Rising over +20% in Wednesday’s buying and selling session, Palantir Applied sciences PLTR inventory has been a spotlight of this week’s earnings lineup after reporting robust This autumn outcomes yesterday night.

Palantir has garnished Wall Road’s consideration as its synthetic intelligence platform (AIP) is seeing excessive demand with PLTR spiking to over $100 and now up +500% within the final 12 months.

Picture Supply: Zacks Funding Analysis

Palantir’s Sturdy This autumn Outcomes

Primarily offering software program platforms that help with counterterrorism investigations, Palantir AIP seems to be drawing curiosity from extra conventional enterprises as effectively.

Stating its U.S. enterprise is on the forefront of the AI revolution, Palantir’s This autumn gross sales spiked 36% 12 months over 12 months to $827.52 million in comparison with $608.35 million within the comparative quarter. Drawing Wall Road’s consideration, Palantir comfortably exceeded This autumn gross sales estimates of $777.49 million and noticed its high line stretch 14% sequentially.

The corporate’s operational effectivity additionally stood out with Palantir producing $460 million in money from operations and $517 million in adjusted free money circulation, representing margins of 56% and 63% respectively. Moreover, This autumn EPS of $0.14 beat expectations of $0.11 and rose from $0.08 a share within the prior interval. Palantir has reached or exceeded the Zacks EPS consensus for 9 consecutive quarters with a mean earnings shock of 12.72% in its final 4 quarterly studies.

Picture Supply: Zacks Funding Analysis

Full Yr Outcomes

Rounding out fiscal 2024, Palantir’s complete gross sales spiked 29% to $2.87 billion from $2.22 billion in 2023. Transferring additional previous the profitability line, annual earnings soared to $0.41 per share from EPS of $0.08 in 2023.

Palantir’s full-year money from operations was $1.15 billion with adjusted free money circulation at $1.25 billion, margins of 40% and 44% respectively.

Palantir’s Constructive Income Steering

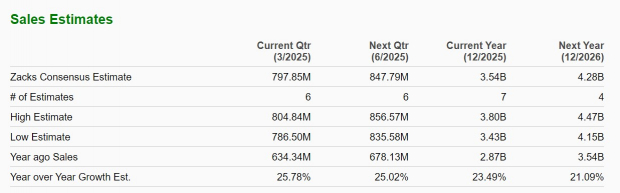

For Q1 FY25, Palantir expects income between $858-$862 million which got here in effectively above the present Zacks Consensus of $797.85 million or 26% progress (Present QTR beneath). For the total 12 months, Palantir expects FY25 gross sales between $3.741 billion-$3.757 billion, topping the consensus forecast of $3.54 billion or 23% progress.

Picture Supply: Zacks Funding Analysis

Takeaway

The unimaginable rally in Palantir Applied sciences inventory may proceed due to its better-than-expected This autumn report and steerage. Sporting a Zacks Rank #2 (Purchase), earnings estimate revisions are more likely to development increased for Palantir within the coming weeks and the corporate’s stability sheet is strengthening due to its rising money pile.

Analysis Chief Names “Single Greatest Decide to Double”

From 1000’s of shares, 5 Zacks specialists every have chosen their favourite to skyrocket +100% or extra in months to return. From these 5, Director of Analysis Sheraz Mian hand-picks one to have essentially the most explosive upside of all.

This firm targets millennial and Gen Z audiences, producing practically $1 billion in income final quarter alone. A latest pullback makes now an excellent time to leap aboard. In fact, all our elite picks aren’t winners however this one may far surpass earlier Zacks’ Shares Set to Double like Nano-X Imaging which shot up +129.6% in little greater than 9 months.

Free: See Our Top Stock And 4 Runners Up

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.