Shares of Tesla ( TSLA) and also General Motors ( GM) had actually remained to drift greater in 2023 after defeating their Q4 top and also profits assumptions in January.

Nevertheless, both of these car manufacturer supplies have actually cooled down since late after problems originating from the economic market splashed right into the wider market.

Allow’s see if the current dip in Tesla and also General Motors supply is a purchasing possibility.

FOMO

The anxiety of losing out (FOMO) on substantial supply rallies is oftentimes a subconscious consider financiers wishing to acquire a supply. This might have lately held true for General Motors and also Tesla supply.

In February, General Motors supply remained to relocate better to its 52-week high at over $40 a share prior to cooling down to present degrees of around $33 per share. When it comes to Tesla, shares of TSLA took back the $200 a share variety in February however have actually currently gone down under these degrees at $183 per share.

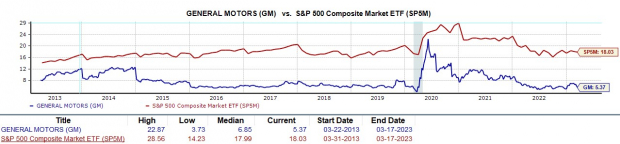

Year to day, Tesla supply is still up +40% to mainly outshine the S&P 500’s +2% with GM’s basically level efficiency tracking the standard.

Picture Resource: Zacks Financial Investment Research Study

Evaluation

In some cases FOMO can have an unwell result on financiers choices to acquire supplies. There is constantly an opportunity that supplies can begin do decrease also after rallies and also keeping track of Tesla and also General Motors appraisal is necessary.

Hereof, both supplies are startng to look much more eye-catching from a rate to profits point of view with General Motors specifically sticking out. Shares of GM profession at 5.3 X onward earing which is 76% listed below its years high of 22.8 X and also a mild price cut to the typical of 6.8 X. General Motors supply likewise trades perfectly underneath the Automotive-Domestic Market standard of 11.2 X, and also the S&P 500’s 18X.

Picture Resource: Zacks Financial Investment Research Study

In contrast, Tesla trades at 45.7 X onward profits. This is well listed below its severe years long high and also a 80% price cut to the typical of 225.81 X. Tesla supply does trade over the Automotive-Domestic sector standard and also the standard however Wall surface Road has actually traditionally been alright with paying a costs for TSLA shares because of the business’s development.

Development & & Expectation

Piggybacking off of Tesla’s development, profits are anticipated to dip -3% this year however rebound and also climb up 29% in monetary 2024 at $5.10 per share. On the leading line, sales are anticipated to increase 24% in FY23 and also dive anther 21% in FY24 to $122.83 billion.

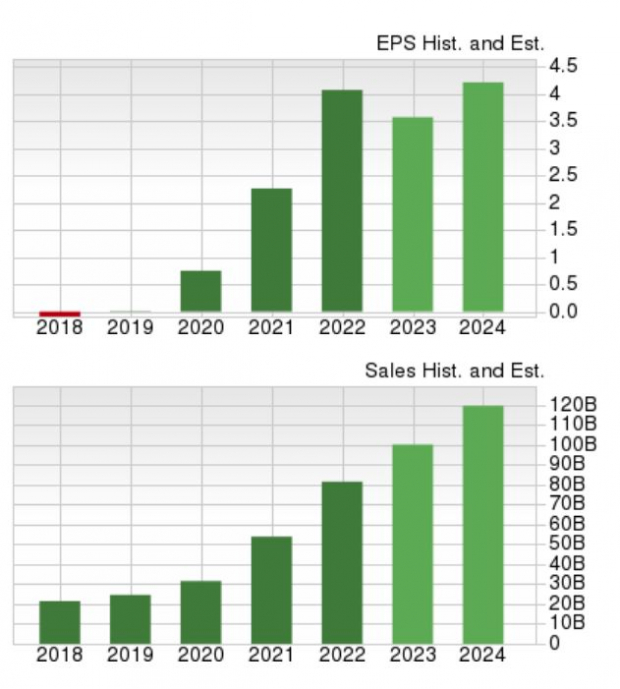

Picture Resource: Zacks Financial Investment Research Study

Rotating to General Motors, profits are predicted to go down -18% in FY23 after a far better than anticipated year that saw EPS at $7.59 in 2022. Financial 2024 profits are anticipated to dip an additional -3% to $5.99 per share. Sales are anticipated to increase 3% this year and also be basically level in FY24 at $162.47 billion.

Picture Resource: Zacks Financial Investment Research Study

Takeaway

Both General Motors and also Tesla supply land a Zacks Ranking # 3 (Hold) currently. While there can be much more temporary weak point in advance hanging on to these supplies at their present levles can be fulfilling when considering their P/E assessments about their past.

This is specifically real for Tesla supply when taking a look at itsstellar historicalperformance, up +7,404% over the last years to quickly cover the S&P 500’s +150% and also General Motors +19%. Keeping that being claimed, Tesla and also General Motors both offer beneficial direct exposure to the automobile sector making their supplies worth holding too.

This Obscure Semiconductor Supply Can Be Your Profile’s Bush Versus Rising cost of living

Every person utilizes semiconductors. However just a handful of individuals recognize what they are and also what they do. If you make use of a mobile phone, computer system, microwave, electronic electronic camera or fridge (which’s simply the idea of the iceberg), you have a demand for semiconductors. That’s why their value can not be overemphasized and also their disturbance in the supply chain has such a worldwide result. However every cloud has a positive side. Shockwaves to the global supply chain from the worldwide pandemic have actually uncovered an incredible possibility for financiers. And also today, Zacks’ top supply planner is disclosing the one semiconductor supply that stands to get one of the most in a brand-new FREE record. It’s your own at no charge and also without responsibility.

>>Yes, I Want to Help Protect My Portfolio During the Recession

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights and also point of views shared here are the sights and also point of views of the writer and also do not always mirror those of Nasdaq, Inc.