Casey’s Basic Shops CASY inventory was a prime mover in Wednesday’s buying and selling session after blasting earnings expectations for its fiscal third quarter yesterday night.

Standing out from an earnings lineup that additionally featured quarterly studies from a number of notable retailers equivalent to Dick’s Sporting Items DKS and Kohl’s KSS, Casey’s inventory rose greater than +6% right now, to over $400 a share.

Casey’s Q3 Outcomes

Casey’s Q3 gross sales spiked 17% yr over yr to $3.9 billion in comparison with $3.32 billion within the comparative quarter. Gas gallons offered have been up 20%, driving Casey’s growth as a retail comfort retailer and fuel station operator. This got here as Casey’s retailer rely grew 10% versus the prior yr quarter after the acquisition of Fikes Wholesale in November, the proprietor of CEFCO comfort shops.

Third quarter internet revenue was at $87 million or $2.33 per share, which was flat from the prior interval however crushed Q3 EPS expectations of $1.76 by 32%. Notably, Casey’s has surpassed the Zacks EPS Consensus for seven consecutive quarters with a median earnings shock of twenty-two.71% in its final 4 quarterly studies.

Picture Supply: Zacks Funding Analysis

Monitoring Casey’s Growth

One other robust driver to Casey’s quarterly gross sales progress was its ready meals enterprise, with the corporate recognized for its signature produced from scratch pizza. Increasing all through the Midwest, Casey’s has operations in 17 states with its shops providing a complete vary of merchandise outdoors of gasoline, together with groceries, pet provides, and automotive provides.

Executing on its 3-year strategic plan, Casey’s intends to continue to grow its meals enterprise and speed up its unit progress, whereas working its shops extra effectively. Conveying such, Casey’s expects full-year fiscal 2025 EBITDA to extend by roughly 11% regardless of the acquisition of property and gear of $500 million.

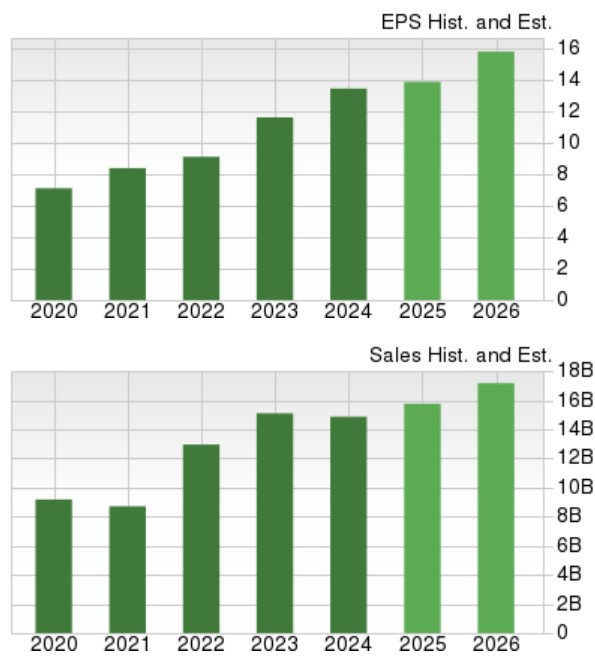

Based mostly on Zacks estimates, Casey’s whole gross sales are presently projected to rise 6% in FY25 and are forecasted to extend one other 10% in FY26 to $17.44 billion. Casey’s annual earnings are actually anticipated to be up 3% this yr and are projected to spike one other 12% in FY26 to $15.60 per share.

Picture Supply: Zacks Funding Analysis

CASY Efficiency & Valuation

12 months up to now, Casey’s inventory is up +2% to outperform the benchmark S&P 500’s -5% with the Nasdaq down 9%. Whereas tariff considerations have dealt a blow to markets of late, it’s noteworthy that CASY has soared over +120% within the final three years to largely outperform the broader indexes.

Picture Supply: Zacks Funding Analysis

At present ranges, Casey’s inventory trades at 24X ahead earnings which isn’t a stretched premium to the benchmark or its main competitor Murphy USA’s MUSA 17X. Plus, CASY trades at lower than 1X gross sales.

Picture Supply: Zacks Funding Analysis

Backside Line

Casey’s operational effectivity could be very engaging and alludes to the notion that the corporate is making the most of its growth and acquisition efforts. For now, Casey’s inventory lands a Zacks Rank #3 (Maintain), though a purchase ranking might be on the way in which contemplating earnings estimate revisions are prone to development greater following its spectacular Q3 earnings beat.

5 Shares Set to Double

Every was handpicked by a Zacks professional because the #1 favourite inventory to realize +100% or extra in 2024. Whereas not all picks will be winners, earlier suggestions have soared +143.0%, +175.9%, +498.3% and +673.0%.

A lot of the shares on this report are flying beneath Wall Road radar, which gives an ideal alternative to get in on the bottom flooring.

Today, See These 5 Potential Home Runs >>

Casey’s General Stores, Inc. (CASY) : Free Stock Analysis Report

Kohl’s Corporation (KSS) : Free Stock Analysis Report

DICK’S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.