record are flying under Wall surface Road radar, which offers a wonderful chance to participate the very beginning.

Today, See These 5 Potential Home Runs >>

Shopify Inc. (SHOP) : Free Stock Analysis Report

ZoomInfo Technologies Inc. (ZI) : Free Stock Analysis Report

Salesforce Inc. (CRM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also viewpoints shared here are the sights and also viewpoints of the writer and also do not always mirror those of Nasdaq, Inc.