JPMorgan JPM shares are down a bit of over -3% since their late-November highs, marginally higher than the Zacks Finance sector however lagging the broader market that’s primarily flat over the identical interval. Because the November elections, nevertheless, JPMorgan shares are up near +2%, whereas the S&P 500 index is modestly within the adverse.

Wells Fargo WFC, which joins JPMorgan in kicking off the This fall earnings season for the Finance sector on Wednesday, January 15th, is barely in constructive territory since election day, whereas Citigroup C, which additionally stories the identical day, has outperformed each of its friends.

Over an extended interval, these three banks have handily outperformed the broader market. You may see this within the chart under that reveals the one-year efficiency of JPMorgan, Citigroup, and Wells Fargo relative to the S&P 500 index in addition to the Zacks Finance sector.

Picture Supply: Zacks Funding Analysis

The outlook for Fed easing that had already dampened following the ‘hawkish reduce’ in December is more likely to average additional following the most recent blockbuster jobs report. That mentioned, the general working setting for these banks has considerably improved recently on the again of a good macroeconomic outlook and a comparatively extra permissive regulatory regime below President Trump.

The event of elevated, longer-dated treasury yields has been an energetic dialogue level out there, because it seemingly runs counter to the easing financial coverage trajectory. We are inclined to agree with the view that the continuing energy in long-term treasury yields is primarily a mirrored image of favorable financial progress expectations and rising demand for capital resulting from funding alternatives in secular progress areas like synthetic intelligence. A part of it’s tied to sticky inflation expectations, however the financial progress angle represents probably the most significant factor.

The bond market’s instant response to the aforementioned blockbuster December jobs report has been to comparatively cut back the yield curve’s steepness, nevertheless it nonetheless stays far steeper than just a few months again. That is constructive for internet curiosity revenue (NII) for these banks, with the whole lot else being fixed. There’s doubtless additional upside to present 2025 NII estimates, significantly if deposit and mortgage progress accelerates.

Mortgage demand has been anemic in current quarters, with business knowledge suggesting mortgage progress of about +1.8% in December, one of the best price in over a yr. Additionally notable is that the expansion isn’t solely ensuing from bank cards, with business & industrial loans (C&I) beginning to present constructive progress.

With respect to credit score high quality, the issues within the business actual property (CRE) market are well-known and already adequately provisioned for on the main banks. Past CRE, combination bankruptcies within the U.S. are up considerably from the Covid-driven low of early 2022, however the progress price has been leveling off in current months.

With present chapter ranges roughly 30% under pre-Covid averages, the current slowing of the chapter progress tempo is probably going indicative of improved family stability sheets. We additionally see this development in early-stage bank card delinquencies, with the flat year-over-year progress charges in current months indicative of favorable developments regarding internet charge-off charges this yr.

Regarding funding banking, revenues ought to be up within the mid-teens share vary, with JPMorgan and different business leaders doubtless having fun with beneficial properties in extra of +20%. The fairness capital markets enterprise has been significantly robust, with respectable beneficial properties on the debt capital market aspect and a few early indicators of life within the M&An area. On the buying and selling aspect, volumes had been up robust in This fall, whereas mounted revenue, currencies, and commodities (FICC) volumes improved in the course of the interval after the flattish displaying within the first three quarters of the yr.

Expectations for JPMorgan, Wells Fargo & Citigroup

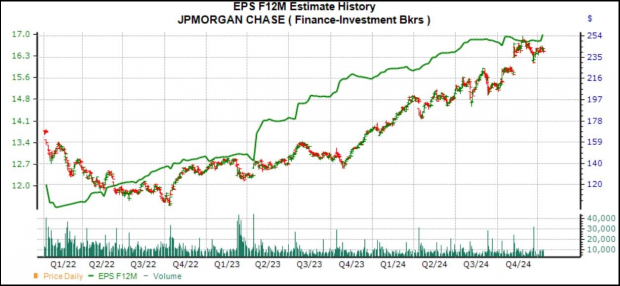

JPMorgan is anticipated to report $4.02 per share in earnings (up +1.3% year-over-year) on $40.9 billion in revenues (up +6.1% YoY). The inventory was up properly on the final earnings launch on October eleventh, reflecting constructive commentary in regards to the outlook. Estimates have been steadily rising, with the present $4.02 per share estimate up from $3.82 a month in the past and $3.79 three months again.

The chart under reveals the JPM inventory worth efficiency relative to how the ahead 12-month consensus EPS estimate has advanced.

Picture Supply: Zacks Funding Analysis

Wells Fargo is anticipated to report EPS of $1.34 (up +3.9% year-over-year) on $20.5 billion in revenues (up +0.1% YOY). Estimates for This fall have inched up for the reason that interval bought underway, with the present $1.34 estimate up from $1.32 a month again and $1.30 three months again. Wells Fargo shares had been up following the final quarterly launch on October 11th.

For Citigroup, the expectation is of $1.24 per share in earnings (up +47.6% YOY) on $19.6 billion in revenues (up +12.1%). The revisions development has been modestly constructive, with analysts nudging their estimates greater for the reason that quarter started. Citi shares had been down following the final quarterly launch. However the market’s response to any Citi quarterly launch is extra a perform of the market’s evaluation of administration’s progress in repositioning the enterprise and simplifying the construction than precise quarterly outcomes. We don’t suppose this report will likely be any totally different in that respect.

