China’s very first quarter GDP numbers were much expected after resuming its economic situation as well as finishing its No Covid-19 plan last December. Remarkably, China’s GDP expanded by 4.5% throughout the very first quarter covering assumptions of 4% as well as increasing 2.2% year over year.

Additionally, the International Monetary Fund (IMF) as well as the Globe Financial institution price China as the globe’s biggest economic situation based upon acquiring power. As received the neighboring graph, China’s complete GDP in money is currently at $17.73 trillion as well as simply behind the united state at $23.32 trillion.

Picture Resource: The Globe Financial Institution

GDP development is frequently a sign of a solid customer as well as this makes it much more interesting to purchase Chinese firms presently. With that said being stated, there are numerous American firms that obtain earnings from China as well as provide an alternate choice beyond acquiring Chinese firms that have American Vault Invoices (ADRs) on united state stock market.

It is essential to keep in mind that the marketplace is progressive numerous supplies providing beneficial direct exposure to China have actually currently skyrocketed in current months however there is still possibility amongst the Zacks Customer Discretionary market particularly.

To that factor, China’s retail sales of durable goods enhanced 5.8% year over year according to the National Bureau of Data. Right here are 3 premier Zacks Customer Discretionary supplies that must have much more upside as well as provide diversity to China’s economic situation.

Trip.com ( TCOM)

Amongst ADRs, Trip.com’s supply sticks out today as well as presently flaunts a Zacks Ranking # 1 (Solid Buy) with its Recreation as well as Entertainment Providers Market in the leading 29% of over 250 Zacks sectors.

As a one-stop traveling solution firm based in Shanghai, Trip.com is anticipated to be a recipient of the warmer summertime in advance as we come close to peak traveling period. Traveling is anticipated to be greater in 2023 from remaining suppressed need complying with the pandemic. This will absolutely hold true for locations in China after resuming its boundaries.

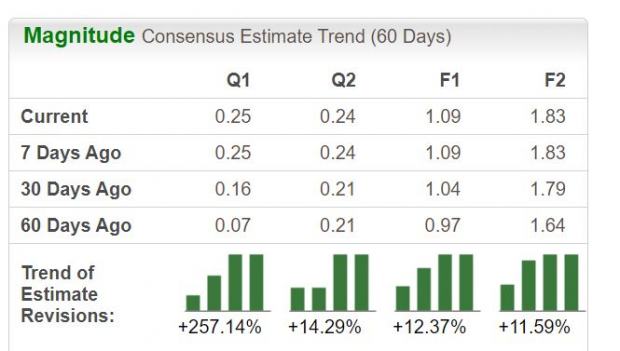

Incomes approximate alterations have actually visibly trended greater for Trip.com over the last 60 days. Over the last 2 months, monetary 2023 as well as FY24 EPS quotes have actually climbed up 12% as well as 11% specifically.

Picture Resource: Zacks Financial Investment Research Study

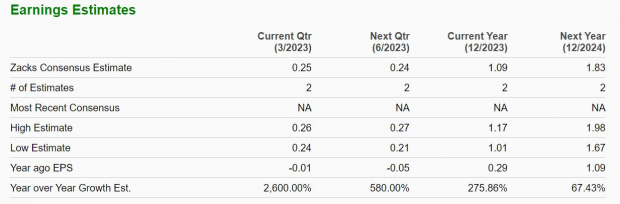

Also much better, Trip.com revenues are currently anticipated to increase 275% this year at $1.09 per share contrasted to EPS of $0.29 in 2022. Financial 2024 revenues are anticipated to skyrocket an additional 67% to $1.83 per share.

Picture Resource: Zacks Financial Investment Research Study

Wynn Resorts ( WYNN)

Beyond buying Chinese firms straight with ADRs, Wynn Resorts is an archetype of an American firm that must gain from the development of China’s economic situation.

Wynn supply sporting activities a Zacks Ranking # 2 (Buy) with the Las Vegas-based firm running its gambling establishment hotels in wrong city, Everett Massachusetts, as well as Macau China.

Actually, greater than 70% of Wynn’s earnings originates from the 3 gambling establishments it runs in Macau which is taken into consideration China’s variation of Las Las vega. A sign of the increase the resuming of the Chinese economic situation will certainly contribute to Wynn’s post-pandemic recuperation as well as future development is that sales are expected to climb up 45% this year as well as dive an additional 17% in FY24 to $6.43 billion.

Picture Resource: Zacks Financial Investment Research Study

China’s development is much more vital to Wynn’s profits. To that note, revenues are anticipated to rebound as well as climb up swing from a loss of -$ 4.47 per share in 2014 to EPS of $1.05 in 2023. Much more interesting, monetary 2024 revenues are anticipated to jump an additional 385% at $5.10 a share. Mostly credited to Wynn’s buy score is that revenues quote alterations have actually skyrocketed as well as remain to increase.

Picture Resource: Zacks Financial Investment Research Study

Nike ( NKE)

With a legendary worldwide brand name, Nike’s supply will certainly obtain an included increase from China’s resuming as well as lands a Zacks Ranking # 2 (Buy). Especially, regardless of Nike’s Greater China section sales dipping -9% in 2022 at $7.54 billion this still represented 16% of its complete sales.

Also much better, this still stood for 47% development over the last 5 years with 2018 Greater China sales at $5.13 billion. As the Chinese economic situation sits back on duty, the shoes as well as clothing titan will absolutely aim to proceed its development in individuals’s Republic. (* ) Picture Resource: Zacks Financial Investment Research Study (* ) This will certainly absolutely contribute to Nike’s stable development as well as revenues power. Nike’s revenues are anticipated to go down -13% this year however rebound as well as pop 23% in FY24 at $4.00 per share. And also, revenues quotes have actually remained to tick greater for FY23 as well as FY24 over the last one month.

Nike supply is much more enticing taking into consideration the firm has actually assembled a string of great revenues beats regardless of decreased payments as well as development from its Greater China section. Suprisingly, Nike squashed its monetary third-quarter revenues assumptions by 52% in March with EPS at$ 0.79 contrasted to quotes of $0.27 a share.

Picture Resource: Zacks Financial Investment Research Study(* )Takeaway

These Zacks Customer Discretionary supplies provide special diversity to China’s substantial economic situation. In addition, China’s solid first-quarter GDP numbers are a favorable affirmation that these firms are expanding also. The increasing revenues quote alterations show up to declare this as well as can remain to trend greater resulting in great benefit in Trip.com, Wynn Resorts, as well as Nike supply.

Zacks Names” Solitary Best Choose to Dual “(* ). From countless supplies, 5 Zacks specialists each have actually selected their favored to increase +100% or even more in months to find. From those 5, Supervisor of Study Sheraz Mian hand-picks one to have one of the most eruptive benefit of all.(* ). It’s an obscure chemical firm that’s up 65% over in 2014, yet still economical. With unrelenting need, rising 2022 revenues quotes, as well as$ 1.5 billion for redeeming shares, retail capitalists can enter at any moment.

This firm can equal or exceed various other current Zacks’ Supplies Ready To Dual like Boston Beer Business which soared +143.0% in bit greater than 9 months as well as NVIDIA which grew +175.9 %in one year.

The sights as well as point of views shared here are the sights as well as point of views of the writer as well as do not always mirror those of Nasdaq, Inc.(* ).