Walmart WMT will give perception into the present state of shopper procuring conduct, with the omnichannel retailer set to launch its This autumn outcomes on Thursday, February 20.

Broadly talking, inflationary pressures have began to ease following a number of price cuts in 2024, however Walmart has saved a aggressive benefit over Goal TGT, which tends to supply premium items at the next value. Moreover, Walmart’s on-line enlargement has put the corporate in a greater place to compete with e-commerce titan Amazon AMZN.

Walmart’s This autumn Expectations

12 months over yr, Walmart’s This autumn gross sales are thought to have elevated 3% to $179.18 billion. On the underside line, This autumn EPS is predicted to be up 6% to $0.64. Extra intriguing, The Zacks ESP (Anticipated Shock Prediction) signifies Walmart may surpass earnings expectations with probably the most up-to-date analyst revisions (Most Correct Estimate) having This autumn EPS pegged at $0.66 and a pair of% above the Zacks Consensus.

Picture Supply: Zacks Funding Analysis

Notably, Walmart has reached or exceeded earnings expectations for 10 consecutive quarters with a mean EPS shock of 9.25% in its final 4 quarterly stories.

Picture Supply: Zacks Funding Analysis

Monitoring Walmart’s Outlook

Wrapping up its present fiscal yr 2025, Walmart’s complete gross sales are slated to extend 5% to $678.56 billion versus $648.13 billion in FY24. Primarily based on Zacks estimates, Walmart’s prime line is projected to develop one other 4% in FY26 to $704.61 billion.

Even higher, Walmart’s annual earnings are slotted to rise 12% to $2.48 per share, from EPS of $2.22 in FY24. Plus, Zacks projections name for Walmart’s EPS to develop one other 11% in FY26 to $2.74.

Picture Supply: Zacks Funding Analysis

WMT Efficiency & Valuation

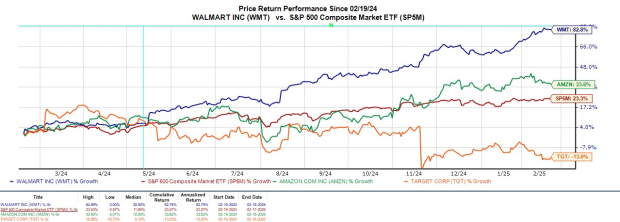

Pounding the query of whether or not it’s time to purchase WMT for extra upside, Walmart’s inventory has already risen over +70% since its 3-1 inventory cut up final February. During the last yr, WMT has impressively outperformed the broader market and Amazon’s +33%, with Goal shares down a dismal -13%.

Picture Supply: Zacks Funding Analysis

Buying and selling round $103, Walmart inventory is at a 37.9X ahead earnings a number of, a noticeable premium to the benchmark S&P 500’s 23X. WMT additionally trades properly above Goal’s 13.7X however is close to Amazon’s 36.2X.

Picture Supply: Zacks Funding Analysis

Takeaway

Forward of its This autumn report, Walmart’s inventory sports activities a Zacks Rank #2 (Purchase). To that time, Walmart’s EPS development has began to justify its price-to-earnings premium to the broader market, particularly with the Zacks ESP suggesting the corporate may exceed This autumn backside line expectations.

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the whole sum of solely $1. No obligation to spend one other cent.

1000’s have taken benefit of this chance. 1000’s didn’t – they thought there have to be a catch. Sure, we do have a purpose. We would like you to get acquainted with our portfolio companies like Shock Dealer, Shares Underneath $10, Expertise Innovators,and extra, that closed 256 positions with double- and triple-digit beneficial properties in 2024 alone.

Walmart Inc. (WMT) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.