Really hopes of a much less hawkish FED might enhance the Customers Staples industry with numerous supplies amongst the Zacks Cosmetic Market attracting attention particularly.

With the Aesthetic Market in the leading 36% of over 250 Zacks markets right here are 3 supplies capitalists might wish to think about purchasing.

e.l.f. Appeal (FAIRY)

Sporting a Zacks Ranking # 1 (Solid Buy) Fairy Appeal supply is intruiging presently. Fairy Appeal runs as an aesthetic firm that largely uses face make-up, eye make-up, lip items, nail items, as well as aesthetic packages.

Trading at $84 per share, fairy supply is up an extremely excellent +47% year to day to quickly cover the S&P 500’s +7% as well as the Cosmetics & & Toiletries Markets +1%. The solid efficiency might proceed as Fairy’s monetary 2023 as well as FY24 EPS price quotes have actually climbed up 27% over the last quarter specifically.

Also much better, Fairy’s profits are currently predicted to skyrocket 69% this year at $1.42 per share contrasted to EPS of $0.84 in 2022. And also, monetary 2024 EPS is anticipated to climb an additional 11%.

Picture Resource: Zacks Financial Investment Study

Inter Parfums ( IPAR)

An Additional Zacks Cosmetic Market supply capitalists might wish to think about purchasing the minute is Inter Parfums which likewise sporting activities a Zacks Ranking # 1 (Solid Buy).

Inter Parfums is participated in the production, circulation as well as advertising and marketing of a vast sounded of scents as well as relevant items. Increasing profits price quotes are a great indicator that Inter Parfums supply might proceed climbing this year.

Trading at $139, shares of IPAR are up +43% YTD to greatly outmatch the criteria as well as the Cosmetic & & Toiletries Market. Monetary 2023 profits price quotes have actually currently risen 7% over the last 60 days with FY24 EPS approximates up 11%. Inter System’s profits are currently anticipated to be practically level this year and afterwards leap 15% in FY24 at $4.62 per share.

Picture Resource: Zacks Financial Investment Study

L’Oreal ( LRLCY)

L’Oréal is just one of one of the most prominent names amongst the cosmetics area as well as its supply presently has a Zacks Ranking # 2 (Buy). Being a staple amongst aesthetic items for over a century, L’Oréal supply is up +26% this year to surpass the S&P 500 as well as the Cosmetics & & Toiletries Market.

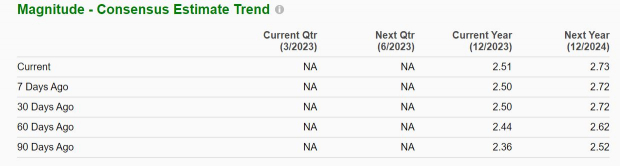

Monetary 2023 profits price quotes have actually climbed 6% over the last 90 days with FY24 EPS approximates climbing 8%. Trading at $89 per share, L’Oréal’s profits are currently anticipated to be up 6% this year as well as dive an additional 9% in FY24 at $2.73 per share.

Picture Resource: Zacks Financial Investment Study

Takeaway

Although capitalists might be paying a mild costs for these aesthetic sellers the rising profits price quotes as well as opportunity of reducing rising cost of living might proceed profiting these firms.

Evaluating off their year to day efficiencies, it would certainly be not a surprise if this caused much more upside in these premier Zacks Cosmetic Market supplies.

Free Record: Must-See Hydrogen Supplies

Hydrogen gas cells are currently utilized to give effective, ultra-clean power to buses, ships as well as also medical facilities. This modern technology gets on the brink of an enormous development, one that might make hydrogen a significant resource of America’s power. It might also completely change the EV market.

Zacks has actually launched an unique record exposing the 4 supplies specialists think will certainly supply the greatest gains.

Download Cashing In on Cleaner Energy today, absolutely free.

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

L’Oreal SA (LRLCY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The sights as well as viewpoints revealed here are the sights as well as viewpoints of the writer as well as do not always show those of Nasdaq, Inc.