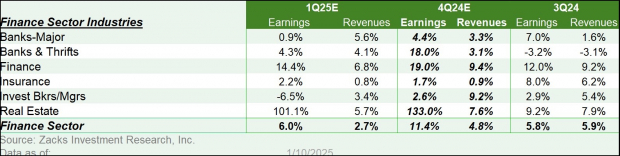

The Zacks Main Banks business, of which JPMorgan, Citigroup, and Wells Fargo are an element, is anticipated to earn +4.4% greater earnings in 2024 This fall on +3.3% greater revenues. Please observe that this business introduced in roughly 50% of the Zacks Finance sector’s complete earnings over the trailing four-quarter interval.

Picture Supply: Zacks Funding Analysis

As you possibly can see above, This fall earnings for the Zacks Finance sector are anticipated to be up +11.3% from the identical interval final yr on +4.8% greater revenues.

Regardless of the massive financial institution shares’ outperformance over the previous yr, they’re nonetheless low-cost on most typical valuation metrics. The chart under reveals a 10-year historical past of the Zacks Main Banks business for a ahead 12-month P/E foundation.

Picture Supply: Zacks Funding Analysis

At first look, this valuation image might look full, if not wealthy. However we should see the group’s valuation a number of relative to the broader market.

Wanting relative to the S&P 500 index, the Zacks Main Banks business is at present buying and selling at 66% of the S&P 500 ahead 12-month P/E a number of. Over the past 10 years, the business has traded as excessive as 78% of the index, as little as 52%, and carries a median of 62%, because the chart under reveals.

Picture Supply: Zacks Funding Analysis

This fall Earnings Season Scorecard

The This fall earnings season will take middle stage with the financial institution outcomes this week. Nonetheless, the reporting cycle has truly gotten underway, with outcomes from 22 S&P 500 index members. These 22 index members, together with bellwether operators comparable to FedEx, Nike, Oracle, and others, have reported outcomes for his or her fiscal quarters ending in November. We and different knowledge aggregators depend these fiscal November-quarter outcomes as a part of the December-quarter tally.

This week brings This fall outcomes from 18 S&P 500 members, which, along with the aforementioned massive banks, embrace UnitedHealthcare, Schlumberger, Fastenal, and others.

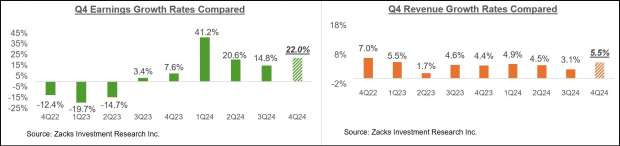

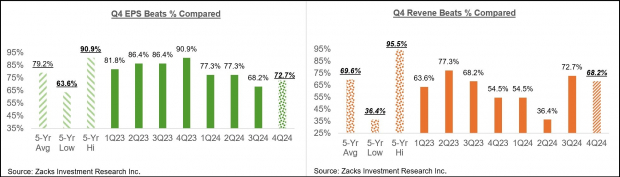

Whole earnings for the 22 index members which have reported outcomes are up +22% from the identical interval final yr on +5.5% greater revenues, with 72.7% beating EPS estimates and 68.2% beating income estimates.

The comparability charts under put the expansion charges for these 22 index members with what we had seen from this identical group of corporations in different current intervals.

Picture Supply: Zacks Funding Analysis

The comparability charts under put the This fall EPS and income beats percentages for this group corporations relative to what we had seen from them in different current intervals.

Picture Supply: Zacks Funding Analysis

The Earnings Huge Image

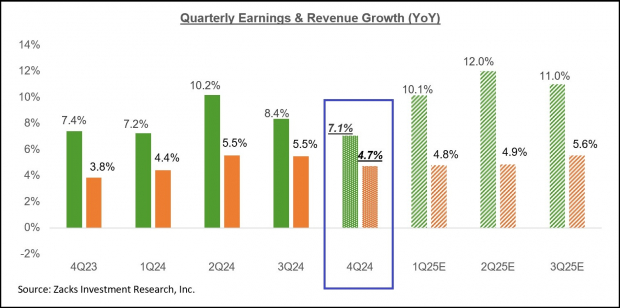

The chart under reveals the This fall earnings and income progress expectations within the context of the place progress has been within the previous 4 quarters and what’s anticipated within the coming three quarters.

Picture Supply: Zacks Funding Analysis

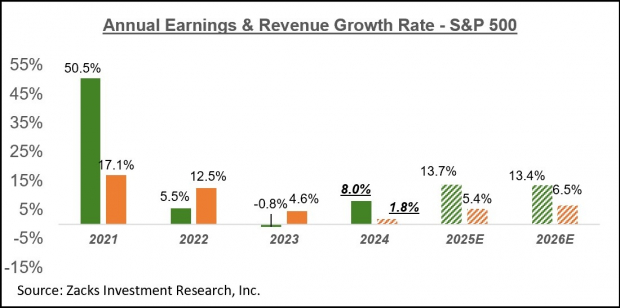

The chart under reveals the general earnings image on a calendar-year foundation, with double-digit earnings progress anticipated in 2025 and 2026.

Picture Supply: Zacks Funding Analysis

For an in depth have a look at the general earnings image, together with expectations for the approaching intervals, please take a look at our weekly Earnings Traits report >>>> Broad-Based Growth Expected in 2025

Solely $1 to See All Zacks’ Buys and Sells

We’re not kidding.

A number of years in the past, we shocked our members by providing them 30-day entry to all our picks for the entire sum of solely $1. No obligation to spend one other cent.

Hundreds have taken benefit of this chance. Hundreds didn’t – they thought there have to be a catch. Sure, we do have a motive. We would like you to get acquainted with our portfolio providers like Shock Dealer, Shares Beneath $10, Expertise Innovators,and extra, that closed 228 positions with double- and triple-digit beneficial properties in 2023 alone.

Wells Fargo & Company (WFC) : Free Stock Analysis Report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.